Weekly Unlock Digest: Jan 12 - 18, 2026

With crypto markets stuck in a tight range, token supply events are once again taking center stage. When price momentum fades, unlocks, emissions, and vesting schedules become the real drivers of performance and risks.

This week’s letter breaks down $HYPE’s post-unlock price impact, massive upcoming cliff unlocks for $ONDO and $TRUMP, and the $LIT TGE, one of the most closely watched perp launches this cycle. In a market where demand is selective, understanding who gets tokens and when matters more than ever.

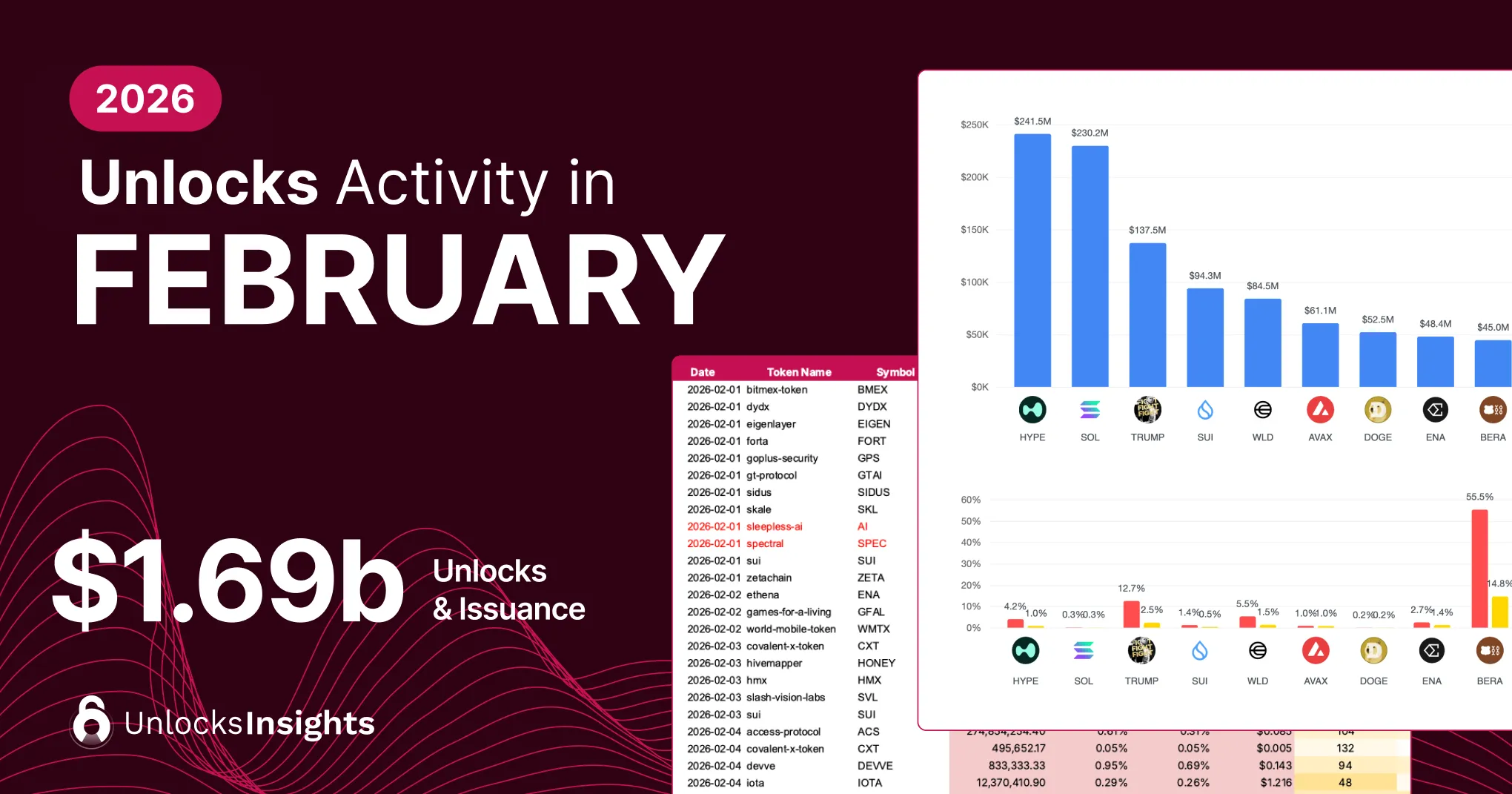

Weekly Unlocks Recap

Since the October 10 liquidation event last year, markets have mostly traded in range as investors grapple with intersecting macro and geopolitical forces. Recent data showed weekly jobless claims lower and a higher Q2 GDP forecast, suggesting the U.S. economy remains stronger than expected — a signal that the Fed may be less inclined to deliver rapid rate cuts in the near term amid persistent inflation pressures.

On the geopolitical front, the U.S. capture of Venezuela’s Nicolás Maduro has injected uncertainty into energy and financial markets. While some analysts view near-term impacts as limited due to Venezuela’s relatively small share of global output, the event has boosted safe-haven demand such as gold immediately.

$HYPE Unlock Impact

Last week’s $HYPE unlock was fully allocated to the team, adding to ongoing supply pressure that has weighed on the token since its first cliff unlock in November 2025. Since then, price action has shown a steady bleed, coinciding with worsen market condition. Looking ahead, nearly 50% of the current circulating supply is set to unlock over the next year, creating a significant overhang. In the absence of a pickup in usage or renewed market momentum, these upcoming releases may continue to challenge $HYPE’s ability to stabilize in the near term.

Upcoming Events

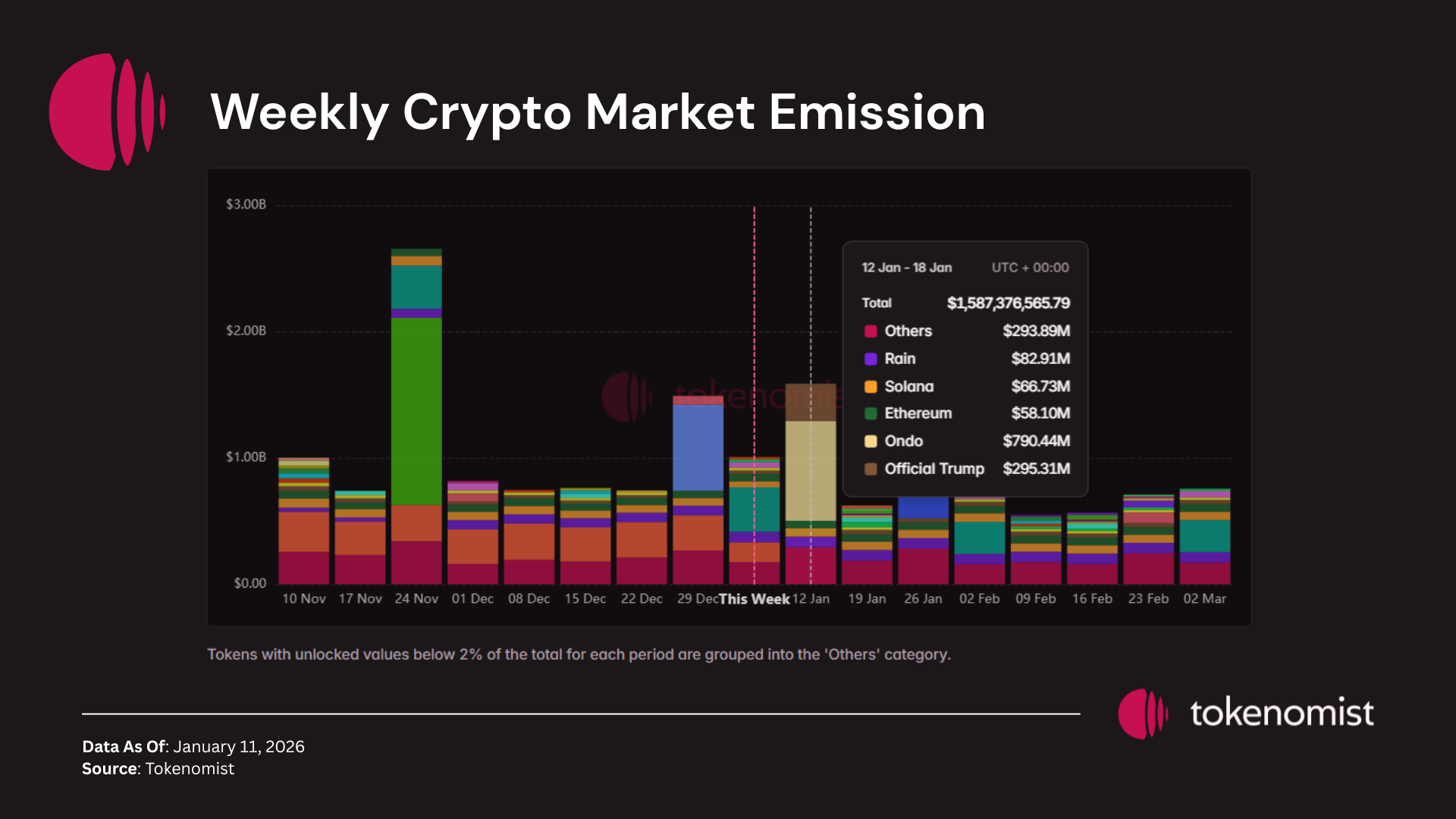

Next week’s scheduled token releases are set to exceed $1.5 Billion in total value. Notable tokens facing sizable releases by dollar value include $ONDO, $TRUMP, $RAIN, $SOL, and $ETH.

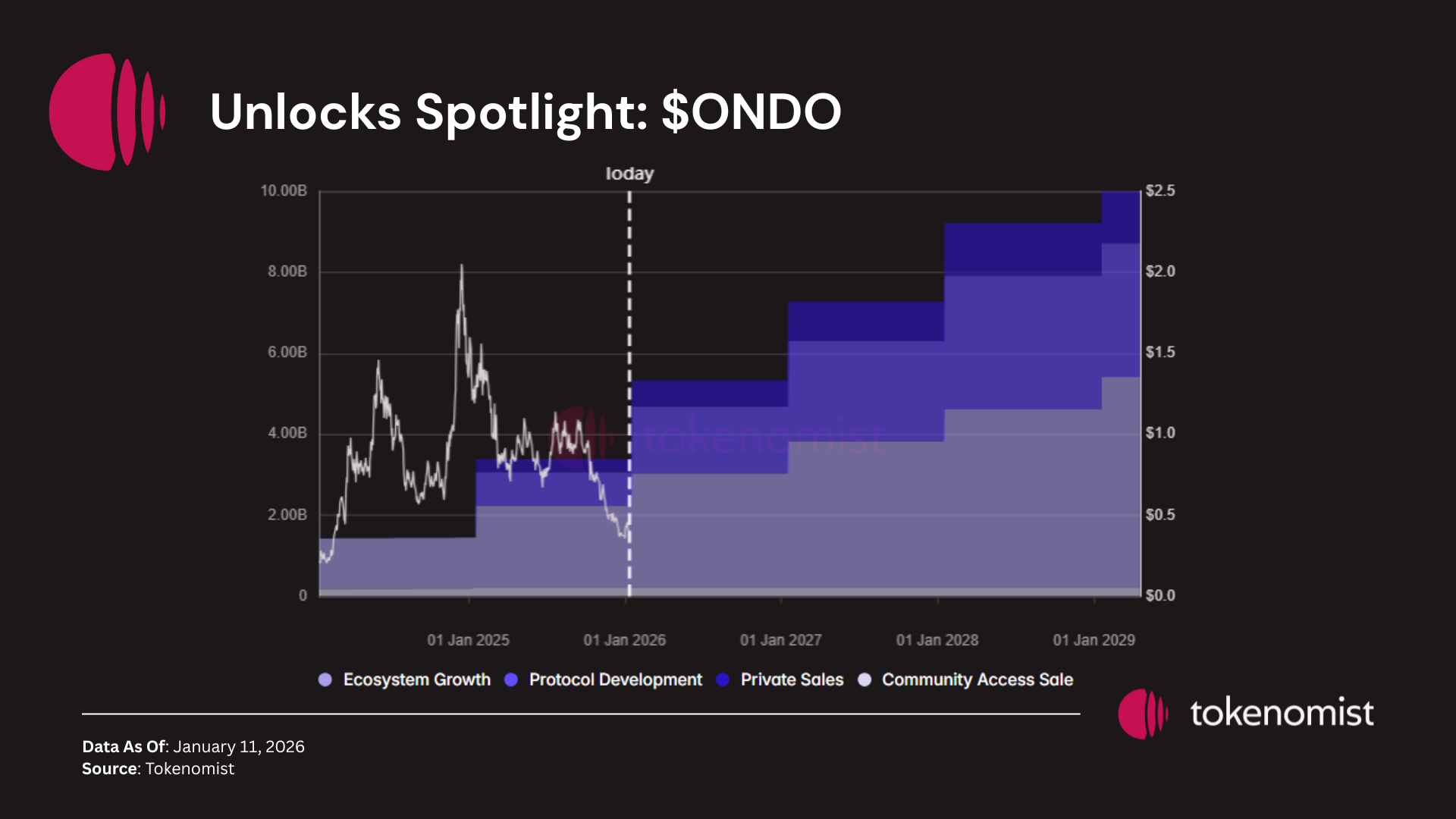

Unlocks Spotlight: $ONDO

- Unlock Date: January 18, 2025

- Amount: $ 780M

- Unlock as % of Released Supply: 57.23%

- Vested Allocations: Protocol Development, Ecosystem Growth, and Private Sales investors

$ONDO records this week’s largest unlock both by dollar value and as a percentage of released supply, with allocations split between insider and community holders.

At launch, $ONDO was widely viewed as a low-float token with distant unlocks, a narrative reinforced by its position as a leading project in the RWA sector. As the vesting schedule has now reached its heavy unlock phase, that initial low float has amplified the price impact of new supply. Since the first cliff unlock in mid-January 2025, $ONDO has fallen over 60%. With additional releases ahead, including private investor and team allocations, supply dynamics remain a key factor to watch in the near term.

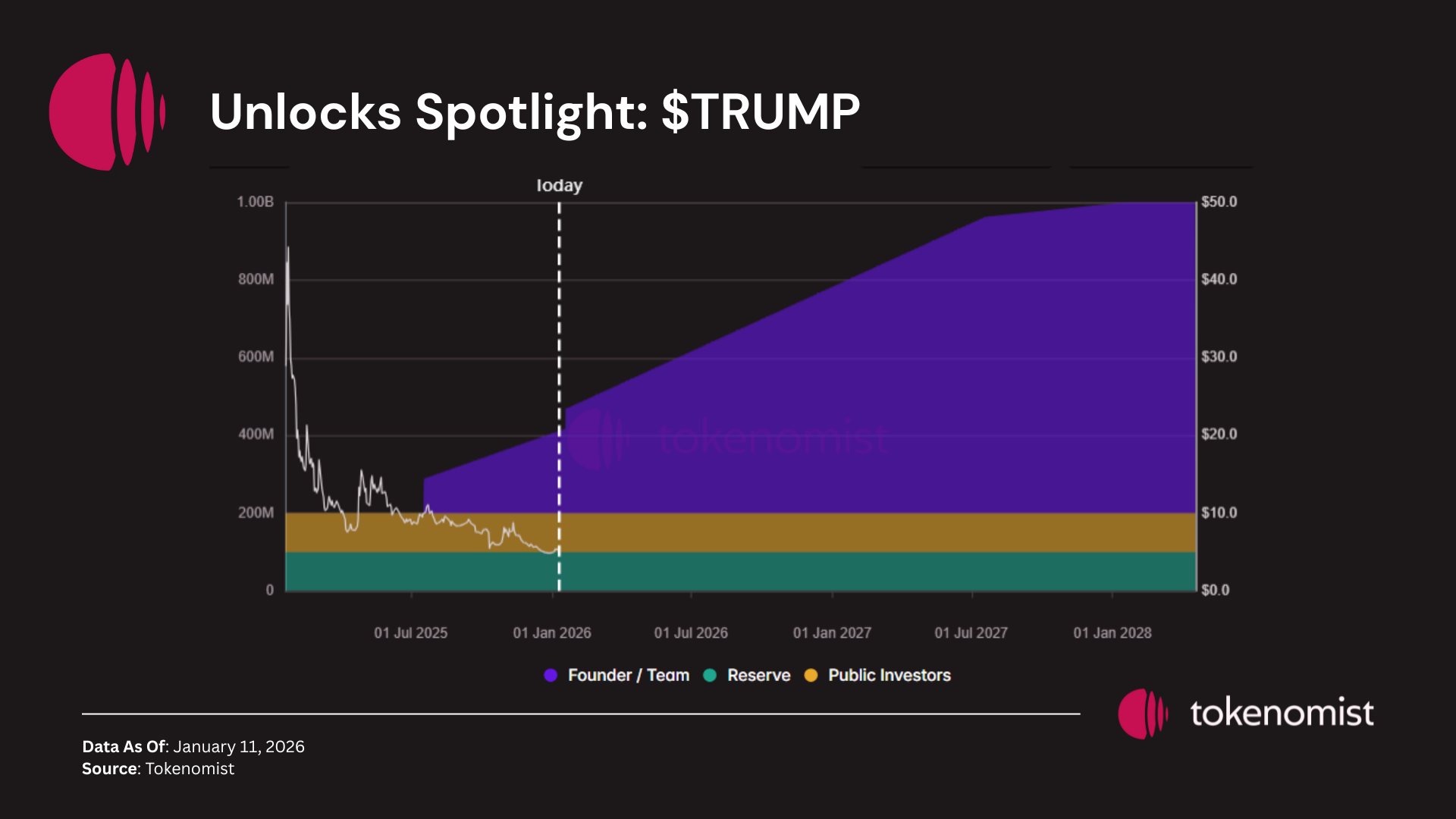

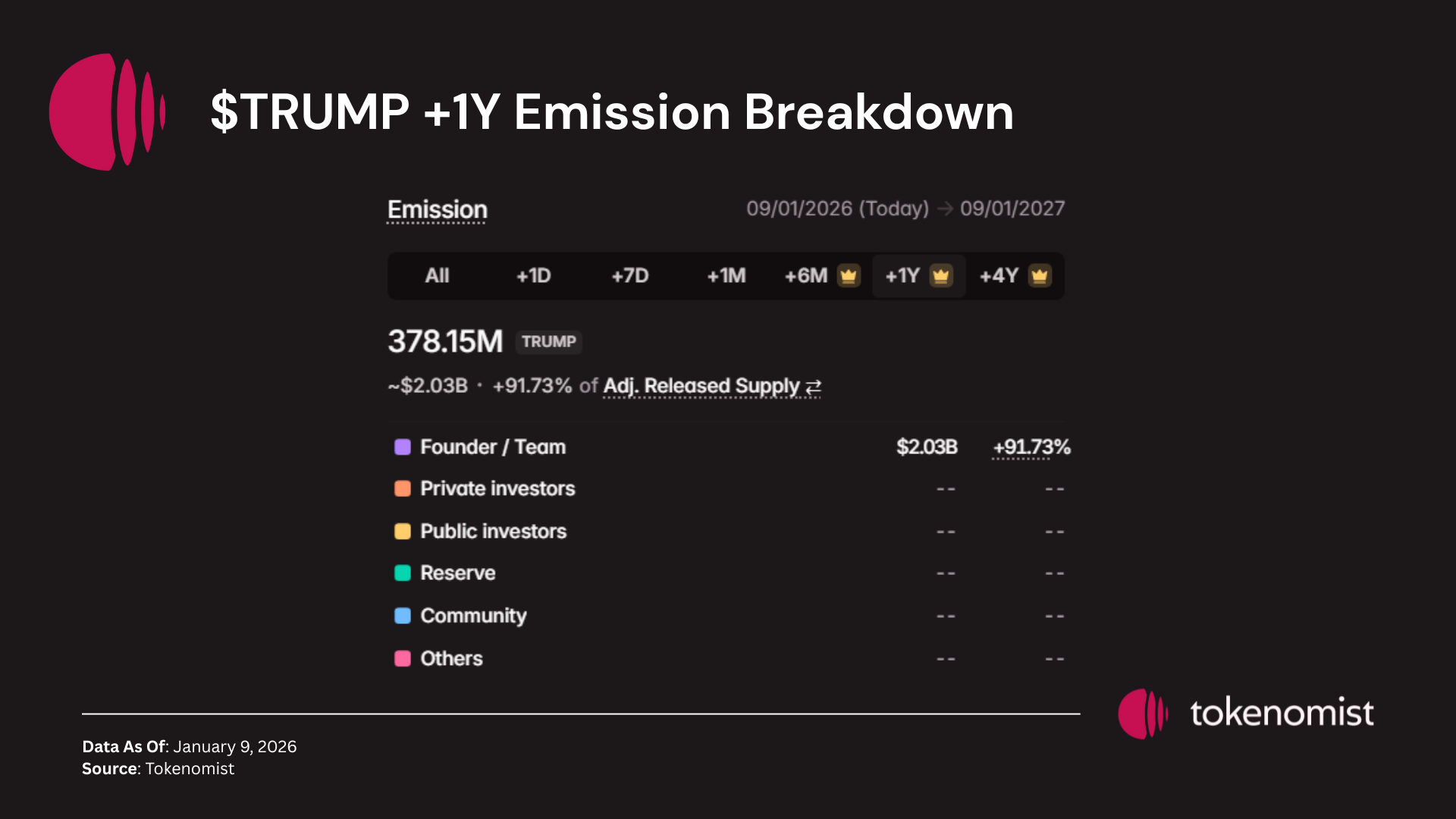

Unlocks Spotlight: $TRUMP

- Unlock Date: January 11, 2025

- Amount: $ 269M

- Unlock as % of Released Supply: 11.95%

- Vested Allocations: Founder/Team

$TRUMP posts the second-largest unlock by dollar value in the coming week, with all released tokens allocated to the team, classifying the event as fully insider-driven.

Since launch, $TRUMP’s price has declined sharply following the post-election speculation phase in early 2025. After peaking at a market cap above $8B, the token now trades closer to $1B. This upcoming event marks the second cliff unlock to insider allocations since TGE, with a long tail of linear releases ahead. Over the next 12 months, cumulative unlocks will exceed 90% of the adjusted released supply, entirely attributed to founders. With price action remaining weak after the hype faded, $TRUMP’s vesting schedule remains a key overhang for investors to monitor.

New TGEs on the Radar

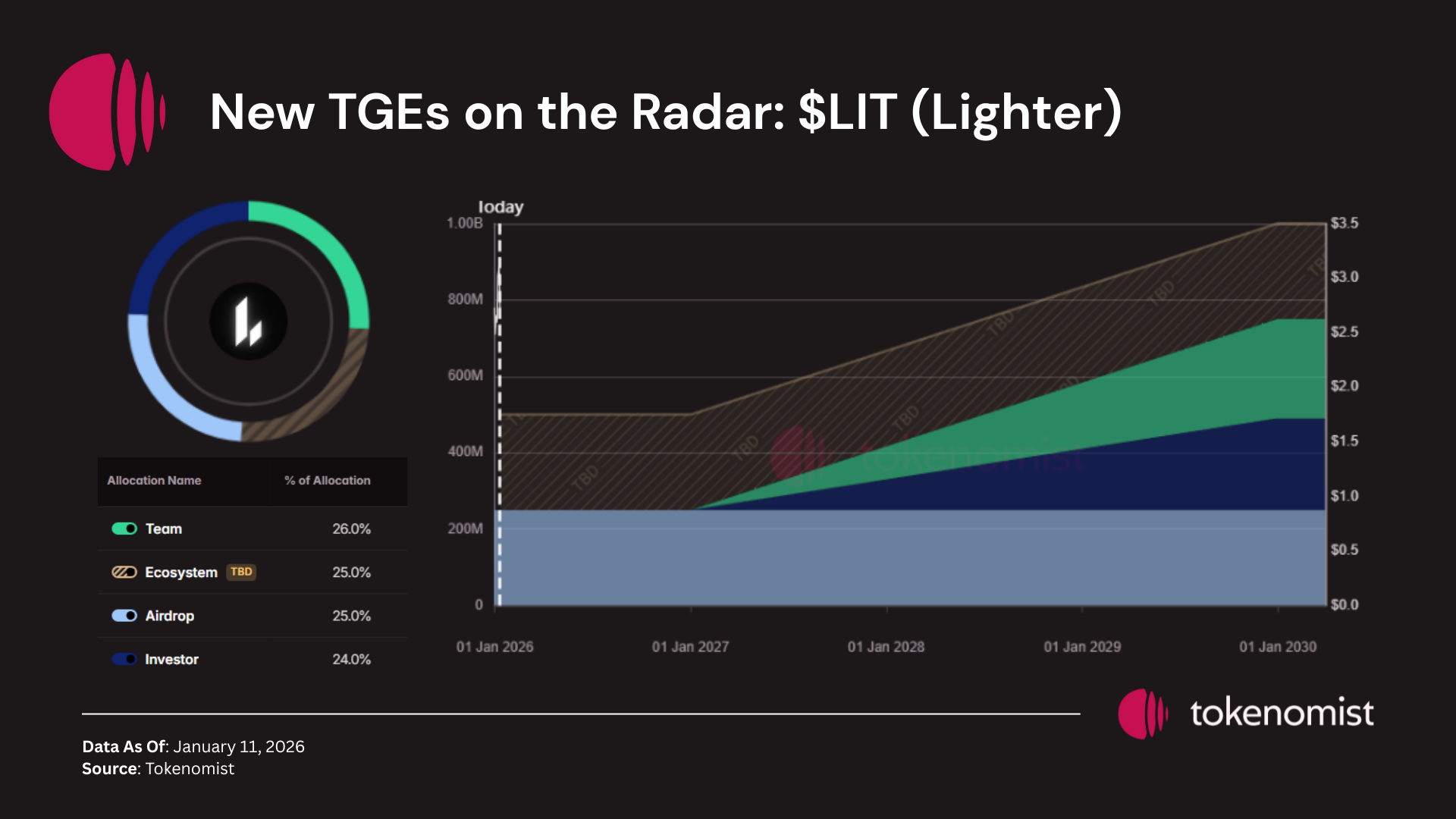

The latest notable TGE is $LIT, the native token of Lighter, a perpetual trading protocol built on Ethereum. Lighter operates as a specialized zk-rollup, using cryptographic proofs and optimized data structures to achieve scalability, security, and transparency in on-chain derivatives trading.

$LIT Tokenomics Overview

Token Supply: 1,000,000,000 $LIT

- Airdrop (25%): Fully unlocked at TGE, distributed to Point Seasons 1 & 2 participants

- Ecosystem (25%): Reserved for future incentives, partnerships, and growth (unlock schedule TBD)

- Team (26%): 1-year cliff followed by 3-year linear vesting

- Investors (24%): 1-year cliff followed by 3-year linear vesting

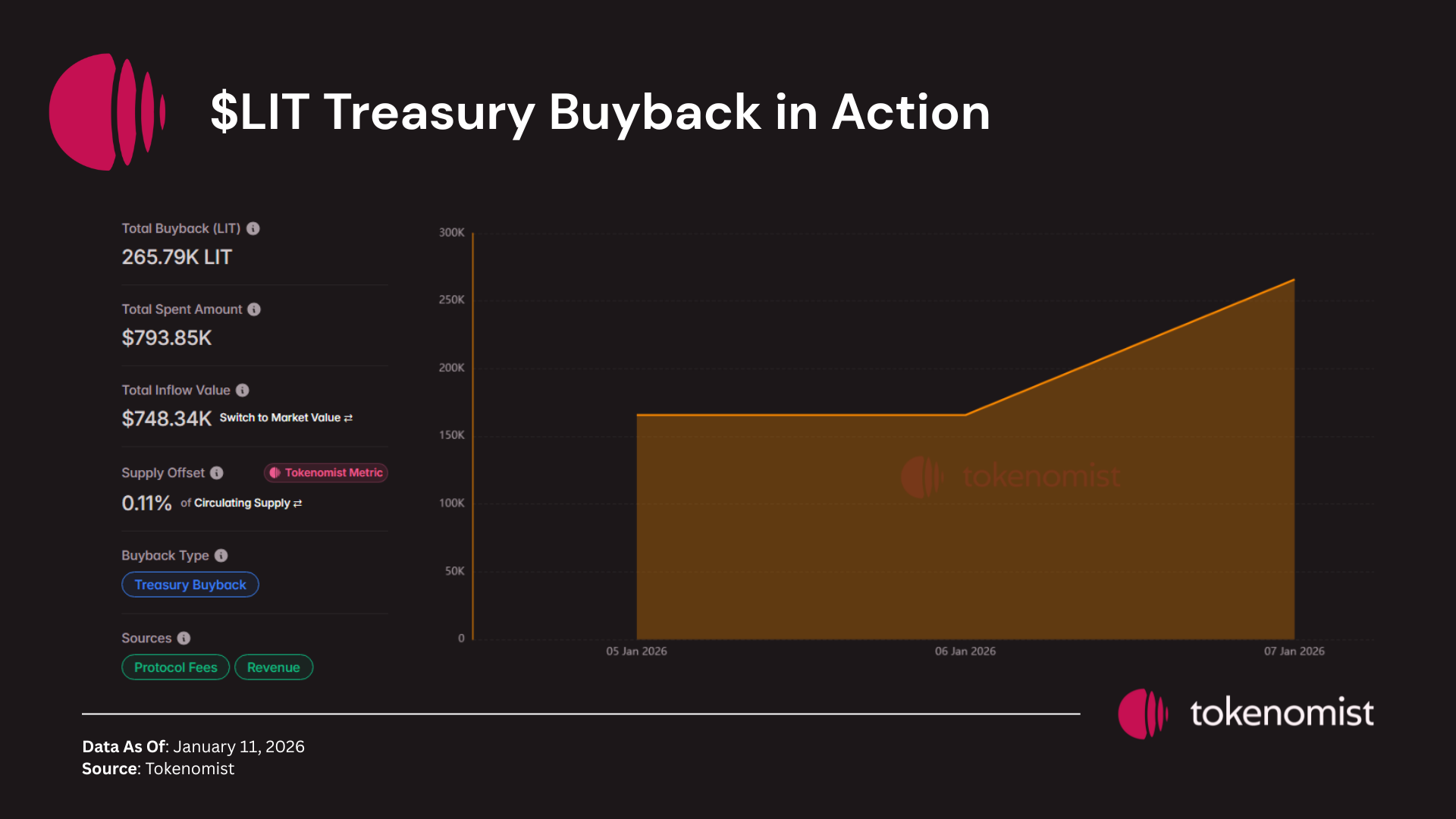

Lighter’s launch strategy closely mirrors Hyperliquid’s playbook, with $LIT initially listed only on the Lighter exchange and a clear focus on routing protocol revenues back to token holders. Since launch, two on-chain buyback transactions have already occurred, accounting for roughly 0.11% of circulating supply. On the usage side, Lighter’s 30-day perpetual trading volume has surpassed $160B, signaling strong early adoption.

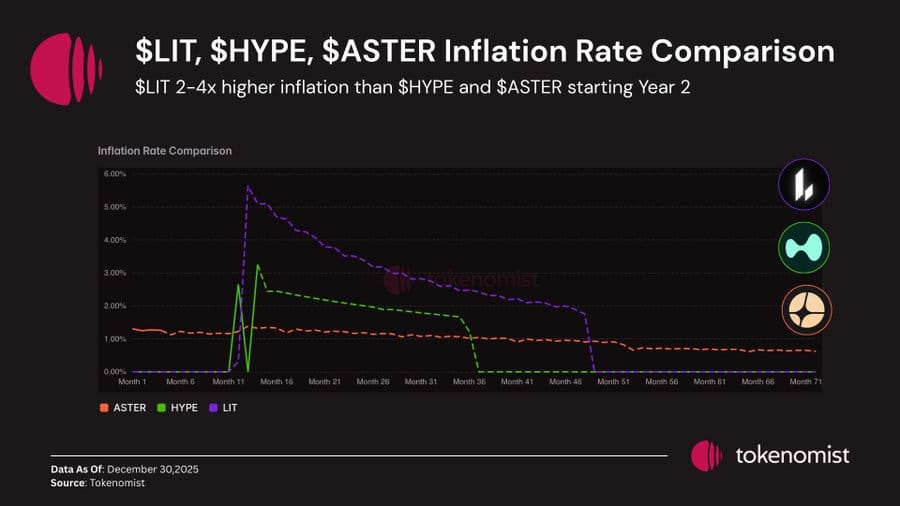

From a supply perspective, $LIT carries a 2–4x higher inflation rate compared to peers like $HYPE and $ASTER. While the vesting structure is broadly similar, the higher inflation is largely driven by $LIT’s low initial float of just 25%, making upcoming emissions more impactful. This dynamic will be particularly important for holders to monitor heading into early next year.

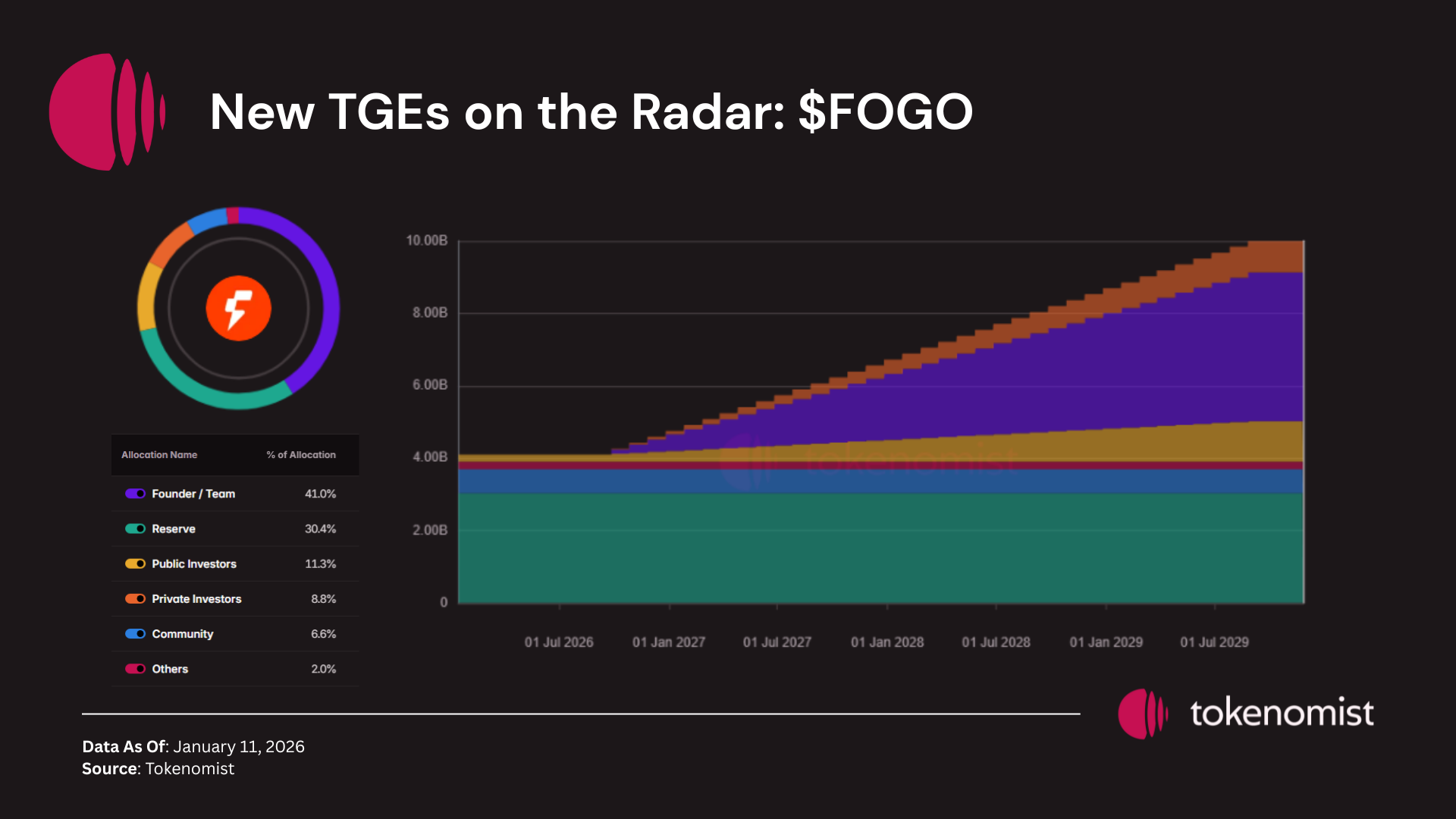

Looking ahead, another token to watch is $FOGO, set to go live on January 13. $FOGO is the native token of a high-performance SVM-based Layer 1 blockchain and recently raised $8M via an ICO on Echo at a $100M valuation. Full $FOGO tokenomics details are now available on our platform for tracking and analysis.

Notable Tokenomics Update

- a16z Crypto invests $15M in Babylon for BTCVaults development (Babylon)

- Kamino Finance restructured allocations and added Season 4 & 5 (Tokenomist)