Weekly Token Unlocks Digest: Feb 2–8, 2026 | Hawkish Fed Fears, $HYPE Unlock Pressure

Markets entered the week on edge as concerns grew around a potential shift in Federal Reserve leadership, reviving fears of a more hawkish policy stance. Against this backdrop, this report breaks down $HYPE’s largest unlock yet despite strong price gains, $BERA’s outsized unlock relative to circulating supply, and Optimism’s move to introduce $OP token buybacks. We also examine how changing macro expectations are reshaping investor reactions to token emissions.

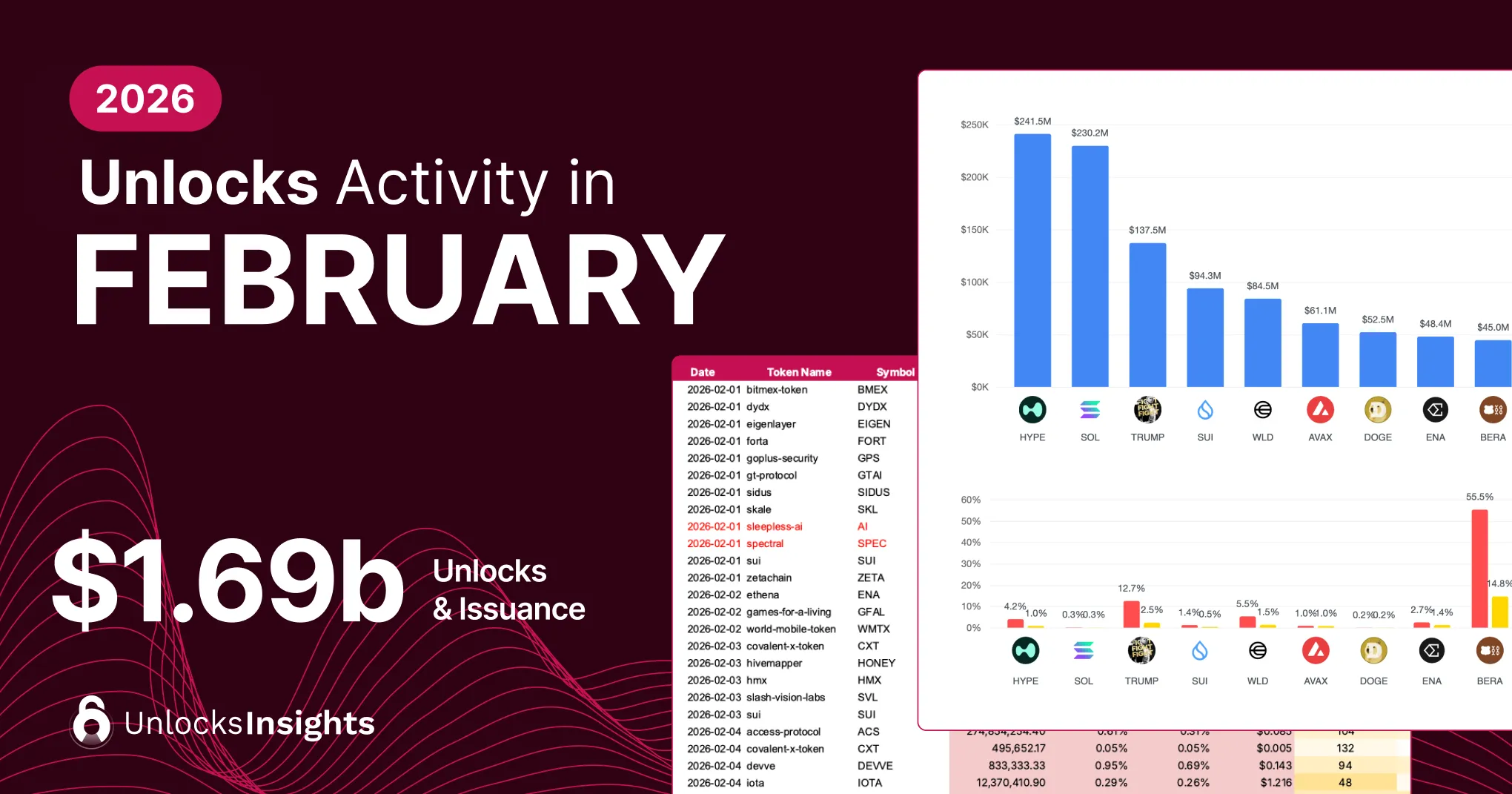

Weekly Unlocks Recap

The Federal Reserve kept rates unchanged at 3.5%–3.75%, in line with market expectations, while reiterating that the economy continues to expand at a solid pace. However, sentiment turned risk-off late in the week after former President Trump announced his intention to nominate Kevin Warsh as the next Federal Reserve Chair. Warsh is widely viewed as hawkish, particularly supportive of balance-sheet reduction, which weighed on risk assets and hit crypto markets hardest.

KEVIN WARSH IS THE RIGHT CHOICE FOR THE FED. 🇺🇸 pic.twitter.com/YIrUTrVKoZ

— The White House (@WhiteHouse) January 30, 2026

Crypto extended its downtrend last week, with Bitcoin and Ethereum falling 11% and 17%, respectively. Despite the broad sell-off, $HYPE and $PUMP stood out as relative outperformers, driven by project-specific catalysts that we cover later in this report.

From a token supply perspective, the weak macro backdrop amplified the impact of unlocks. Among tokens with the highest supply growth over the past 30 days, $ONDO posted the poorest performance, highlighting how heavy emissions can exacerbate downside during risk-off periods. Meanwhile, $RIVER, despite posting gains earlier, has retraced sharply from its peak near $80 to around $20, underscoring how price strength can quickly fade once liquidity thins and supply dynamics dominate.

Upcoming Events

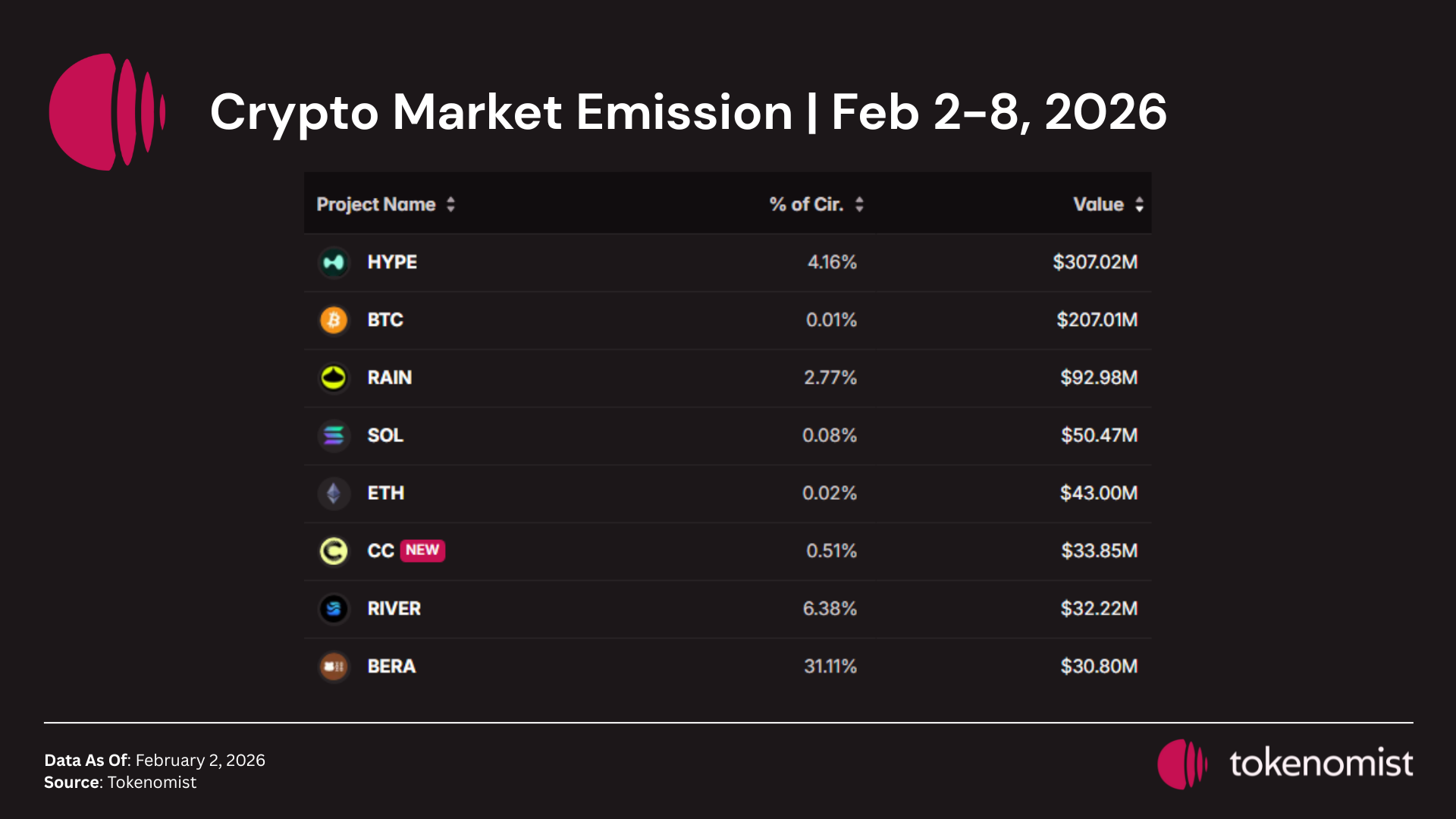

Next week’s scheduled token releases are set to exceed $1 Billion in total value. Notable tokens facing sizable releases by dollar value include $HYPE, $BTC, $RAIN, $SOL, and $RIVER.

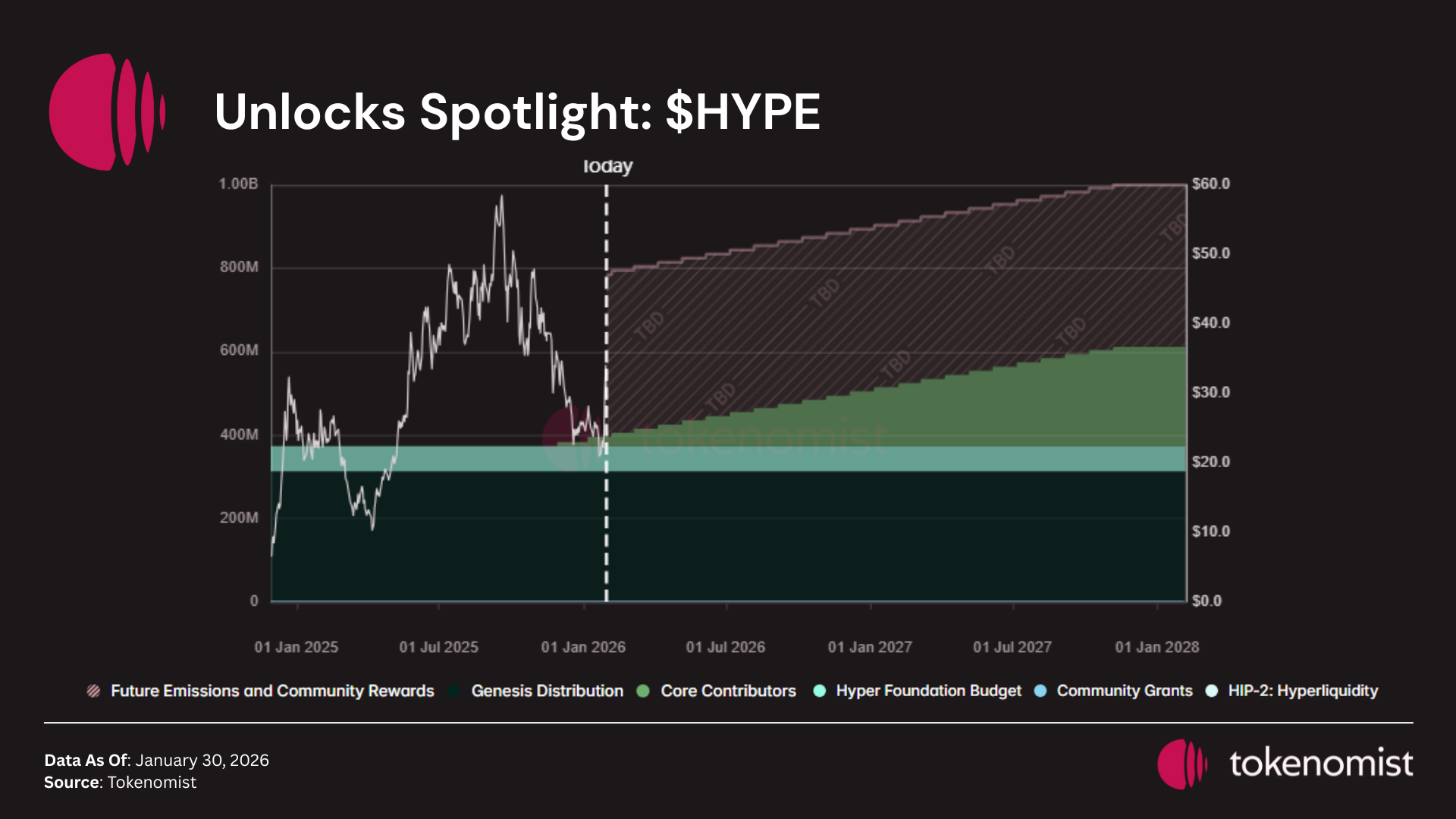

Unlocks Spotlight: $HYPE

- Unlock Date: February 6, 2026

- Amount: $ 288M

- Unlock as % of Circulating Supply: 2.79%

- Vested Allocations: Core Contributors

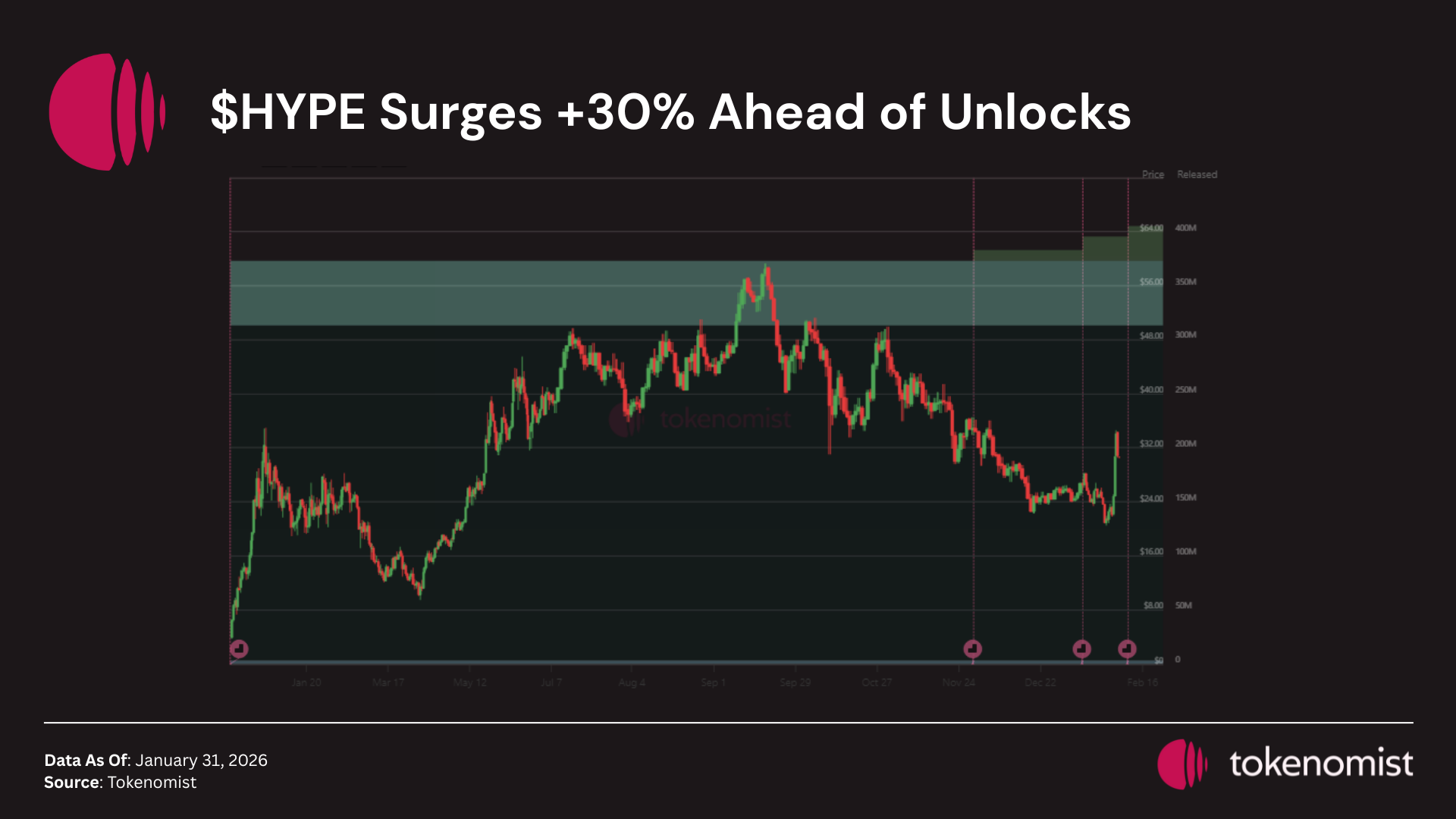

$HYPE records the largest unlock by dollar value this week, with vested tokens allocated to core contributors. Despite broader market uncertainty, the token posted a strong rally, gaining over 30% on the week.

The move was largely driven by fundamentals. The launch of HIP-3 (Builder-Deployed Perpetuals) enabled permissionless creation of new perp markets, significantly expanding the protocol’s addressable activity. This translated into a sharp pickup in usage, with trading volume and open interest reaching new all-time highs near $1.1B, driven primarily by demand for tokenized gold and silver perps.

Exchange-related catalysts also played a role. $HYPE was listed on Kraken on Jan 28, 2026, and its appearance on Coinbase’s to-list roadmap further strengthened market confidence, amplifying short-term momentum.

Importantly, the supply overhang may be less aggressive than headline unlock figures suggest. According to the team, only ~140k $HYPE units are expected to be distributed over the coming months for team unlocks, sharply lower than the ~1.2M units released in the prior month. This partial claiming approach reduces near-term sell pressure and helps explain why price action has remained resilient into the unlock.

[ ZOOMER ]

— zoomer (@zoomerfied) January 29, 2026

HYPERLIQUID ANNOUNCES 140K UNITS TO BE DISTRIBUTED NEXT MONTHS FOR TEAM UNLOCKS, DOWN FROM 1.2M UNITS THE PREVIOUS MONTH: DISCORD

Looking ahead, $HYPE still carries a heavy emission schedule over the next 12 months, with a sizable portion of supply slated for insider vesting. However, if protocol revenue, volume, and open interest continue to grow, future unlocks may remain absorbable. As growth normalizes, emissions could become more influential again, making usage trends and fee generation the key variables to watch.

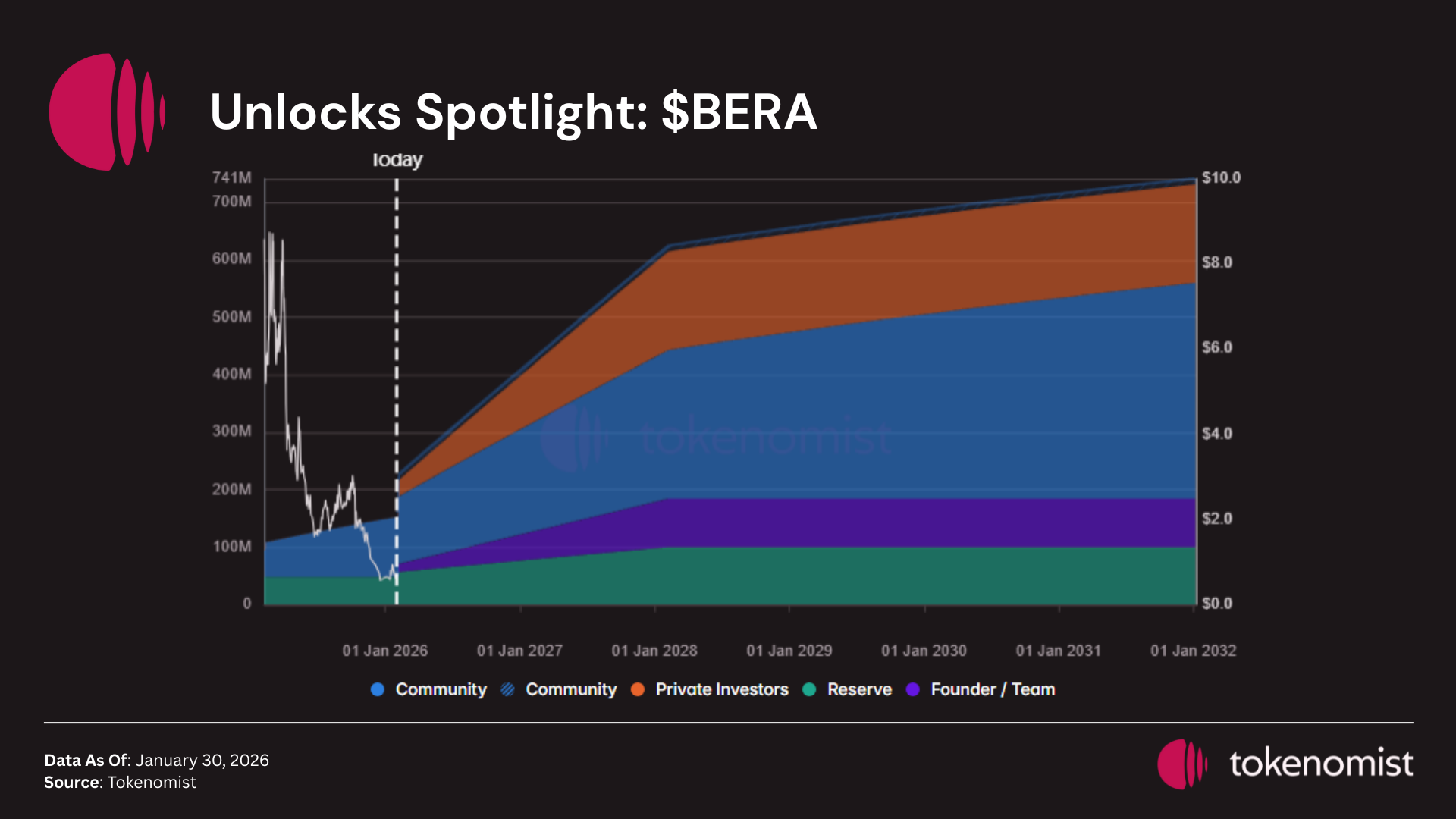

Unlocks Spotlight: $BERA

- Unlock Date: February 6, 2026

- Amount: $ 38M

- Unlock as % of Circulating Supply: 41.7%

- Vested Allocations: Investors, Initial Core Contributors, Future Community Initiatives, Ecosystem and R&D, and Airdrop

$BERA records the highest unlock relative to circulating supply this week, making it a meaningful potential price mover. Since TGE, price action has remained weak, signaling limited spot demand and low capacity to absorb new supply.

This unlock also marks the start of a much larger emission phase. Over the next 12 months, cumulative releases are set to exceed 177% of current circulating supply, creating sustained dilution pressure rather than a one-off event. In this context, near-term performance is likely to depend less on broader market conditions and more on whether incremental demand can materialize to offset the expanding supply. Until then, $BERA remains structurally exposed to unlock-driven volatility.

Notable Tokenomics Update

Optimism governance approved a plan to allocate 50% of Superchain revenue toward $OP token buybacks starting in February. Explore $OP tokenomics and unlock schedules here

The Buyback proposal has been approved by Optimism governance.

— Optimism (@Optimism) January 29, 2026

Starting in February, Optimism will use 50% of incoming Superchain revenue to buy back OP tokens. This marks a meaningful step that fundamentally aligns the token with the growth of the Superchain. pic.twitter.com/aPuHAzZlzc