Weekly Unlock Digest: August 4-10, 2025

The crypto market traded sideways this week as momentum from last month’s rally faded. Macro developments have prompted traders to turn cautious, waiting for fresh catalysts before taking new positions. In this week’s report, we highlight $ENA’s insider-heavy unlock, $MAVIA’s high-percentage release amid GameFi weakness, and other upcoming emissions totaling over $535M.

Weekly Unlocks Recap

The crypto market remained range-bound this week following last month’s sharp surge. Sentiment has worsen after last week’s FOMC meeting, where updated guidance lowered the probability of a September rate cut from 68% to 42%. With macro momentum easing, traders appear more cautious, awaiting fresh catalysts before taking new positions.

The largest unlock of last week came from $SUI, with nearly $190 million worth of tokens released. Price action has been weak both before and after the event, as the broader market lacks fresh catalysts and many investors chose to lock in profits following its recent rally. This combination of supply pressure and cautious sentiment has kept $SUI under selling pressure lately.

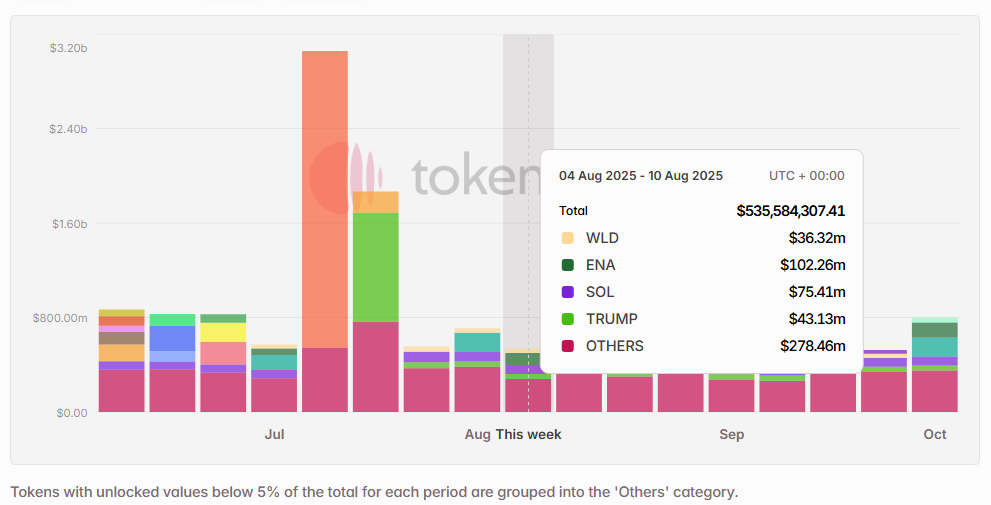

Upcoming Events

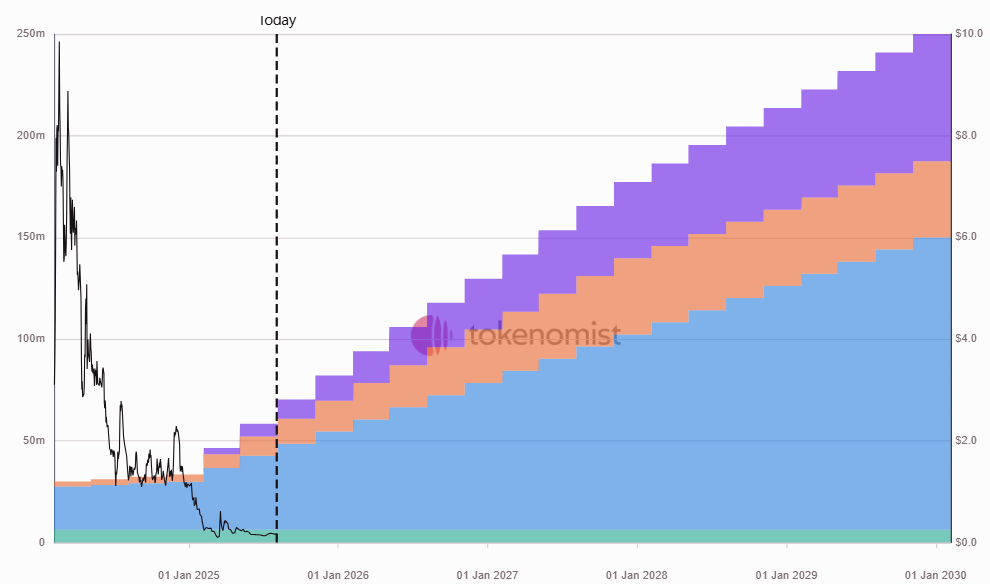

Next week’s scheduled token unlocks are set to exceed $535 Million in total value. Of this, approximately 18.7% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $ENA, $SOL, $TRUMP, $WLD, and $MOVE.

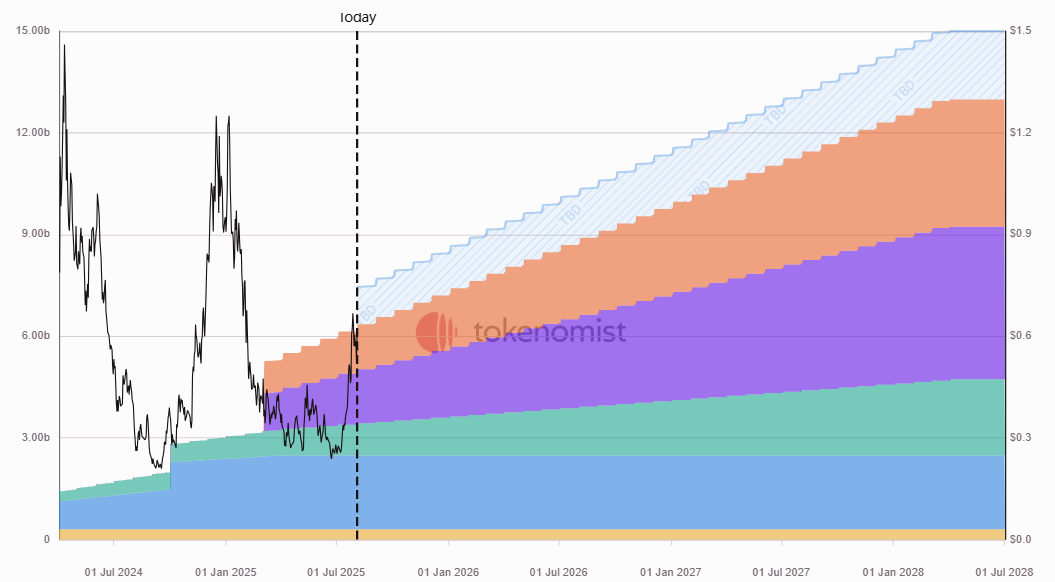

Unlocks Spotlight: $ENA

- Unlock Date: August 5, 2025

- Amount: $ 106.08M

- Unlock as % of Circulating Supply: 2.70%

- Vested Allocations: Core Contributors and Investors

$ENA tops this week’s unlock schedule in dollar terms, with the entire release allocated to insider cohorts — namely core contributors and early investors.

Over the past month, $ENA has delivered strong performance, buoyed by the growing trend of companies adopting token treasuries and a series of strategic partnerships that have strengthened its ecosystem narrative. While large insider unlocks often raise concerns about sell pressure, the recent positive momentum around $ENA could help cushion the immediate market impact.

Unlocks Spotlight: $MAVIA

- Unlock Date: August 6, 2025

- Amount: $ 1.95M

- Unlock as % of Circulating Supply: 23.03%

- Vested Allocations: Community & Ecosystem, Pre-sale, Team, Gameplay Rewards, and Advisors

$MAVIA leads this week in terms of percentage unlocked relative to circulating supply, with allocations split between insider stakeholders and ecosystem development initiatives.

However, the broader GameFi narrative has significantly lost momentum since the last cycle, and $MAVIA’s price action reflects that weakness — consistently sliding to new all-time lows. Without renewed interest in the sector or a fresh catalyst for the project, the upcoming unlock could further weigh on market sentiment.

Notable Crypto News

Institutional

- Strategy reports record net income in Q2, files $4.2 billion STRC offering to buy bitcoin (The Block)

- SharpLink Gaming buys $295 million in ETH, pushing total holdings over 438,000 ETH (The Block)

- Tether posts record $4.9 billion net profit for second quarter (The Block)

- JPMorgan to enable crypto purchases via credit cards in Coinbase tie-up (Reuters)

Regulation

- SEC Chair Atkins debuts 'Project Crypto' to update rules and regulations, with a focus on onchain (The Block)

- SEC Permits In-Kind Creations and Redemptions for Crypto ETPs (SEC)

Tokenomics

- Linea unveils LINEA Tokenomics (Linea)

General