Weekly Unlock Digest: Dec 8 – 14, 2025

This week’s report lands as crypto markets pushed higher into a busy macro calendar. BTC gained 6.5% over the past seven days, with total liquidations climbing to roughly $2.98B as traders repositioned ahead of the next FOMC decision. On the token side, we track $LINEA and $STRK, two of the week’s key unlocks by value and circulating-supply impact.

Weekly Unlocks Recap

BTC moved up 6.5% this week as markets looked through weekend noise and focused on the upcoming FOMC interest-rate decision. Positioning around these events helped drive about $2.98B in liquidations across majors.

This week’s macro attention centers on:

• JOLTS Job Openings

• FOMC Interest Rate Decision

On the token side, several near-term catalysts stand out:

• $BTC — FOMC interest-rate decision on Dec 10

• $ASTER — S4 buyback program begins Dec 10

• $TAO — First halving event on Dec 12

• $AVAX — US ETF approval deadline on Dec 12

• Lighter — Expected memecoin launch

WCT, USUAL, RIVER, PUFFER, and STBL lead 30D supply expansion, posting 20–66% increases over the past month. Across this basket, price performance remains broadly negative, signaling that recent supply growth has been driven primarily by vesting-related emissions rather than organic demand.

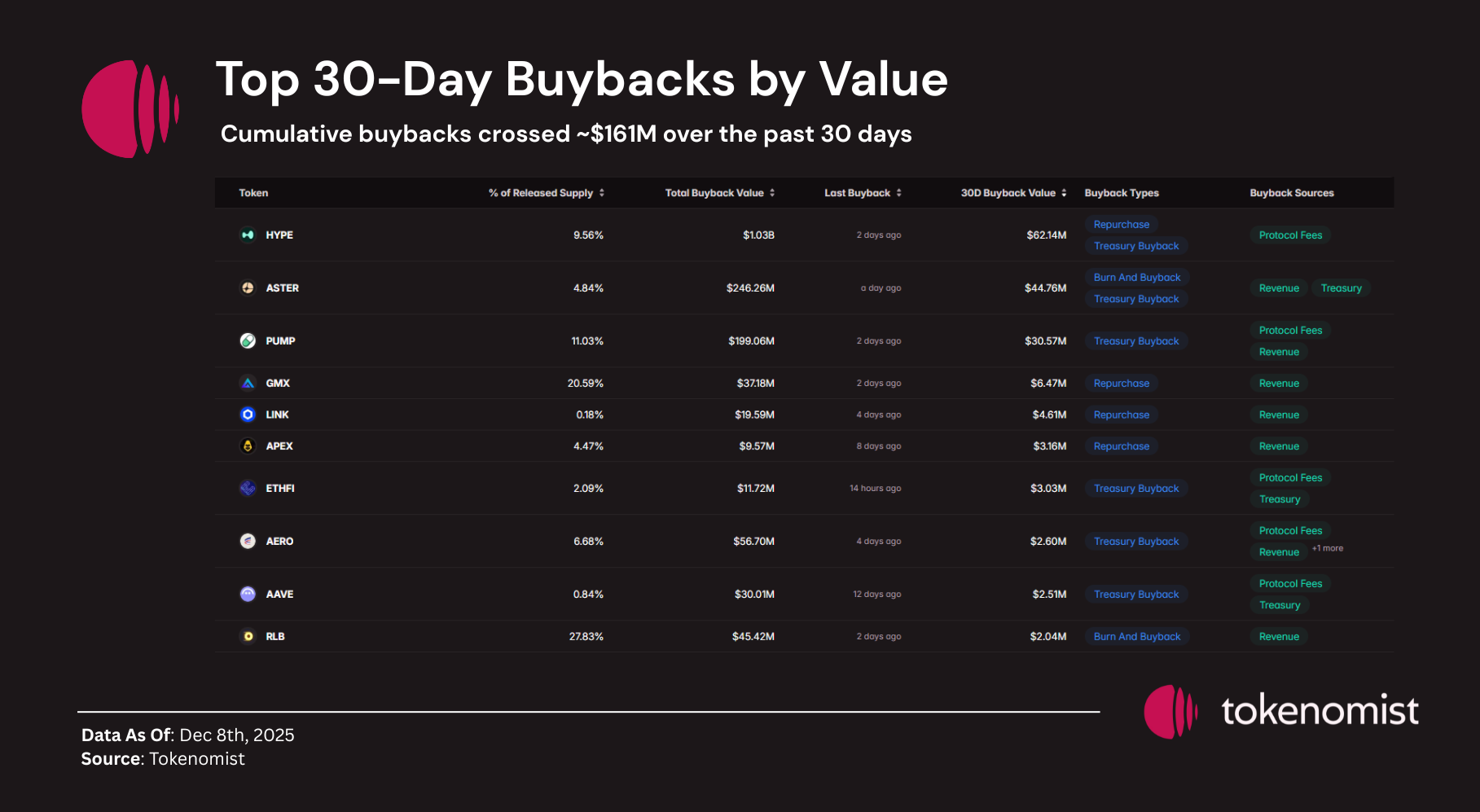

Top 30D Buybacks

Cumulative 30D buyback activity exceeded $190M across major tokens.

• HYPE, ASTER, and PUMP dominate recent repurchase activity, driven by protocol revenue and treasury-funded programs.

• HYPE alone accounts for over $62M in 30D buybacks — the largest among all tracked assets.

• GMX, LINK, APEX, ETHFI, and AAVE continue steady repurchase activity at smaller but consistent scales.

Full Dashboard : https://tokenomist.ai/buyback/screener

Upcoming Events

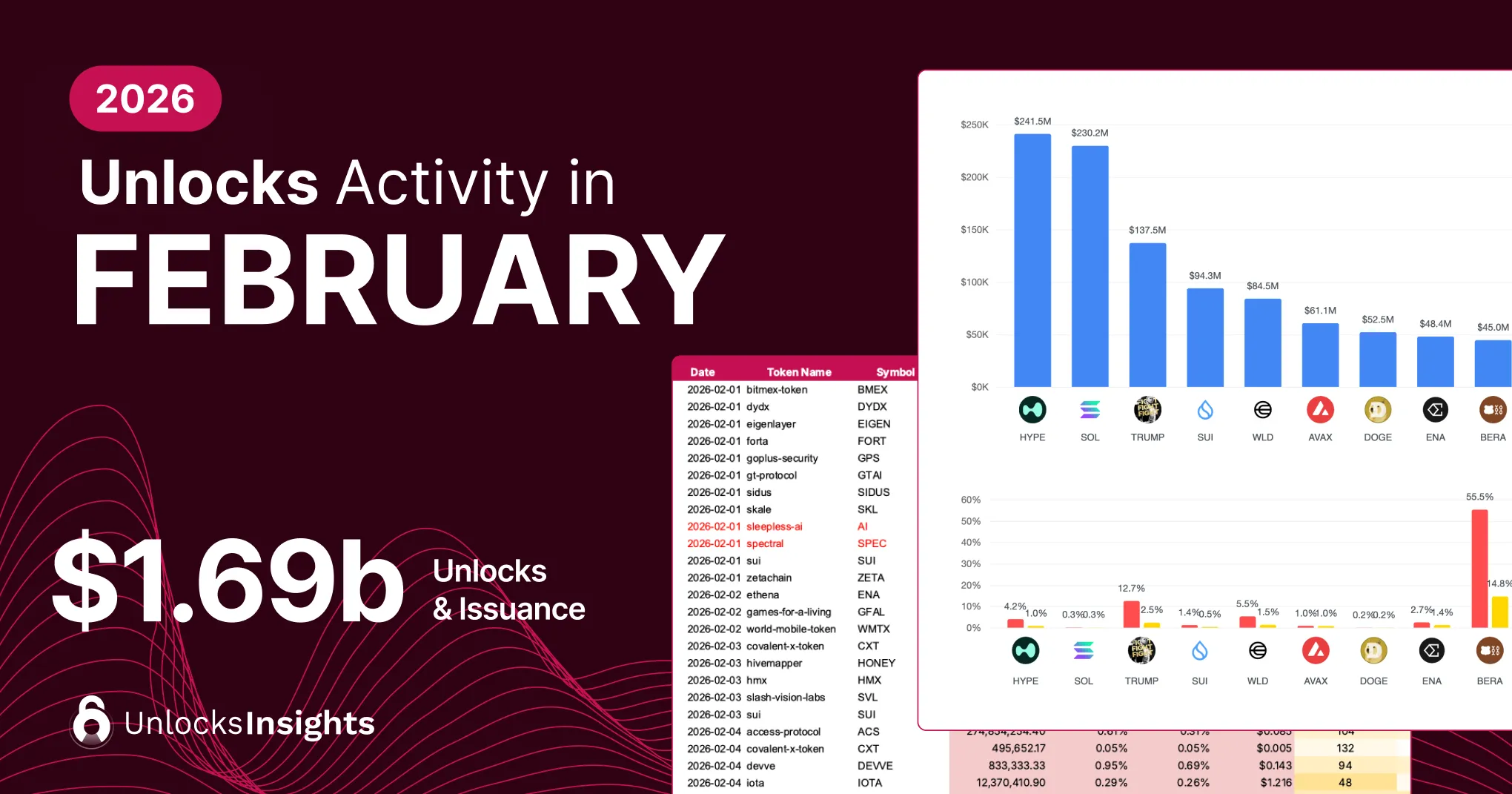

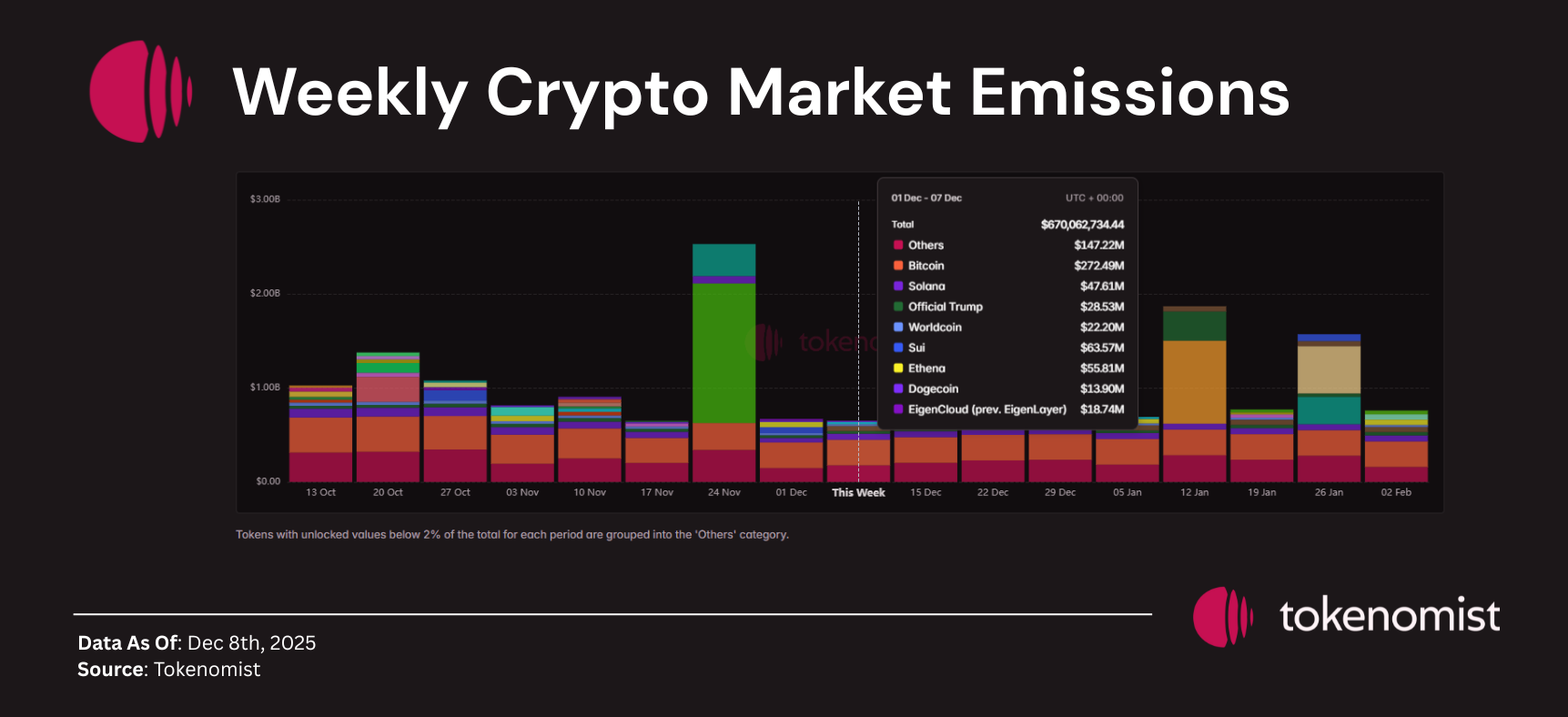

This week’s scheduled unlocks total ~$650M, lower than last week’s ~$706M marking one of the lowest weekly emissions in 2025.

Unlock contributions are spread across BTC, SOL, TRUMP, SUI, and mid-cap assets, with no single token dominating total weekly emissions. Overall unlock pressure remains muted relative to recent months.

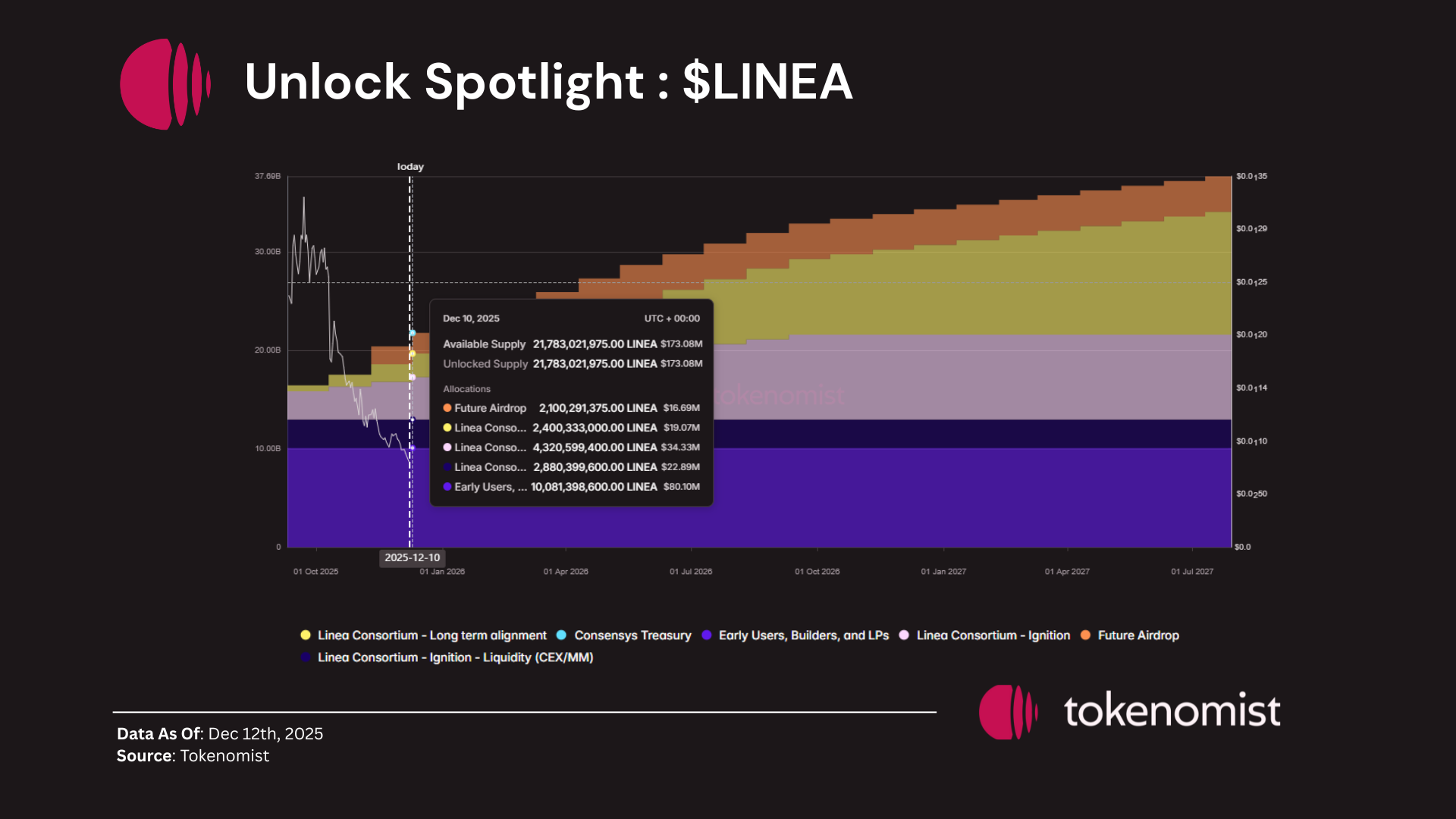

Unlocks Spotlight: $LINEA

Unlock Date: Dec 10, 2025

Amount: $11M

Unlock % of Circulating Supply: 6.76%

Allocations: Community

$LINEA records the largest unlock relative to circulating supply this week, with all emissions tied to community allocations.

Full Dashboard : https://tokenomist.ai/linea

A large share of $LINEA’s supply remains locked under a multi-year schedule. This week’s 6.76% unlock is allocated to the community, meaning tokens may not enter circulation immediately and are likely to be deployed gradually based on ecosystem needs rather than direct market release.

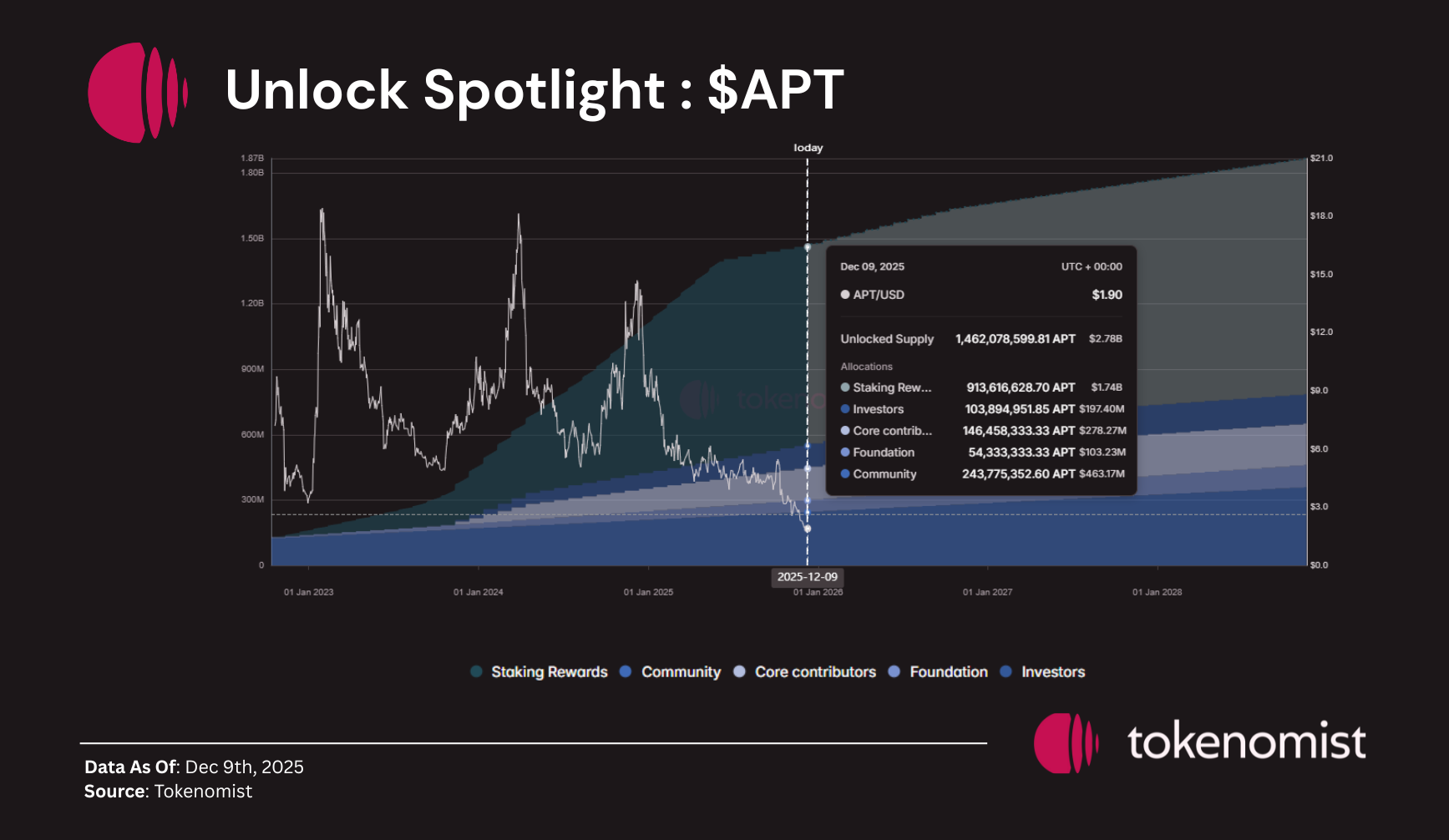

Unlocks Spotlight: $APT

Unlock Date: Dec 11, 2025

Amount: $20M

Unlock % of Circulating Supply: 0.8%

Allocations: Community, Investors, Team & Foundation

$APT records the week by unlock value, with the majority of emissions directed toward internal foundation, team, investor and community allocations

Full Dashboard : https://tokenomist.ai/aptos

$APT follows a monthly unlock schedule with around 60% of the supply already unlocked. The remaining insider allocations will vest over the next 2–4 years, while inflation rewards are expected to remain the main source of emissions going forward.

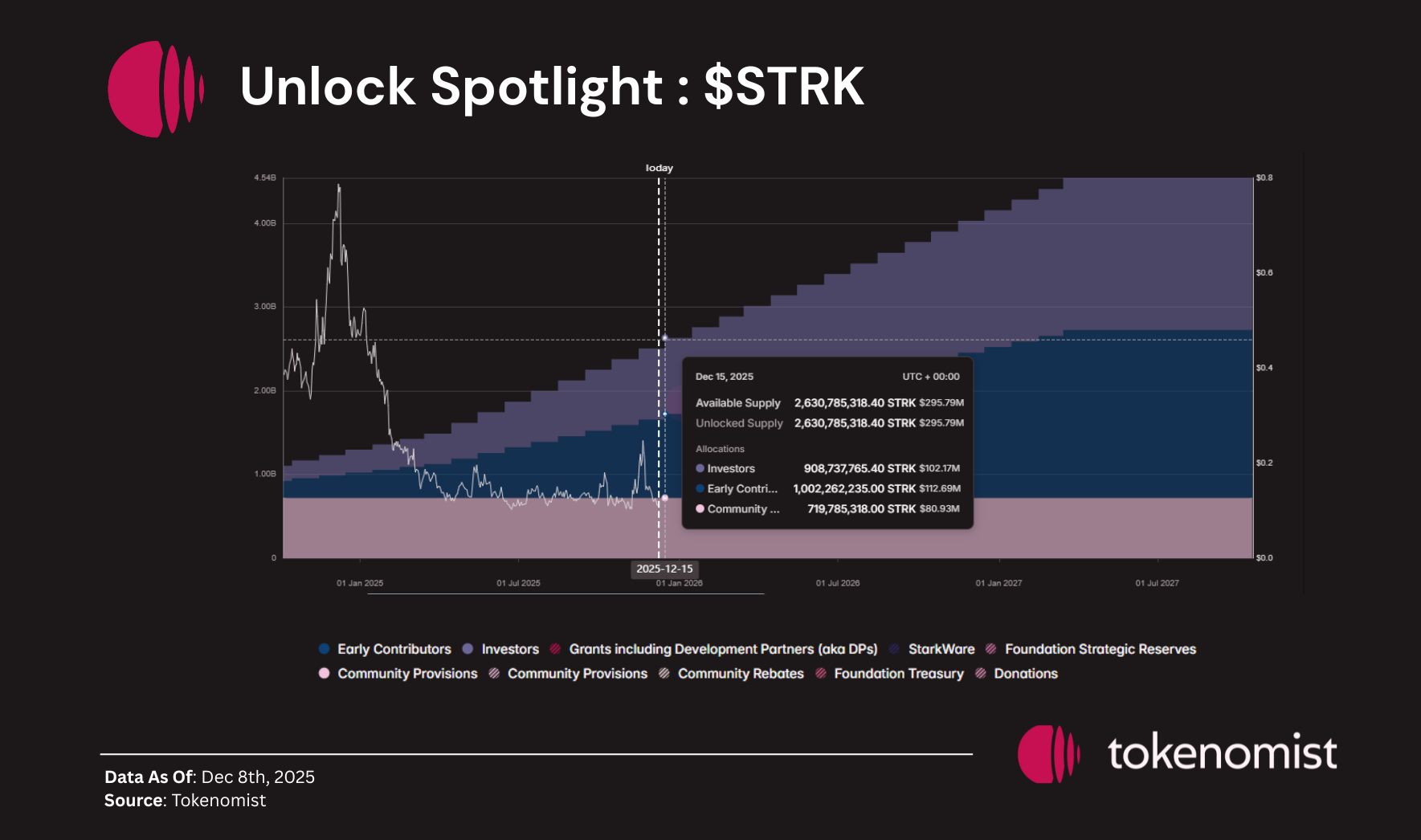

Unlocks Spotlight: $STRK

Unlock Date: Dec 15, 2025

Amount: $14.26M

Unlock % of Circulating Supply: 5.07%

Allocations: Investors & Team

$STRK leads the week by unlock value, with the majority of emissions directed toward internal foundation, team, and investor allocations.

Full Dashboard : https://tokenomist.ai/starknet

Most of the allocations don’t have a vesting schedule, on the tracking side—only 25% is unlocked so far. Currently, only the Investor and Team allocations are unlocking.

Notable Crypto News

- Binance receives full regulatory authorization from the FSRA ( https://beincrypto.com/binance-fsra-license-abu-dhabi-crypto-regulation/)

- FOMC Interest Rate Decision (Dec 10)

- US FOMC Press Conference (https://www.ebc.com/forex/when-does-the-fed-meet-again-final-2025-meeting-and-amp-2026-dates)

- Polkadot launches zero-fee DOT & KSM staking on Revolut ( https://www.coindesk.com/press-release/2025/11/25/polkadot-announces-launch-of-zero-fee-dot-and-ksm-staking-on-revolut )

- Japan’s rising rates increase pressure on BTC via potential yen carry unwind ( https://finance.yahoo.com/news/japan-higher-rates-puts-bitcoin-033000168.html)