Weekly Unlocks Digest: Jan 05 –11, 2026

This week’s report arrives as crypto markets stabilized after a relatively quiet start to the year. Broad market sentiment turned moderately constructive, with total liquidations falling to $412.91M and aggregate price action ending the week ~5% higher, signaling reduced leverage stress across major pairs.

Macro conditions remained supportive, as the Federal Reserve injected ~$31B into the U.S. banking system, helping ease short-term liquidity pressures.

On the token side, attention shifts to $LINEA, which posts the largest unlock relative to circulating supply this week, alongside $HYPE, where the largest unlock by value is directed entirely toward core contributor allocations.

Weekly Unlocks Recap

Macro developments continued to play a central role alongside token-native events. Liquidity conditions and global inflation expectations shaped broader sentiment, while unlocks, buybacks, and emission-related protocol changes drove supply-side dynamics across crypto assets.

Macro focus remains centered on upcoming ISM Manufacturing PMI (US) and global inflation prints from the Euro Area, Australia, and China — data points that could influence near-term liquidity expectations and risk positioning.

Token-level attention this week centers on protocol-specific developments:

- $REZ — Monthly burn update scheduled

- Lighter — Token launch ($LIT)

- $UNI — $578M worth of UNI burned; buyback mechanism activated

- Fluid & ORBS — Buyback programs confirmed or expanded

- $MACARON — First inflation halving reduces mining emissions

- $ROUTE — Vesting unlock delayed by six months

- $AAVE — Proposal to distribute non-protocol revenue to token holders

- $JUP / $HNT — Buyback pauses and halts introduce contrasting supply signals

Together, these events highlight a widening divergence between deflationary, fee-backed models and protocols still relying on emissions-led incentives.

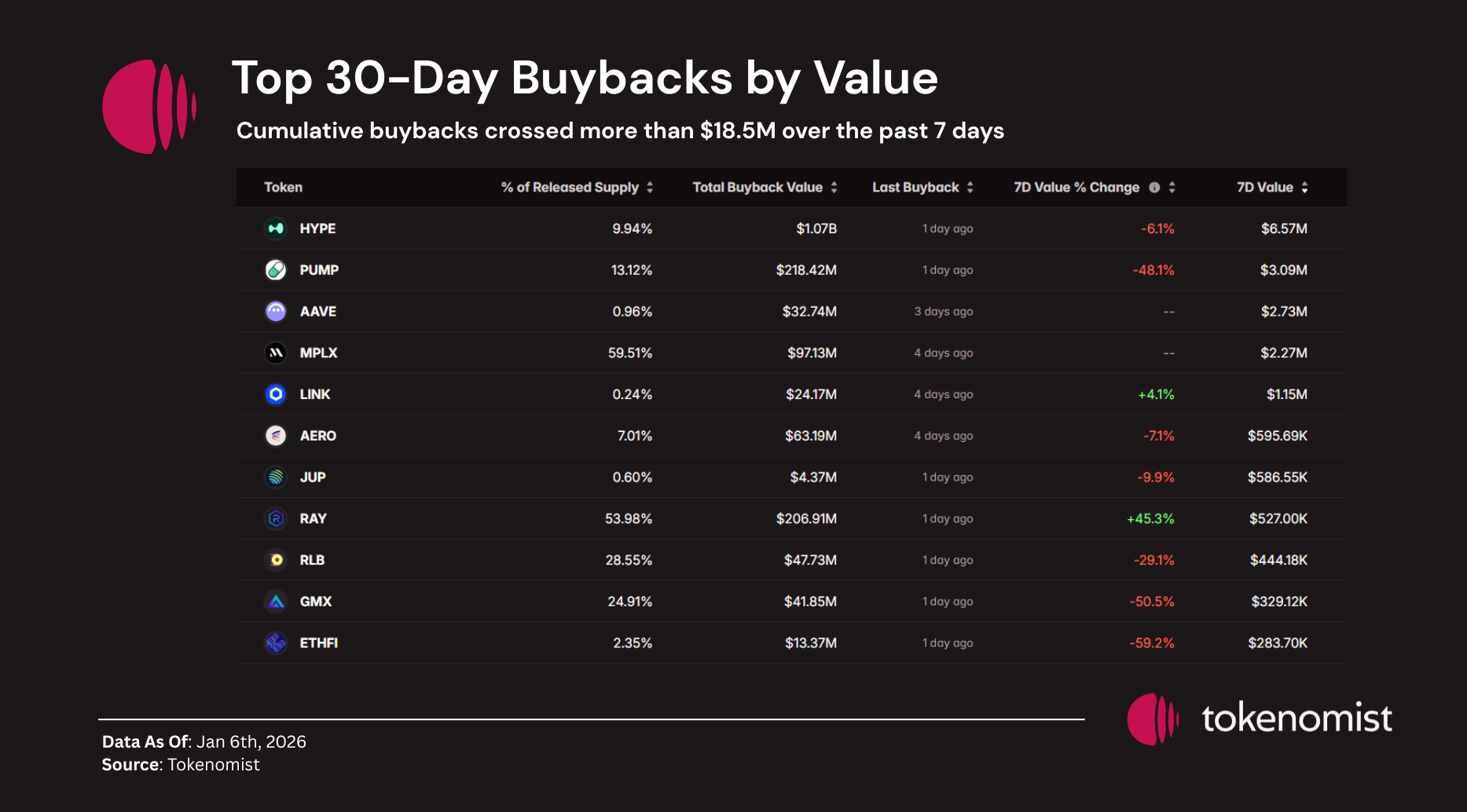

Top 7-Day Buybacks

Cumulative buyback activity remains dominated by fee-driven and treasury-backed programs:

- $HYPE leads recent buybacks by value, supported by consistent protocol fee flows

- $PUMP follows with continued repurchases, though recent activity slowed week-over-week

- $AAVE, $LINK, $RAY, $JUP, $GMX, and $MPLX maintain steady but smaller-scale buyback activity

Full Dashboard : https://tokenomist.ai/buyback/screener

Across tracked protocols, 7-day buybacks remain concentrated, reinforcing the structural divergence between revenue-generating platforms and inflation-heavy token models.

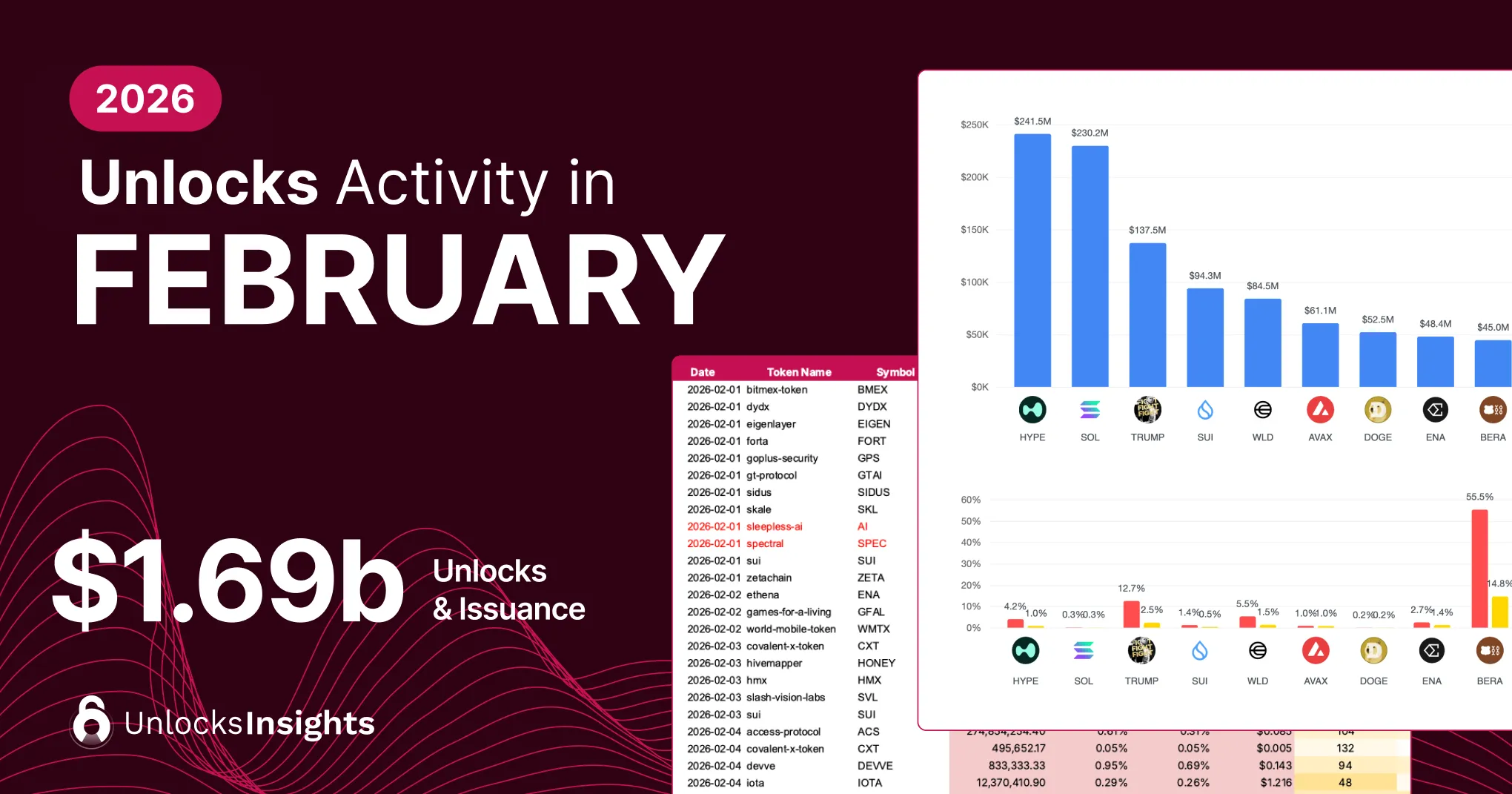

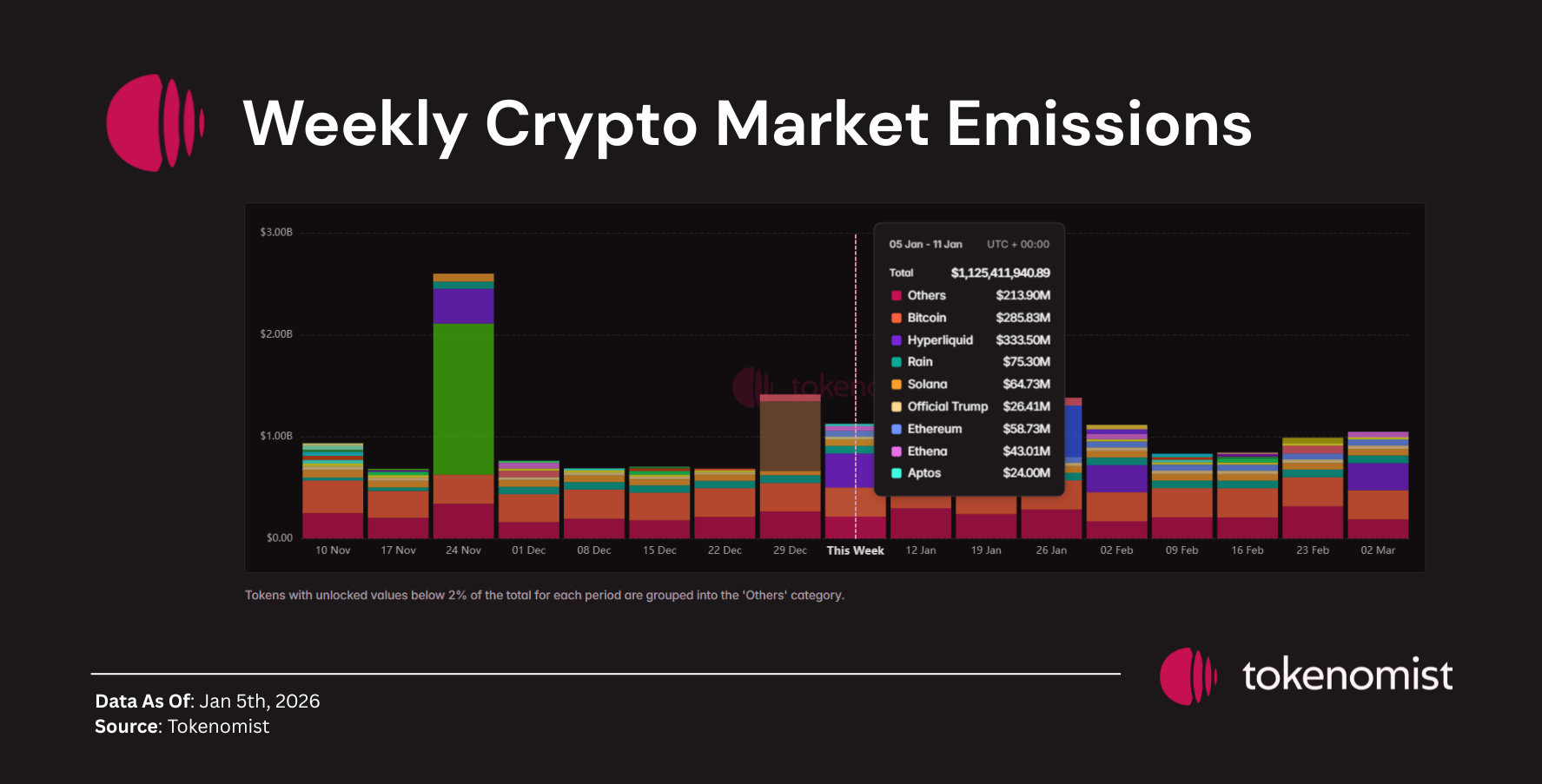

Weekly Crypto Market Emissions

This week saw total emissions of roughly $1.12B, a significant rebound compared with December’s average weekly emissions (~$600M). Emissions remain broadly distributed across a mix of major and mid-cap tokens, with no single project dominating supply flow.

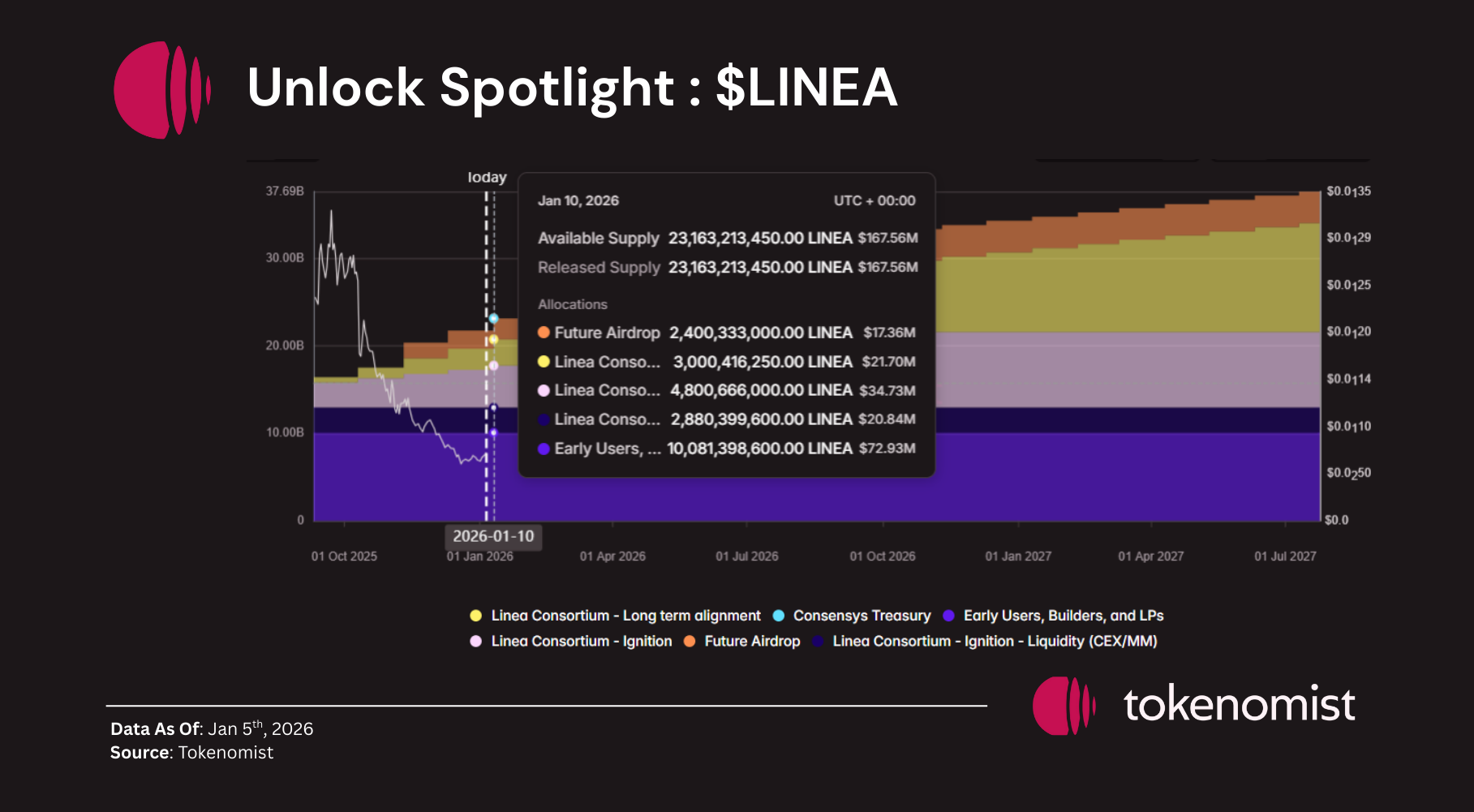

Unlock Spotlight : $LINEA

- Unlock Date: Jan 10, 2026

- Amount: $10.08 M

- Unlock % of Circulating Supply: 8%

- Allocations: Airdrop, Linea Consortium

$LINEA records the largest unlock relative to circulating supply this week. All emissions are tied to treasury-controlled allocations.

Full Unlock Schedule : https://tokenomist.ai/linea

A significant portion of total supply remains locked under a multi-year schedule — only treasury allocations are vesting this week.

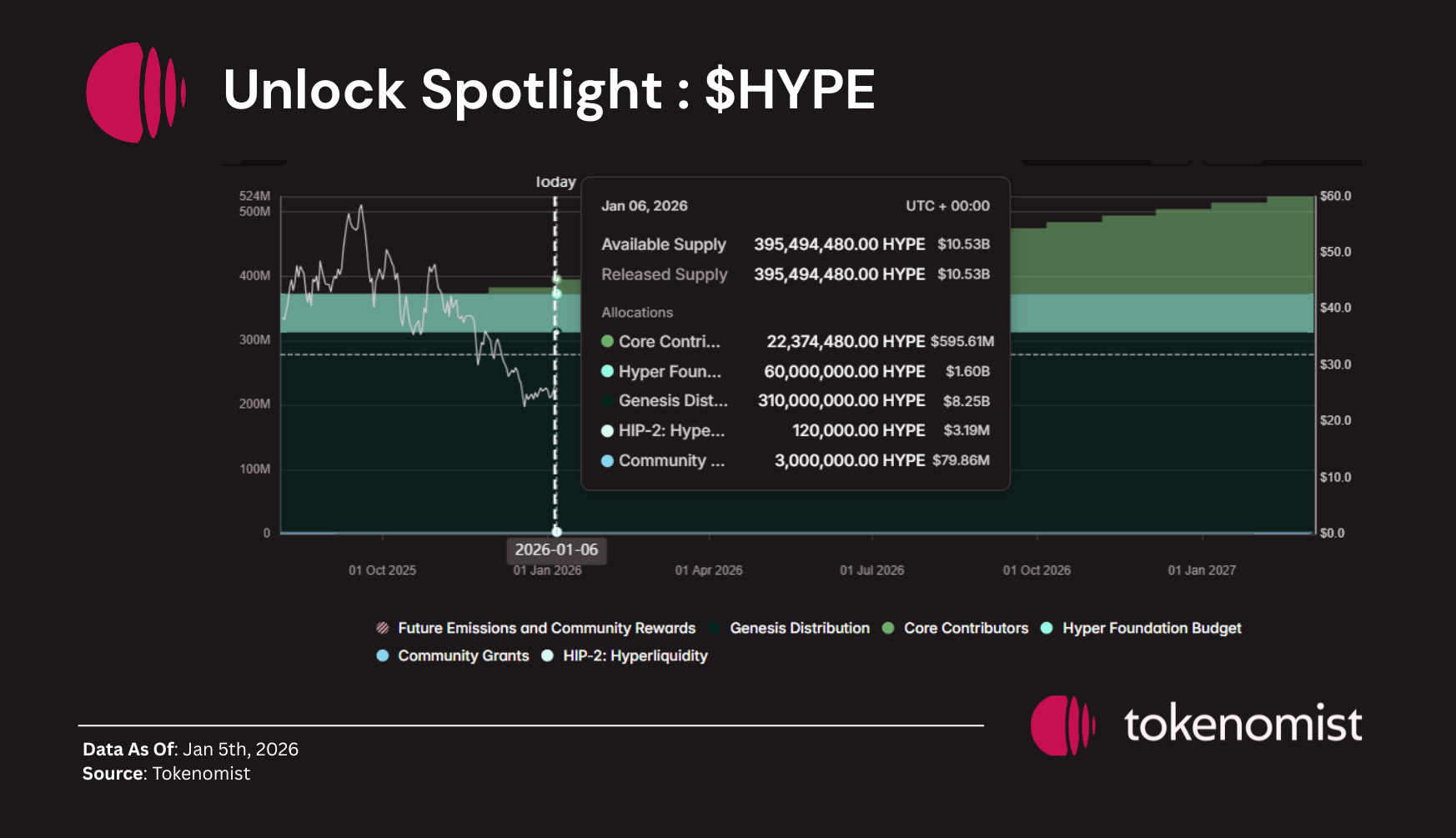

Unlock Spotlight : $HYPE

- Unlock Date: Jan 6, 2026

- Amount: $330 M

- Unlock % of Circulating Supply: 5.3%

- Allocations: Core Contributors

$HYPE leads the week by unlock value, with the entire release directed toward core contributor allocations.

Full Unlock Schedule : https://tokenomist.ai/hyperliquid

While this adds 5.3% to circulating supply, the broader emission curve remains gradual, following a steady monthly release schedule — the majority of supply is still locked long-term.

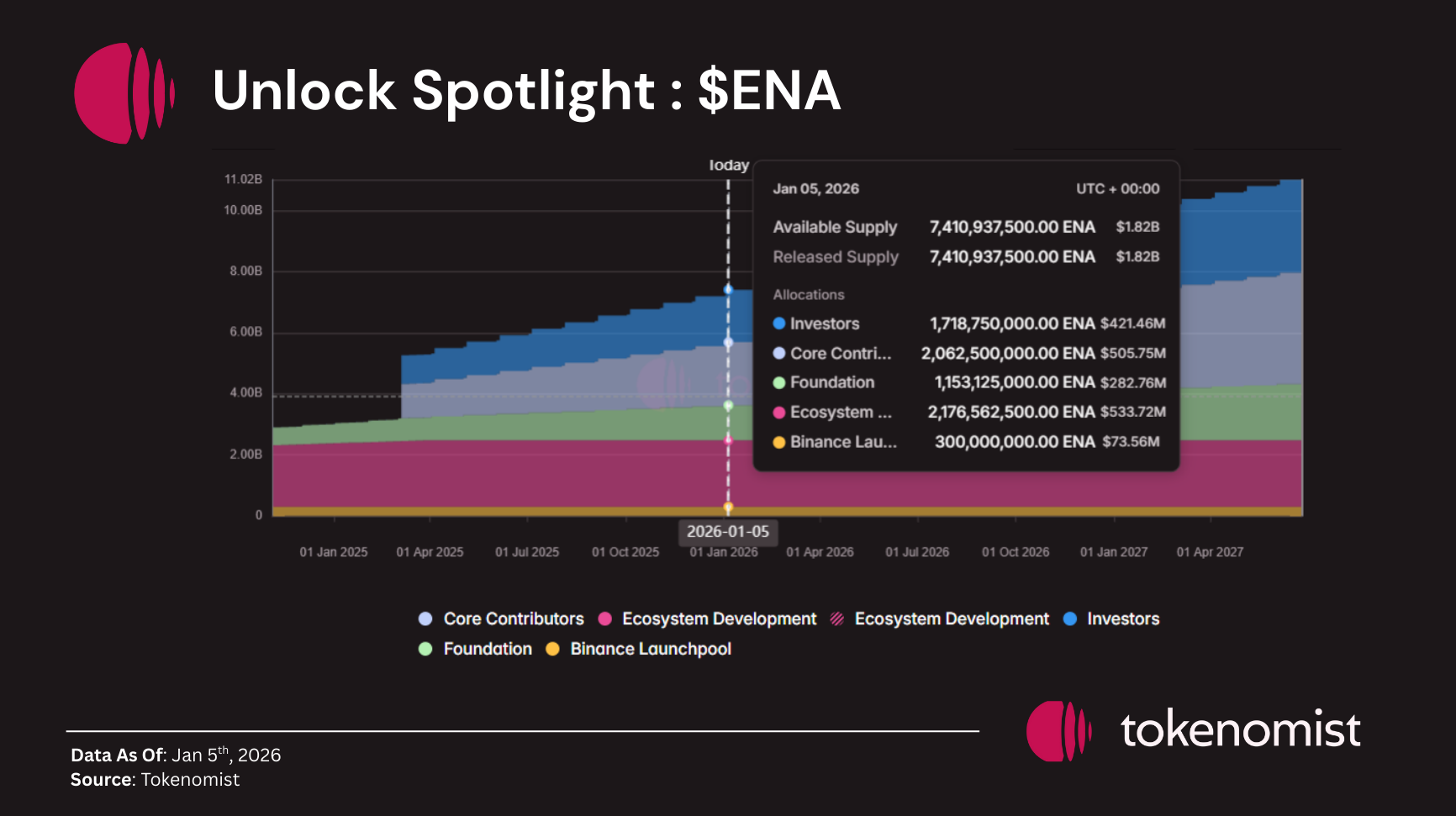

Unlock Spotlight : $ENA

- Unlock Date: Jan 5, 2026

- Amount: $42 M

- Unlock % of Circulating Supply: 2.1%

- Allocations: Core Contributors & Investors

$ENA leads the week by unlock value, with the entire release directed toward core contributor & Investors allocations.

Full Unlock Schedule : https://tokenomist.ai/ethena

A significant portion of total supply remains locked under a multi-year schedule — only Insider allocations are vesting monthly.

Notable News & Macro Flow

- Investors and Economists React to US capture of Venezuela's Maduro ( https://www.ig.com/en/news-and-trade-ideas/weekly-market-navigator--5-jan-2026-260105?utm_source=chatgpt.com)

- Iran Accepts Cryptocurrency as Payment for Advanced Weapons ( https://finance.yahoo.com/news/iran-accepts-cryptocurrency-payment-advanced-120940828.html)

- 3. Justin Sun Transferred $5.4M from Lighter Spot Balance to Perps and Has started Selling $LIT ( https://www.kucoin.com/news/flash/justin-sun-shifts-5-4m-lit-to-perpetual-contracts-market-reacts)

- 4. Fed Reserve pumped $31 Billion into the U.S. Banking ( https://x.com/_Investinq/status/2006537963392393655)

- Global inflation & macro data from key regions — including inflation releases in Euro-area, Australia, and China later in the week. ( https://www.ig.com/en/news-and-trade-ideas/weekly-market-navigator--5-jan-2026-260105?utm_source=chatgpt.com)