Weekly Unlock Digest: Aug 11-17, 2025

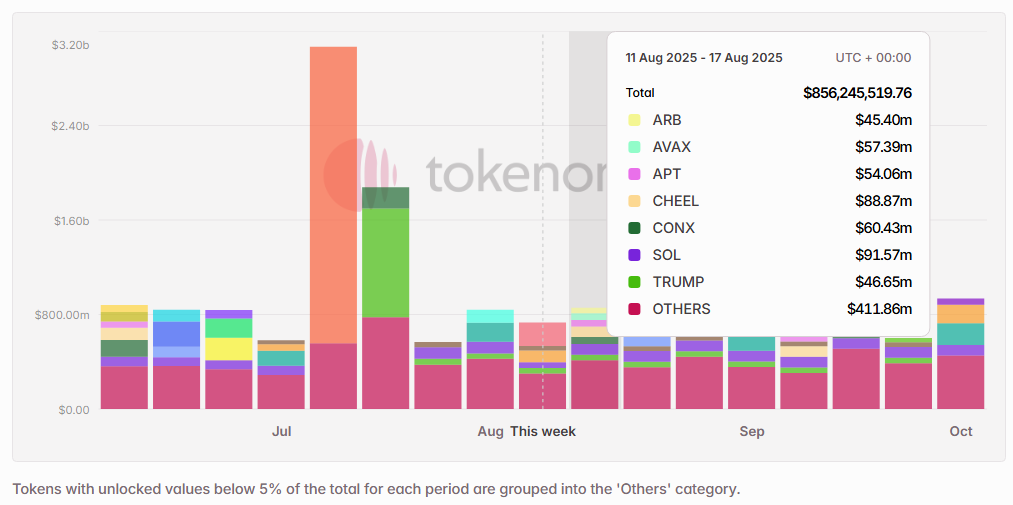

Crypto markets traded mixed this week, with Bitcoin holding steady while Ethereum and major altcoins pushed higher. Momentum was supported by continued treasury-driven token buying and policy tailwinds from the U.S. In this week’s report, we highlight $ENA’s resilient post-unlock gains, $APT’s insider-heavy release near all-time lows, and upcoming emissions exceeding $856M alongside $PROVE’s high-valuation TGE.

Weekly Unlocks Recap

Bitcoin remained range-bound this week, while Ethereum and several major altcoins posted strong gains. Part of this rally appears to be fueled by aggressive token purchases from crypto treasury-focused companies, which have been steadily accumulating across the market. Sentiment received an additional boost after President Donald Trump signed an executive order allowing cryptocurrencies to be included in 401(k) retirement plans, a move widely seen as a milestone for mainstream adoption.

Last week’s largest unlock came from $ENA, with over $106 million released — the majority allocated to insider holdings. Despite the potential for sell pressure, $ENA’s price climbed roughly 6%, supported by strong momentum from the broader token treasury trend and growing interest in the stablecoin narrative.

Upcoming Events

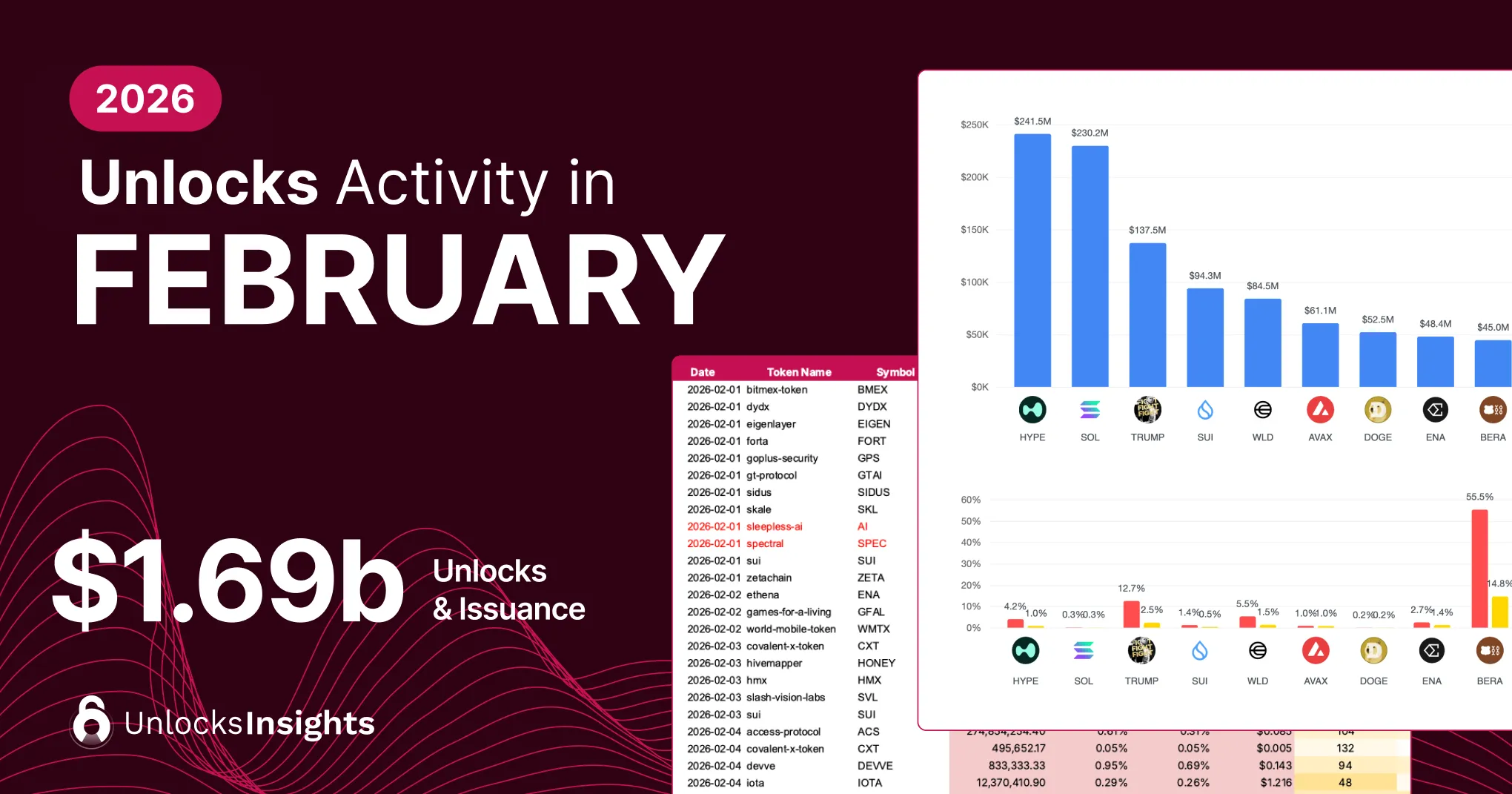

Next week’s scheduled token unlocks are set to exceed $856 Million in total value. Of this, approximately 14% is classified as insider unlocks under Tokenomist’s framework — referring to allocations designated for founders, core teams, or early investors. Notable tokens facing sizable releases by dollar value include $SOL, $CHEEL, $CONX, $AVAX, and $APT.

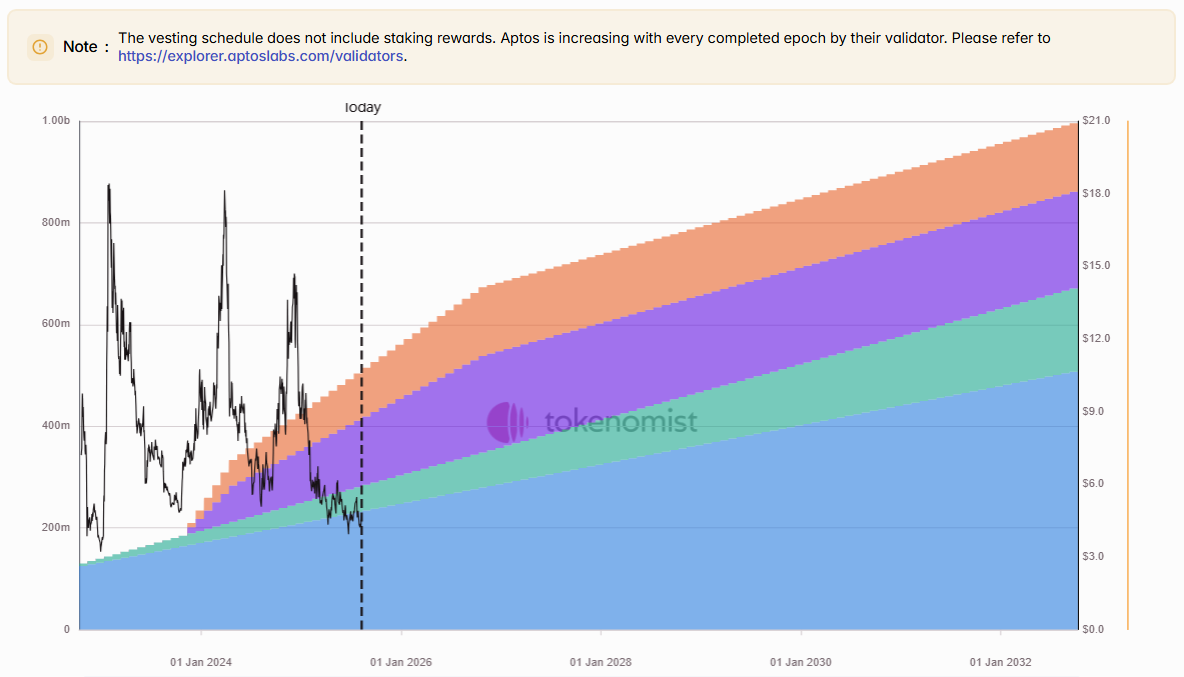

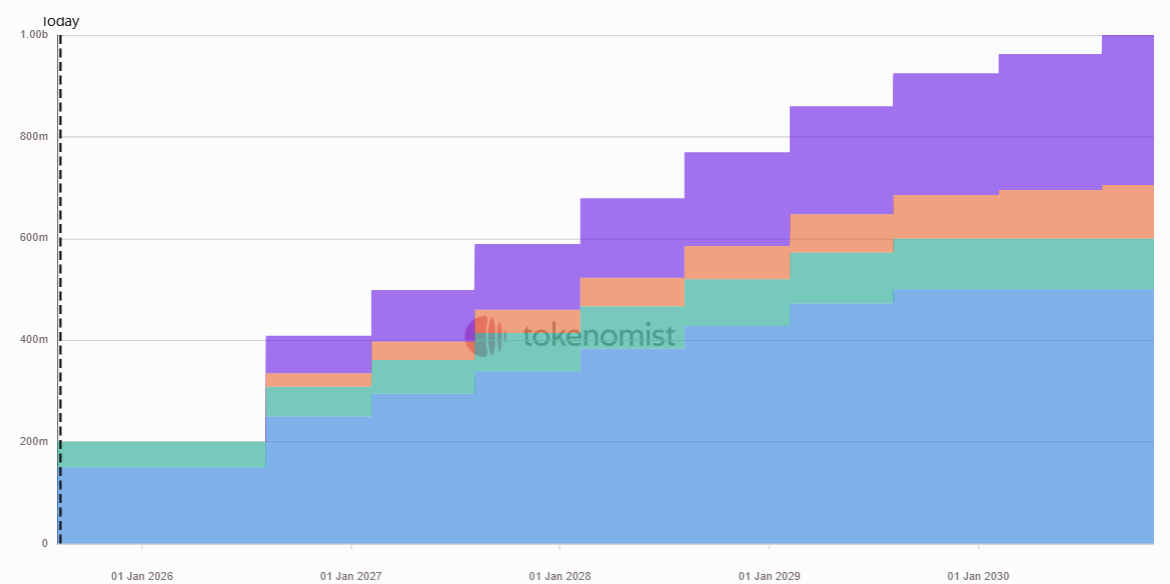

Unlocks Spotlight: $APT

- Unlock Date: August 12, 2025

- Amount: $ 53.38M

- Unlock as % of Circulating Supply: 2.20%

- Vested Allocations: Core Contributors, Community, Investors, and Foundation

$APT leads this week’s unlocks in dollar terms, with the majority of the release going to insider allocations such as core contributors, the foundation, and early investors. Despite the broader market showing resilience, $APT’s price action has lagged — trading near all-time lows. This underperformance suggests persistent sell pressure or waning investor confidence, and the upcoming insider-heavy unlock could further challenge sentiment unless the project delivers a new catalyst.

New TGEs on the Radar

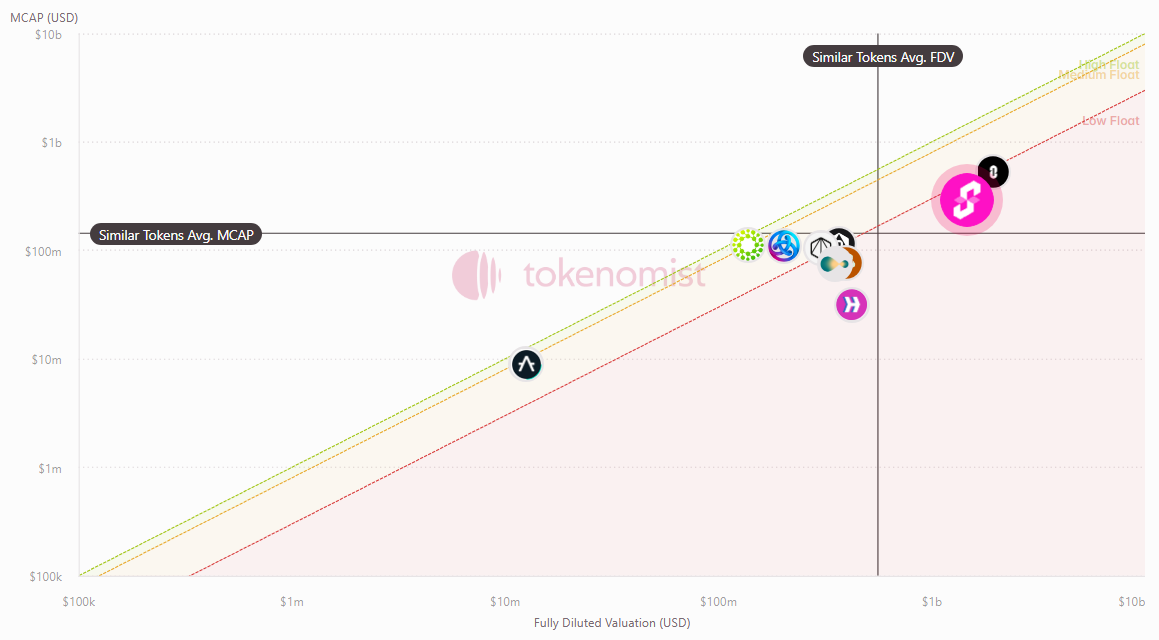

Succinct ($PROVE) is building a secure interoperability layer for blockchains, featuring a gas-efficient Ethereum light client powered by zkSNARKs. The token launched with an initial float of 20% of total supply, split between community and reserve allocations, while insider tokens remain locked until a year after TGE.

With a relatively low float and a valuation close to that of LayerZero, $PROVE entered the market under a high-valuation structure compared to peers. Despite this, early price action has been strong, delivering gains for initial investors and signaling healthy demand out of the gate.

Notable Crypto News

Institutional

- BitMine’s Ethereum holdings surge to 833,000 ETH worth $2.9 billion, largest among public firms (The Block)

- Harvard endowment invests $116M into BlackRock Bitcoin ETF (CoinTelegraph)

Regulation

- Trump to Sign Order Easing Path for Private Assets in 401(k)s (Bloomberg)

- The SEC has announced that liquid staking activities and tokens are not classified as securities (Solana)

Tokenomics

- Pump.fun Launches Real-Time Revenue Dashboard, Allocating Over 100% of Revenue to Token Buybacks (Pump.fun)

General