Weekly Unlock Digest: Nov 24–30, 2025

This week’s report comes as crypto markets extended recent weakness. BTC declined 8.7% over the past seven days, briefly moving below the $83k level for the first time since April, with liquidations totaling ~$2.2B across major pairs. On the token side, we track $HYPE, this week’s largest unlock by dollar value, along with $EIGEN seeing outsized changes to circulating supply.

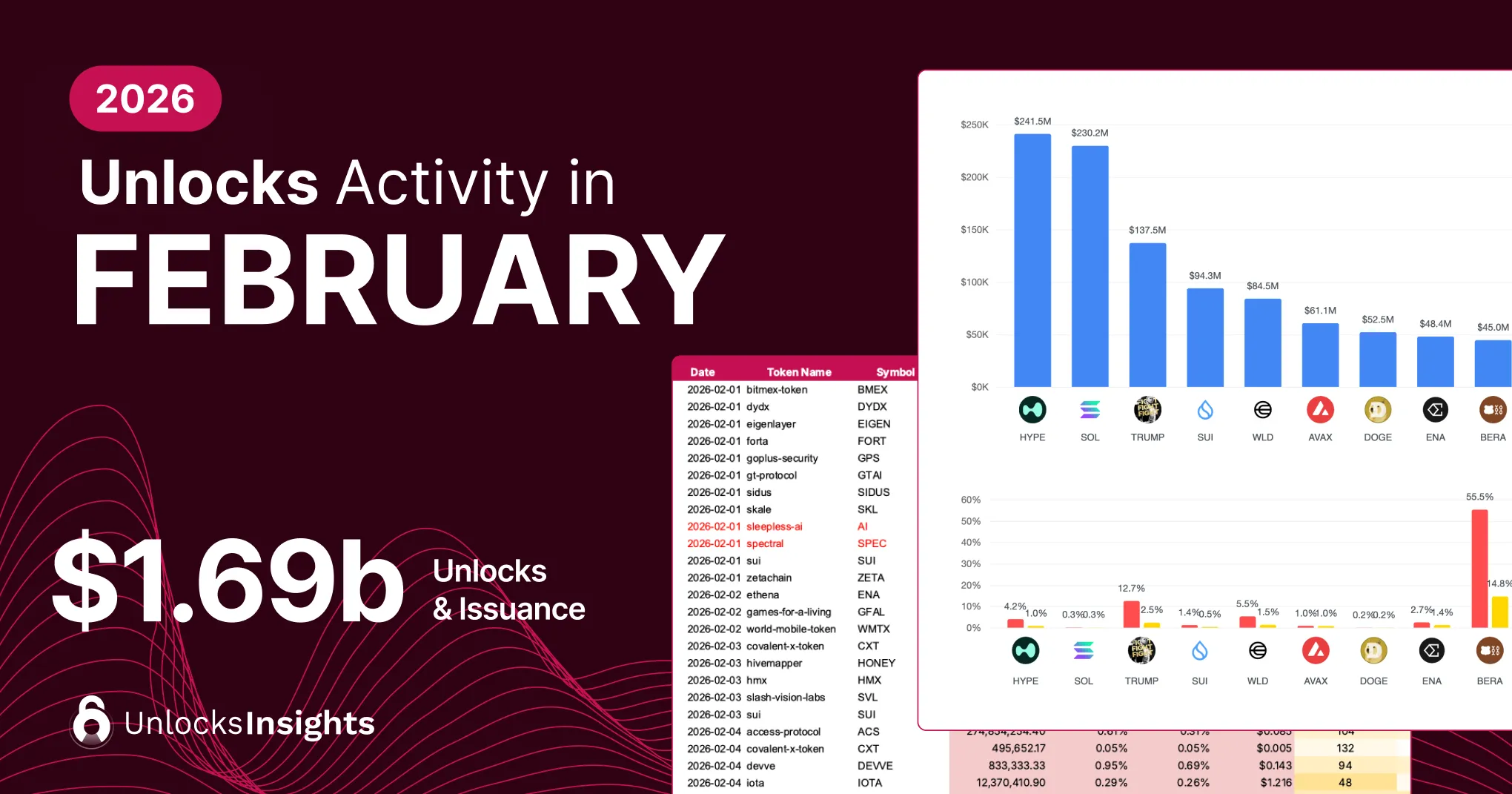

Weekly Unlocks Recap

BTC slid 8.7% and briefly broke below $83k for the first time since April, triggering roughly $2.2B in liquidations before bouncing back above $84k after New York Fed President Williams signaled room for a rate cut “in the near term.”

Macro focus now centers on December’s FOMC meeting, with rate-cut odds for next month rising to ~71%, while on the token side attention shifts to tomorrow’s $MON mainnet launch and MegaETH’s pre-deposit bridge going live on Nov 25.

Narrative Watch: $MON TGE tomorrow, and MegaETH Pre-Deposit Bridge launches Nov 25.

WCT, GRASS, OMNI, RIVER and USUAL all posted strong 30-day supply growth.

WCT recorded the largest increase, adding 65.9% new supply this month. GRASS and RIVER followed with 27–54% growth, while OMNI and USUAL added 24–30%.

Issuance remains the main driver across this group: all five names show double-digit 30-day supply growth paired with negative price performance.

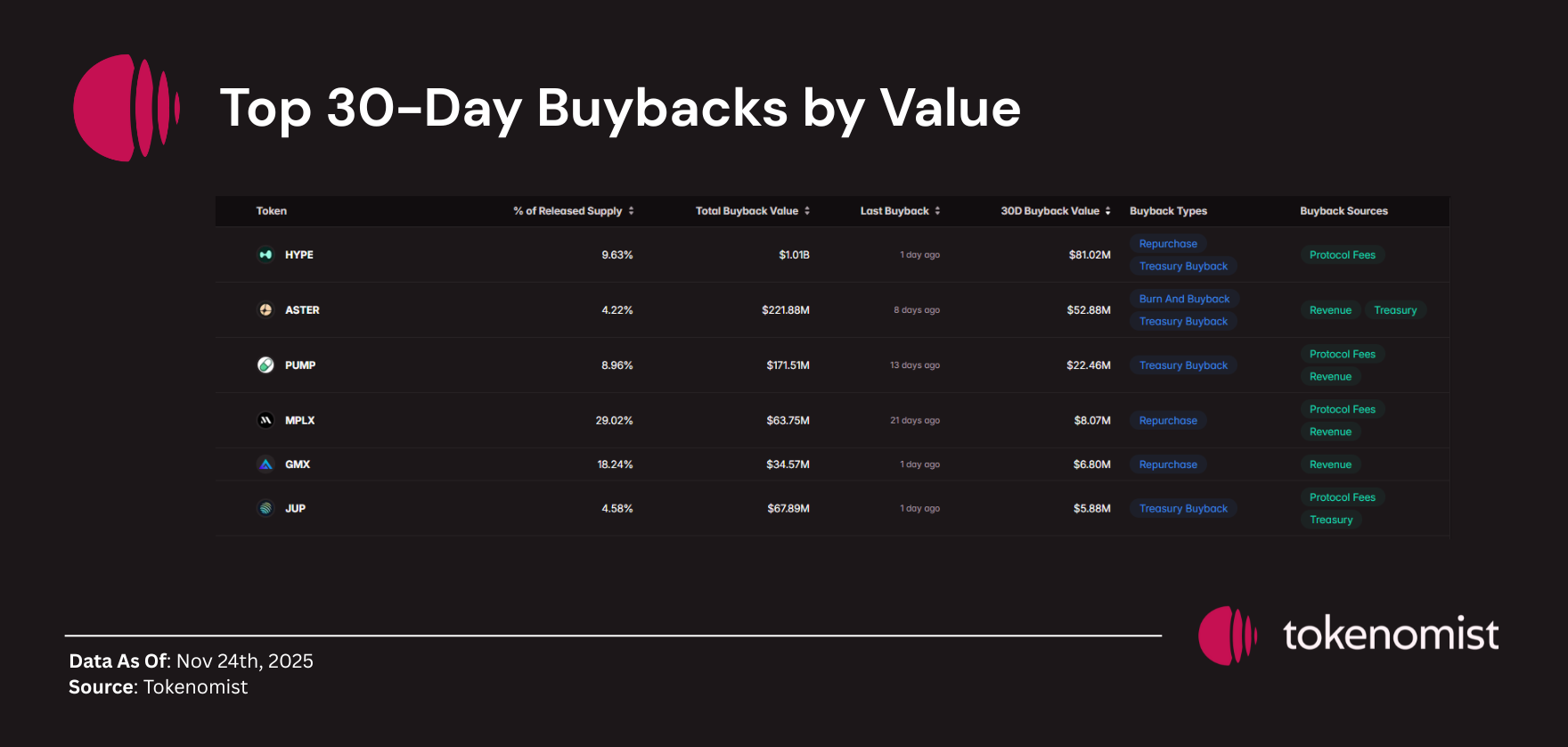

HYPE, ASTER, PUMP, MPLX, GMX and JUP continued executing consistent buybacks over the last 30 days.

HYPE led by value, recording $81.02M in 30D buybacks sourced primarily from protocol fees.

ASTER and PUMP followed, driven by treasury and revenue-supported programs.

Buybacks remain a key narrative as protocols shift toward supply reduction and revenue-linked mechanisms.

For Latest Buyback Updates https://x.com/Tokenomist_ai/status/1992187806207332856?s=20

Upcoming Events

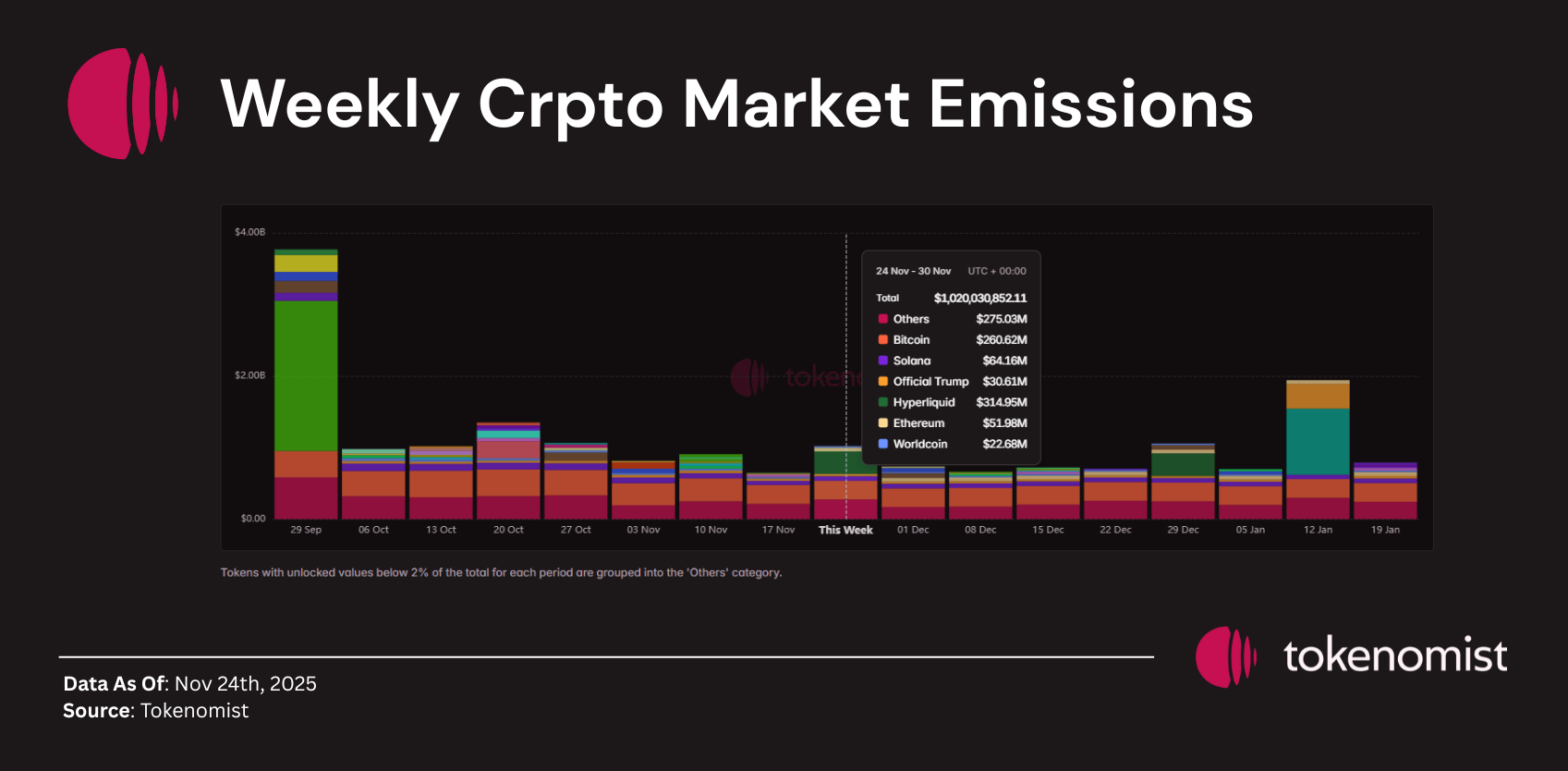

Next week’s scheduled token releases total ~$1.02B, with notable unlocks across BTC, SOL, ETH, Official Trump, Hyperliquid, and Worldcoin.

These assets account for the majority of this week’s unlock value, though impact will depend on float size and liquidity depth.

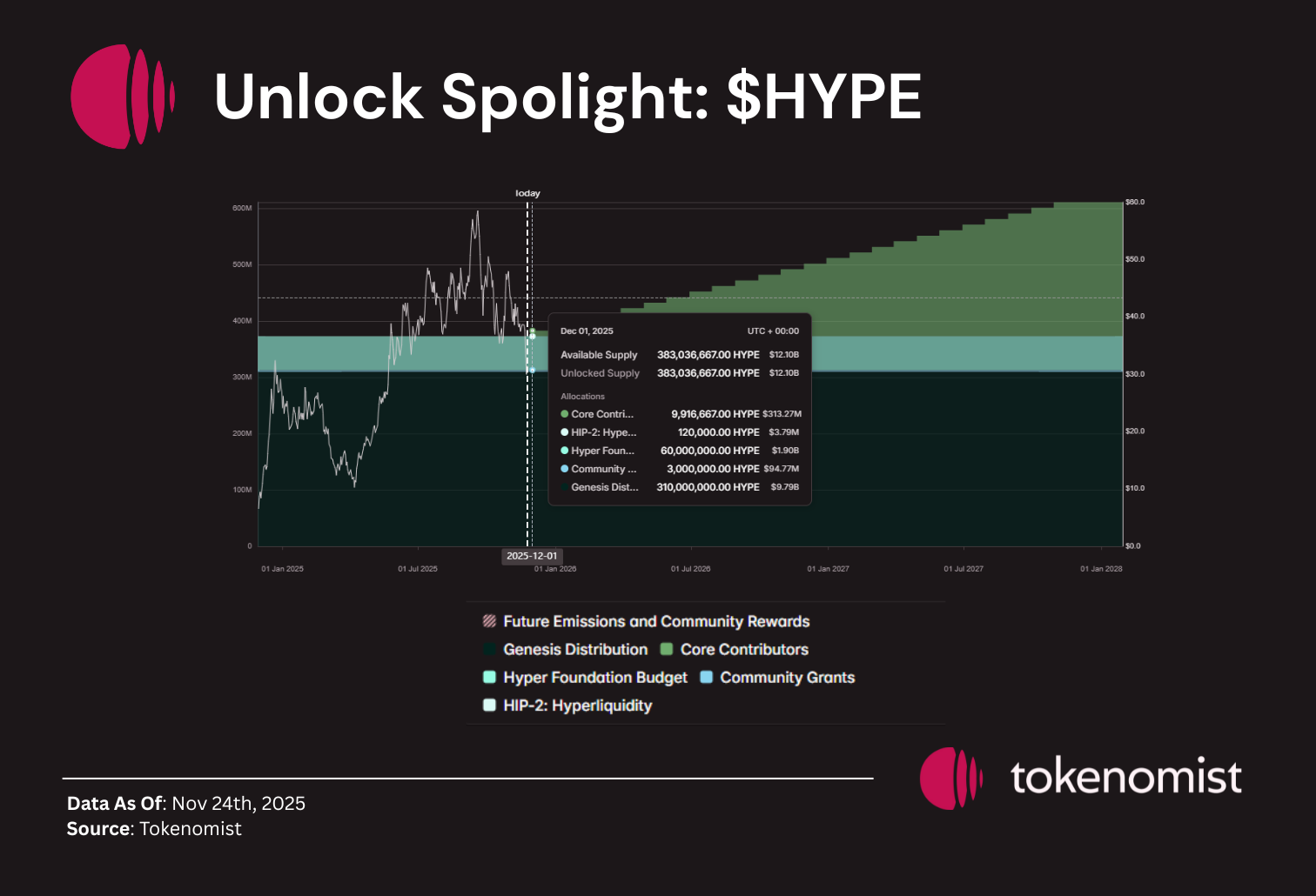

Unlocks Spotlight: $HYPE

- Unlock Date: Nov 29, 2025

- Amount: $309M

- Unlock as % of Circ. Supply: 2.66%

- Vested Allocations: Core Contributors

$HYPE leads the week by unlock value, with the entire release directed to core contributors.

A large portion of $HYPE’s supply remains locked under a multi-year schedule, with core contributor allocations releasing gradually over time. This week’s unlock adds 2.66% to circulating supply, but the broader curve follows a steady monthly emission pattern.

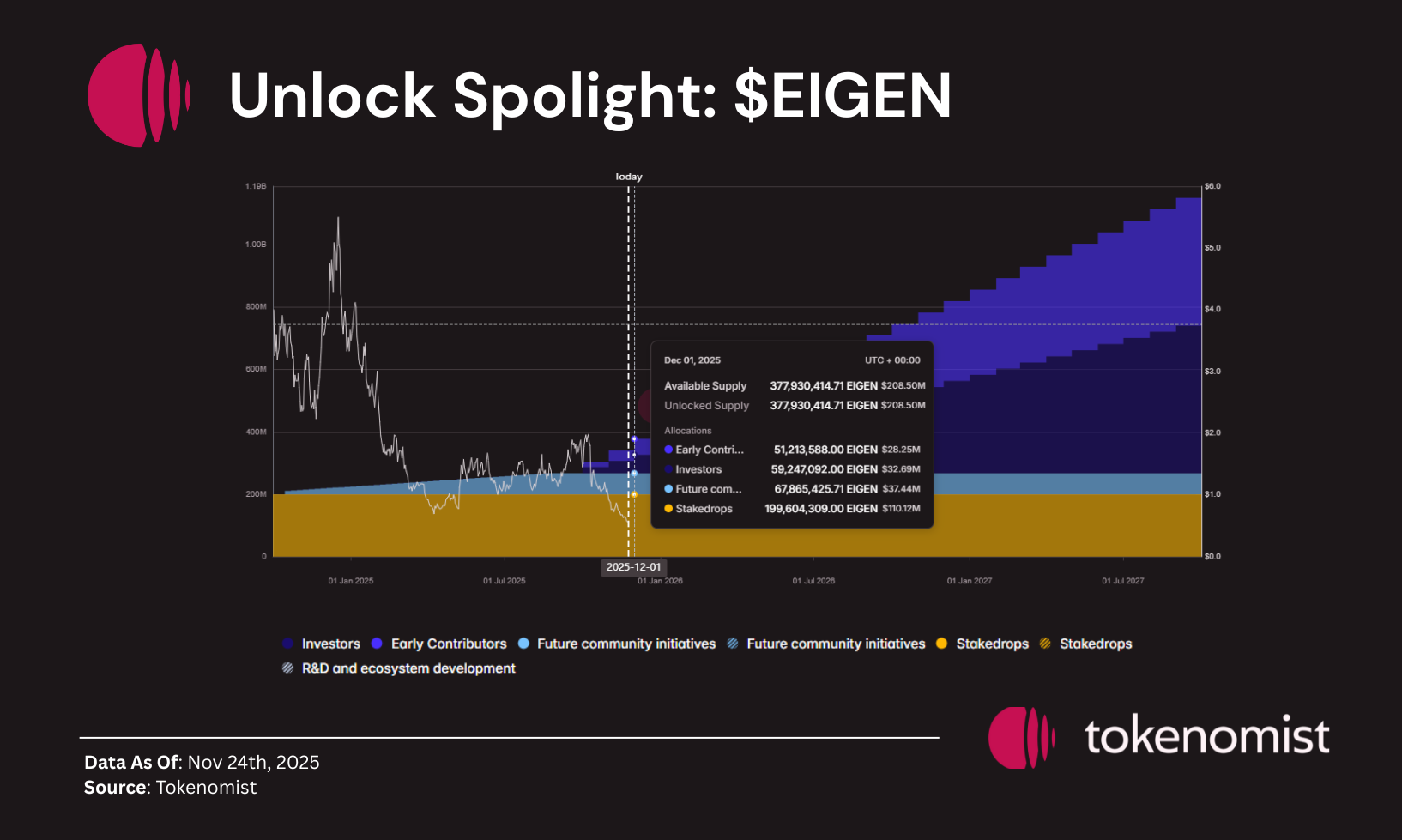

Unlocks Spotlight: $EIGEN

- Unlock Date: Dec 1, 2025

- Amount: $20.48M

- Unlock as % of Circ. Supply: 10.79%

- Vested Allocations: Investors & Early Contributors

$EIGEN records the largest float expansion relative to current circulating supply this week, with most of the release split between early contributors and investors.

Most of $EIGEN’s supply is still locked across early contributors and investor allocations. The upcoming release expands circulating supply by 10.79%, with remaining investor and team tokens vesting through a multi-year linear schedule.

Notable Crypto News

- First spot Chainlink ETF expected to launch next week, framing LINK as core infra for tokenized finance. ( www.coindesk.com/business/2025/11/21/chainlink-is-essential-infrastructure-for-tokenized-finance-says-grayscale-research )

- U.S. House bill on crypto taxes advances, proposing to allow federal tax payments in BTC and to streamline reserve management for U.S. holdings. ( www.coindesk.com/policy/2025/11/21/u-s-house-bill-would-allow-federal-taxes-in-btc-while-aiding-u-s-reserve )

- Bitcoin led with ~$2.67 B in inflows last week, representing ~84% of total weekly crypto fund inflows. (https://www.ifcci.org.my/bitcoin-dominates-institutional-crypto-inflows-last-week/)