Weekly Token Unlocks Digest: Jan 26 – Feb 1, 2026 | Geopolitical Tensions and $BGB’s Unlock

Geopolitical tensions are back in focus, and risk assets are starting to feel the pressure. As macro uncertainty rises, token unlocks are once again becoming a key driver of crypto price action. In this report, we break down the latest market backdrop, examine $ONDO’s sharp underperformance following its recent unlock, preview large upcoming supply events for $BGB and $TREE, and highlight $ME, which is now fully tracked on Tokenomist so investors can monitor its next major cliff unlock ahead of time.

Weekly Unlocks Recap

Crypto markets slid back toward the lower end of their recent trading range last week, with Bitcoin and Ethereum down roughly 7% and 14%, respectively. Risk sentiment weakened as geopolitical tensions resurfaced, while capital continued to rotate into traditional safe havens. Gold, which has seen sustained demand since last year, extended its strength amid rising uncertainty. Market attention was further drawn to reports that Donald Trump threatened an additional 10% tariff on goods from eight European countries unless they backed his proposed purchase of Greenland, adding another layer of macro and geopolitical risk.

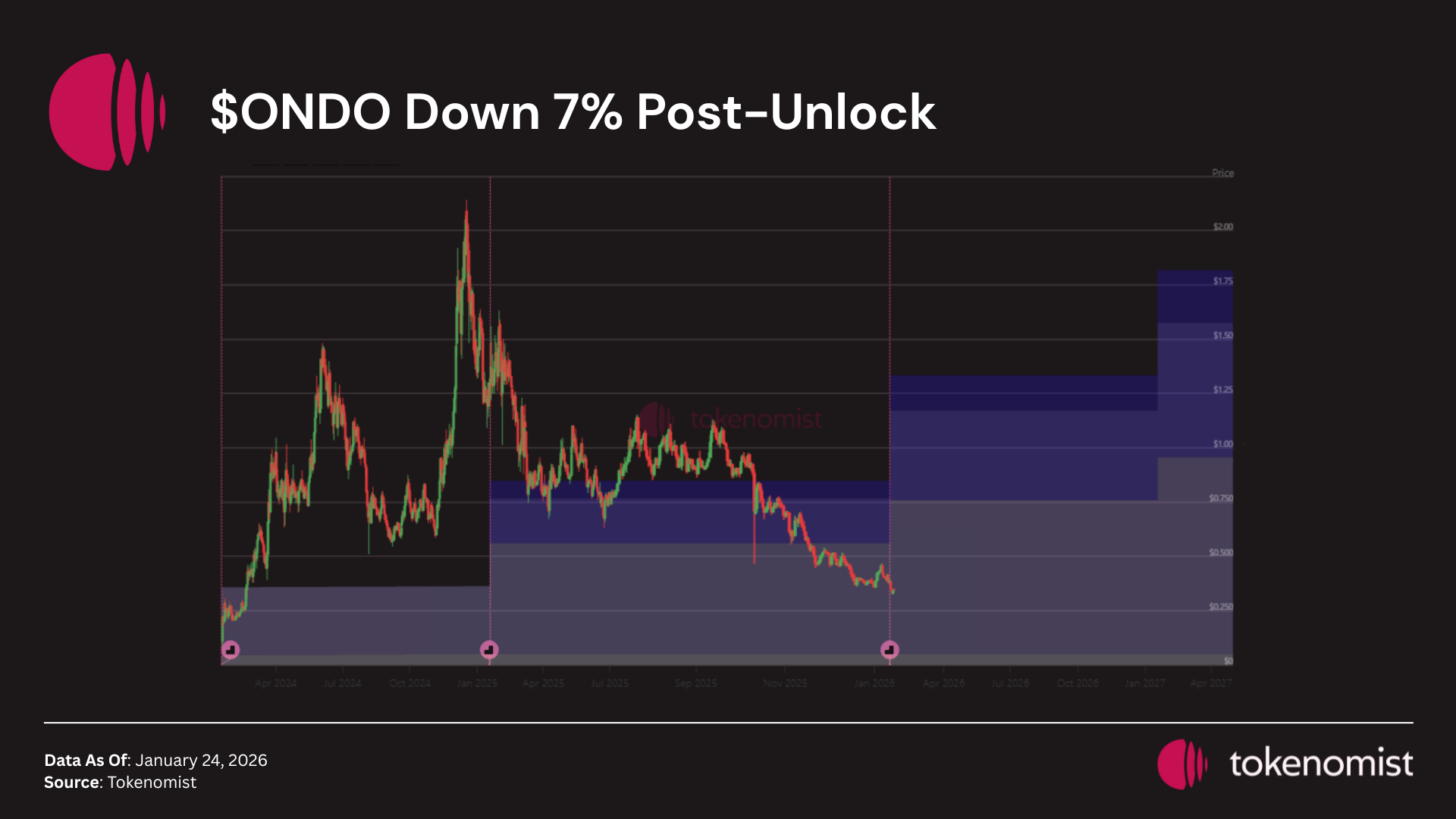

On the token supply side, $ONDO recorded the largest cumulative unlock over the past 30 days, and its price continued to react negatively under mounting supply pressure. Looking ahead, the next major cliff unlock is scheduled for January 2027, with vested tokens allocated across founders, private investors, and the community. This overhang remains a key factor shaping market expectations.

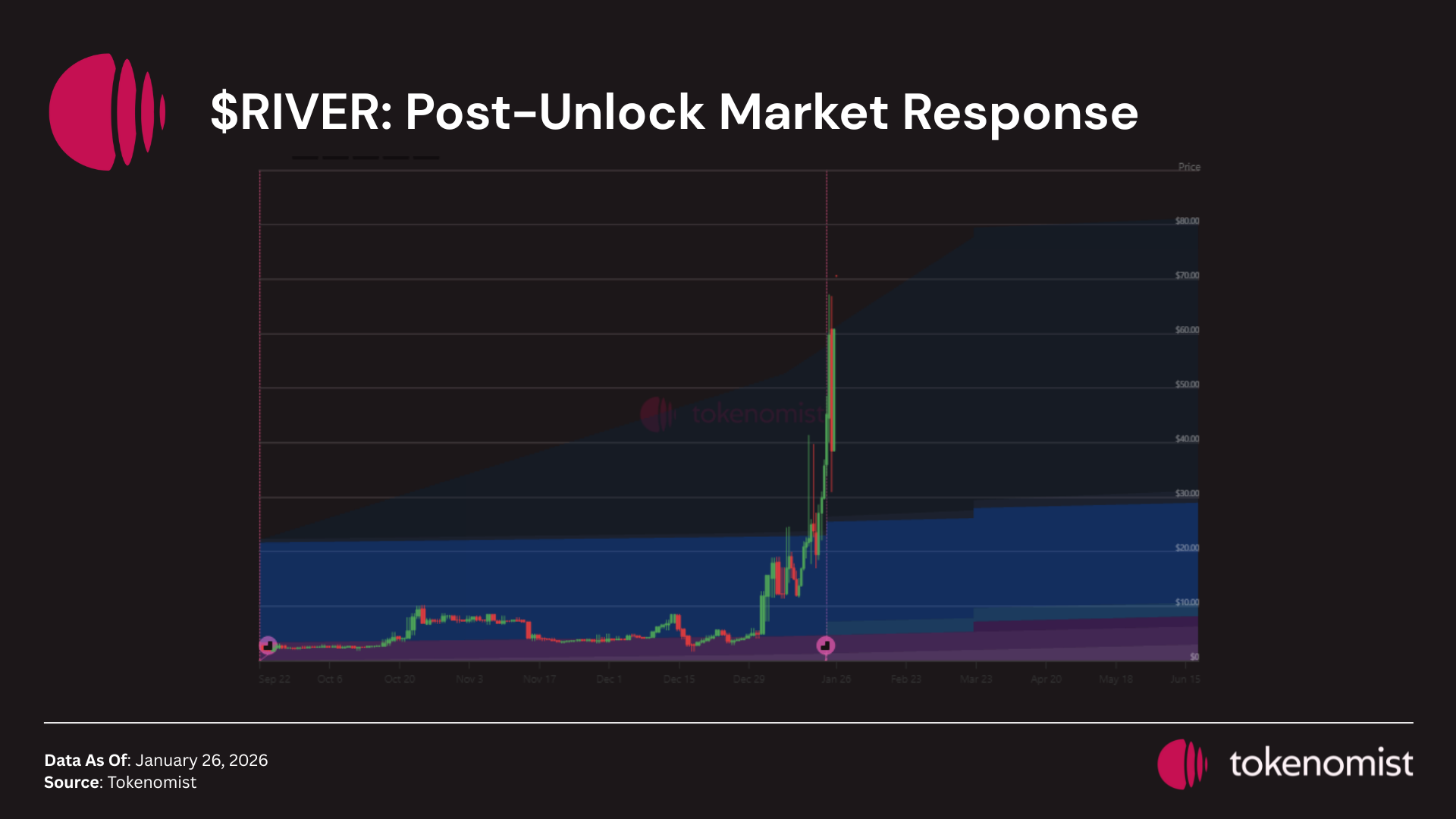

In contrast, $RIVER posted strong price performance despite being the second-largest unlock over the same period. The rally followed notable investments from Maelstrom and Justin Sun, helping offset near-term supply concerns. That said, caution is still warranted, as token ownership remains highly concentrated, with the top five wallets controlling around 96% of total supply.

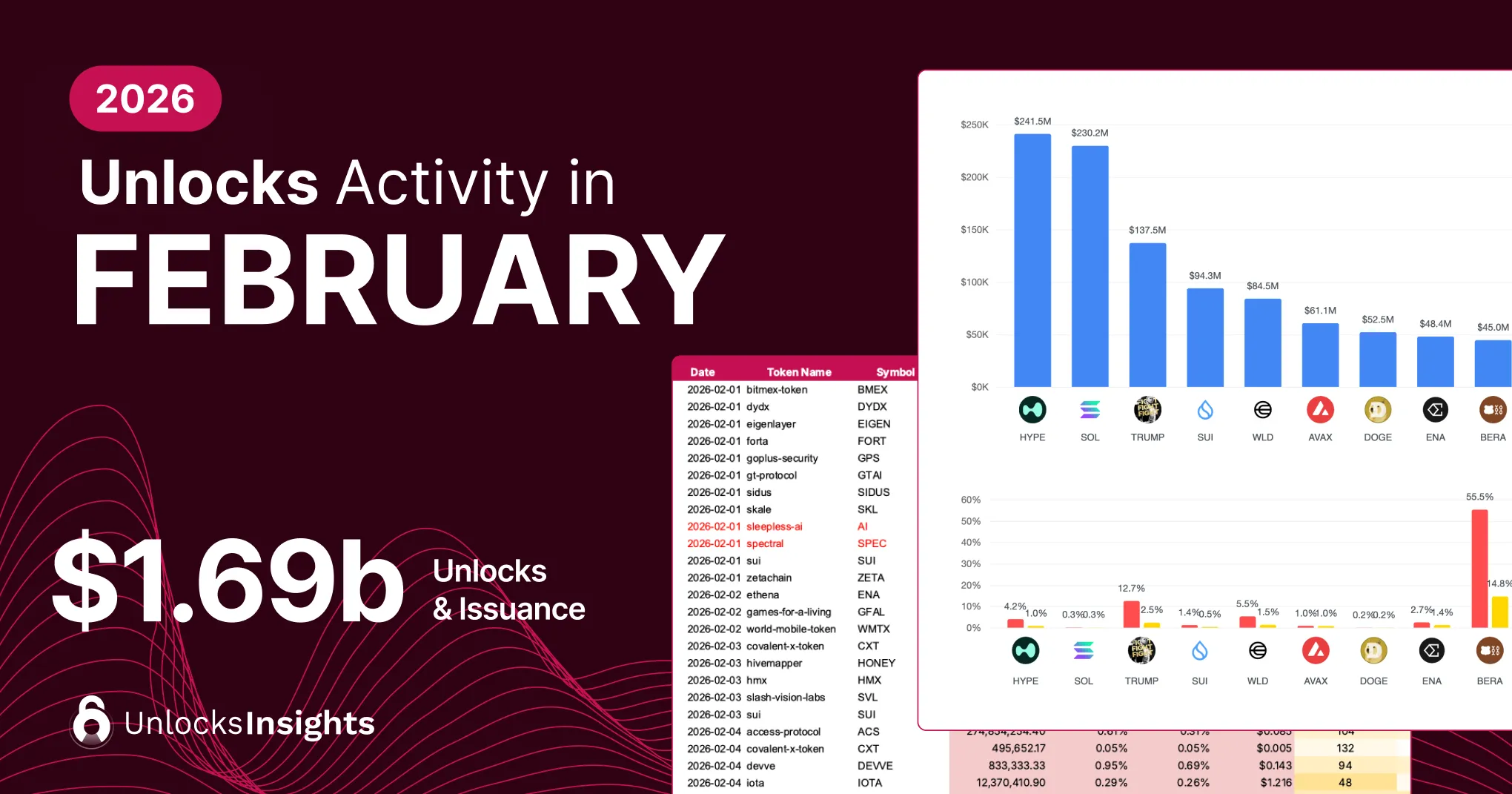

Upcoming Events

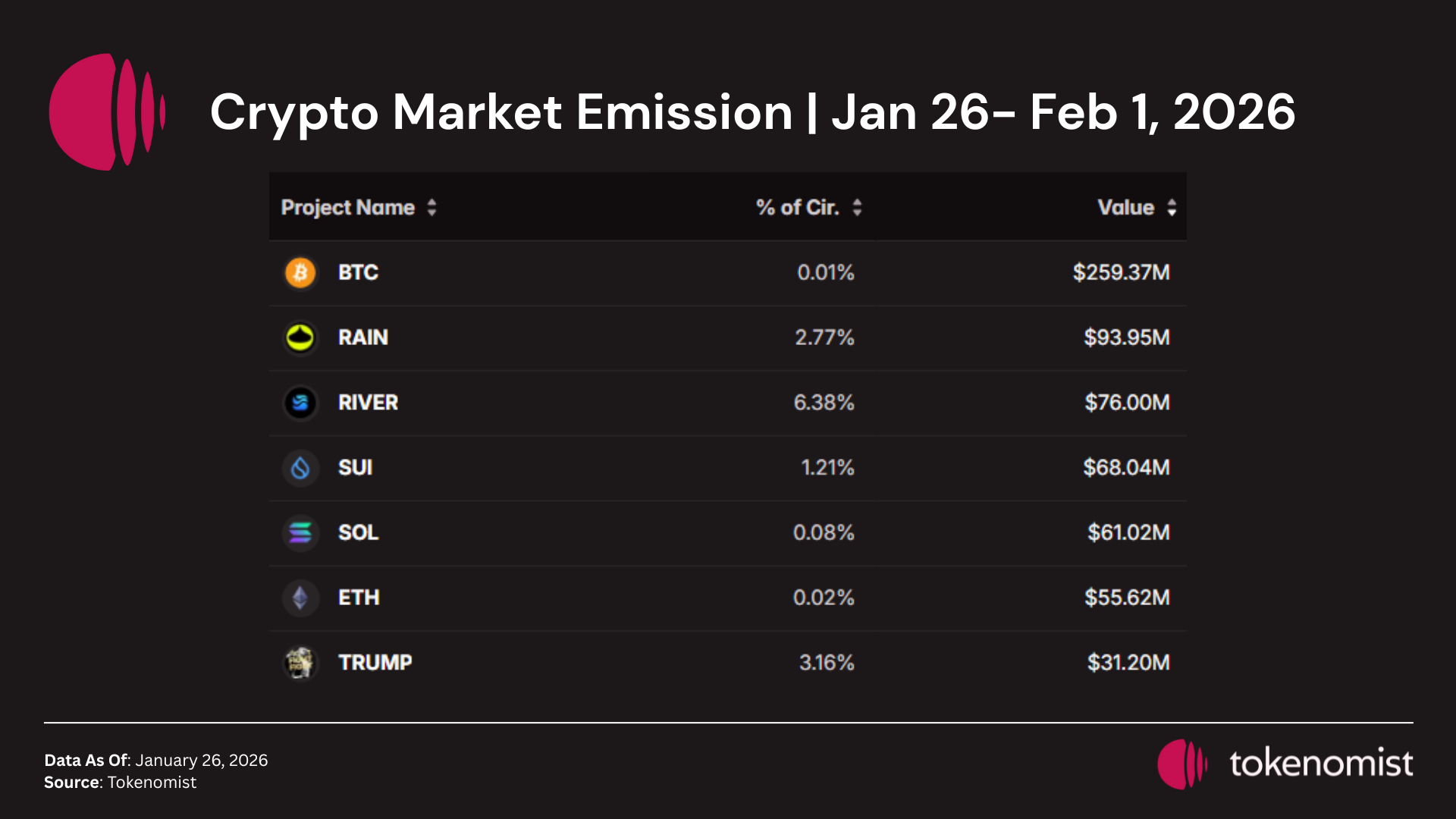

Next week’s scheduled token releases are set to exceed $1.4 Billion in total value. Notable tokens facing sizable releases by dollar value include $BGB, $BTC, $RAIN, $SUI, and $ETH.

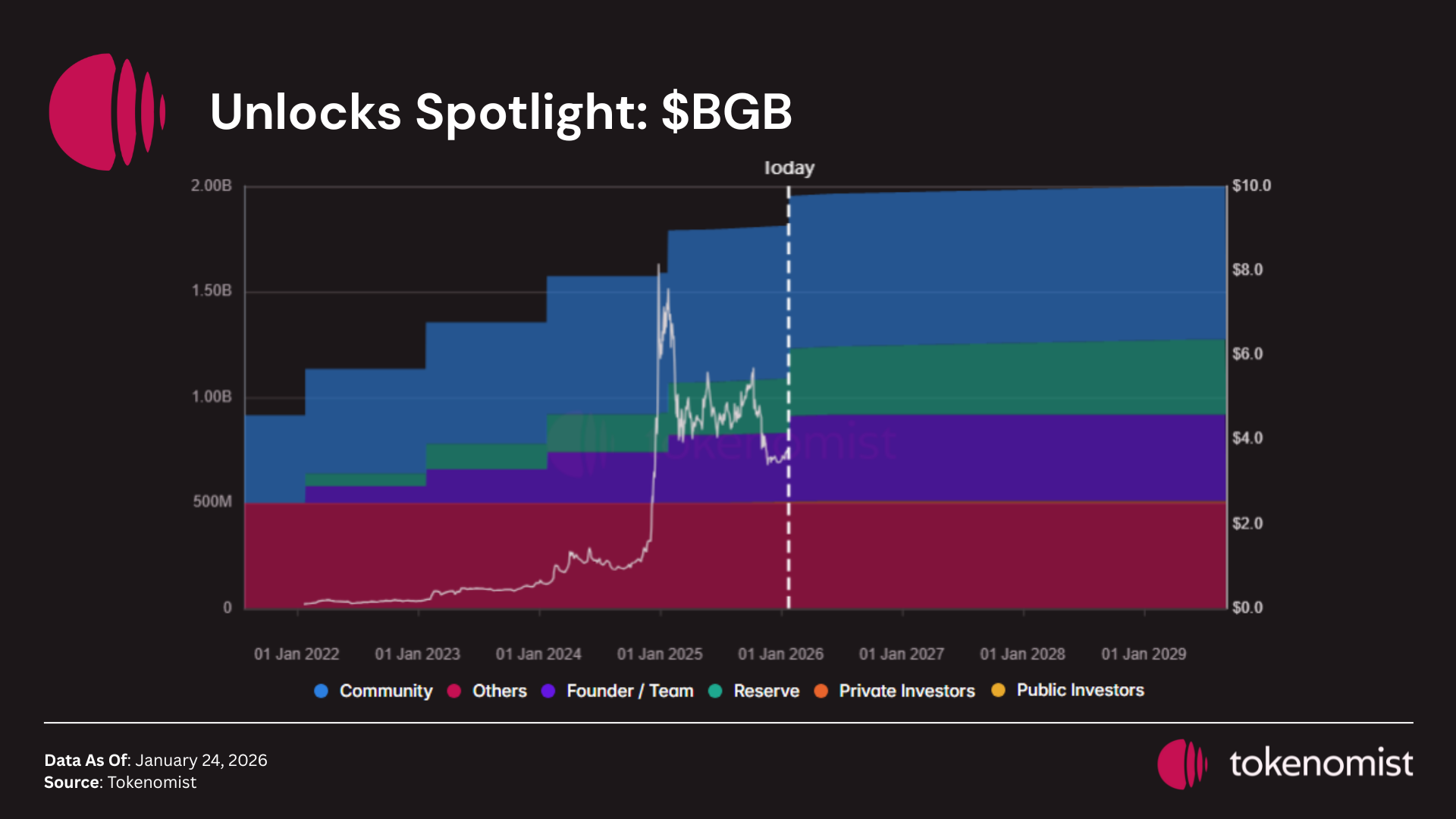

Unlocks Spotlight: $BGB

- Unlock Date: January 26, 2026

- Amount: $ 510M

- Unlock as % of Released Supply: 10.53%

- Vested Allocations: Team Incentives and Branding & Promotion

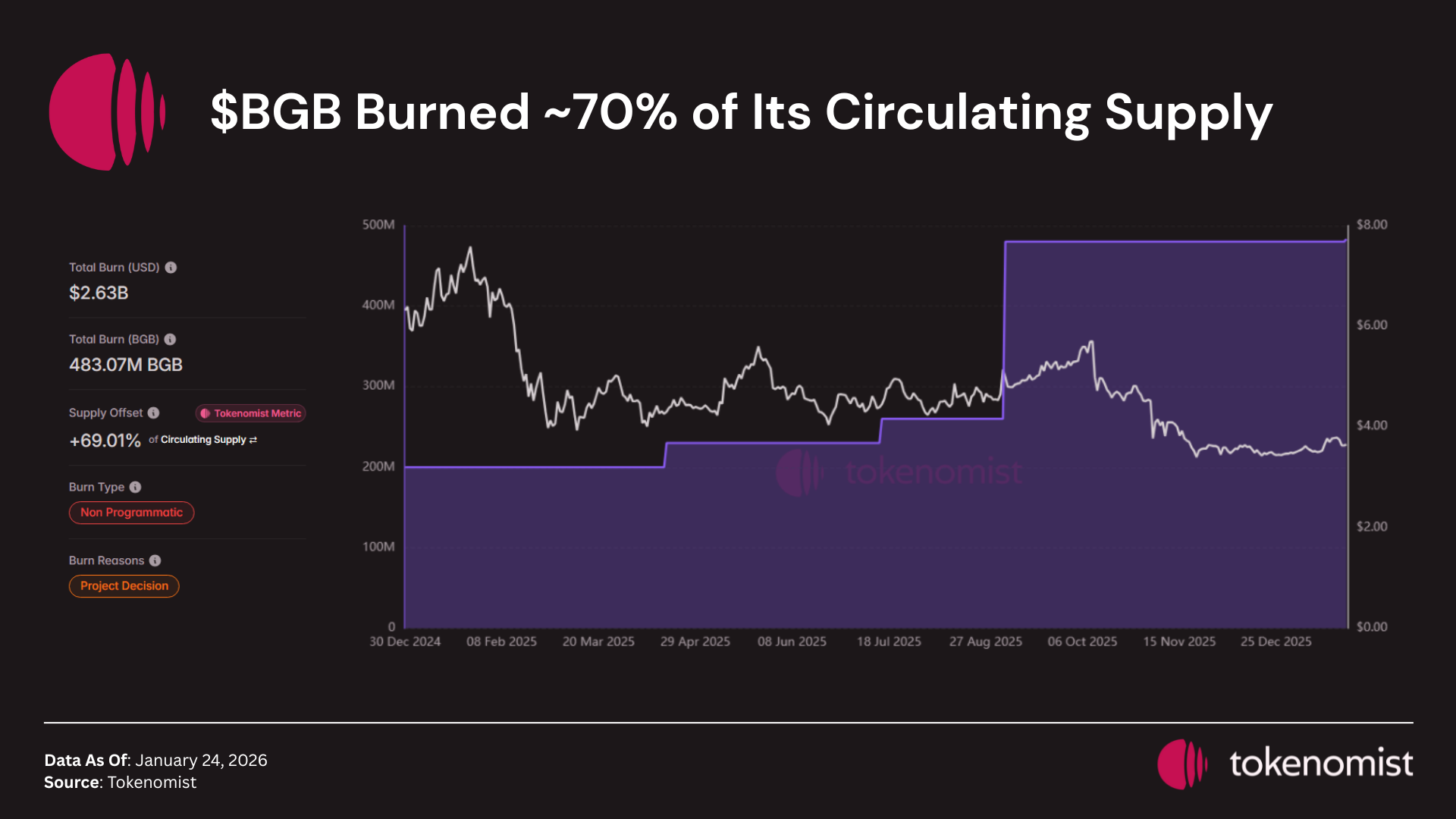

$BGB (Bitget Token) records the largest unlock by dollar value this week, marking the final phase of its emission schedule, with roughly 90% of total supply already in circulation. As a late-stage unlock, the marginal impact of this release is structurally different from earlier cliff events, as most supply has already been absorbed by the market.

Historically, $BGB’s price action around prior unlocks has been counterintuitive. Ahead of its previous major cliff, the token rallied nearly 8×, driven largely by Bitget’s aggressive token burn strategy. To date, cumulative burns have removed close to 70% of circulating supply, materially offsetting emissions and reinforcing a deflationary supply narrative.

From a tokenomics perspective, $BGB presents a rare case where large unlocks coexist with strong price performance. The burn mechanism effectively neutralized dilution risk by shrinking net supply, while signaling long-term commitment from the issuer. With the unlock schedule nearing completion, future price dynamics are likely to hinge less on emissions and more on exchange usage, fee generation, and the sustainability of ongoing burns.

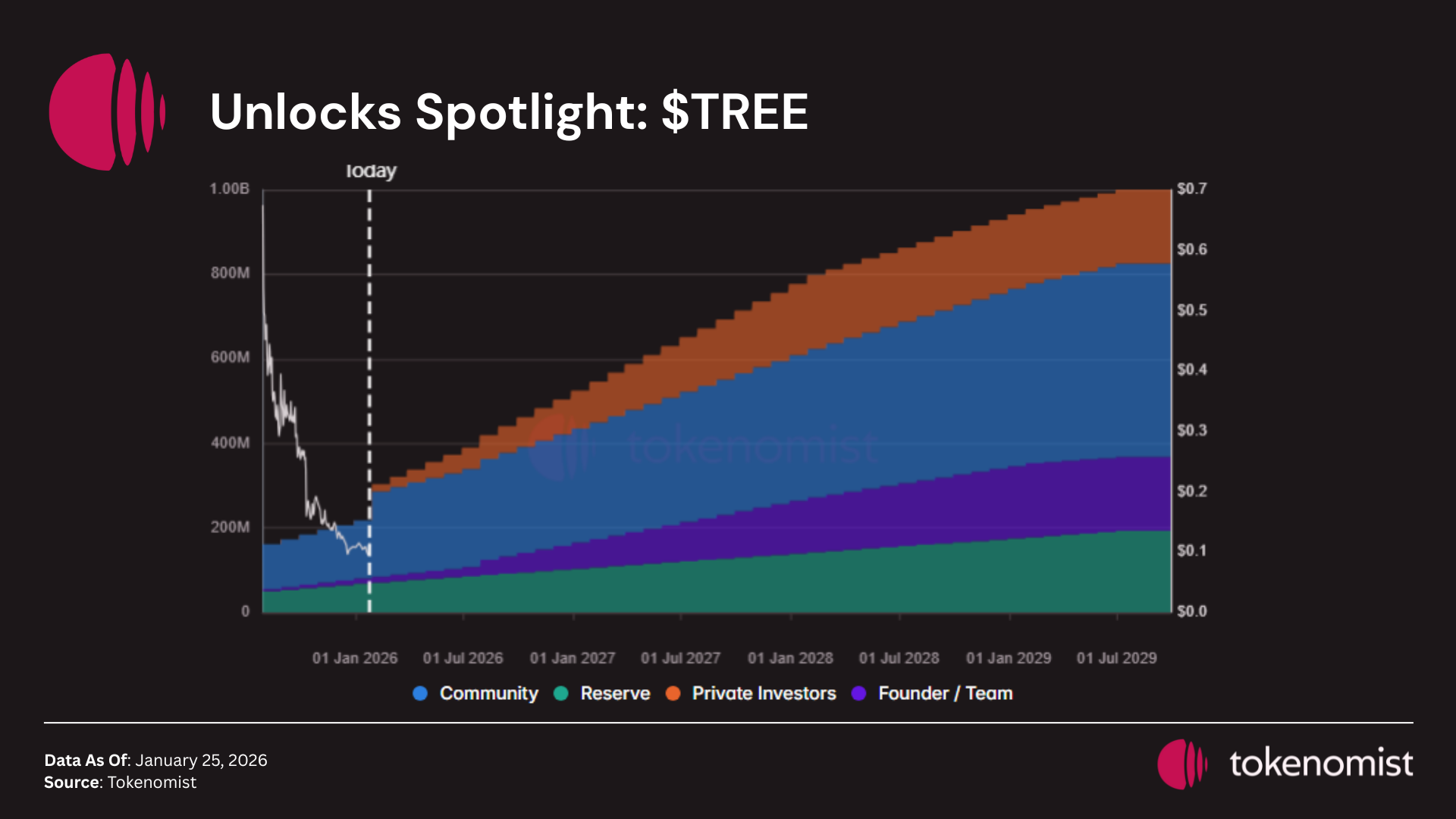

Unlocks Spotlight: $TREE

- Unlock Date: January , 2026

- Amount: $ 9.8M

- Unlock as % of Released Supply: 39.41%

- Vested Allocations: Community, Private Investors, Reserve, and Founder/Team

$TREE records the largest unlock relative to circulating supply this week, with vested tokens split between community and insider allocations. Since TGE, the token has trended steadily lower, pointing to weak demand and limited ability to absorb new supply. Looking ahead, circulating supply is set to nearly double over the next year, which raises the bar for sustained demand growth. How the market digests this accelerated emission will be a key factor in determining whether price pressure persists or stabilizes.

Tokens Now Live on Tokenomist

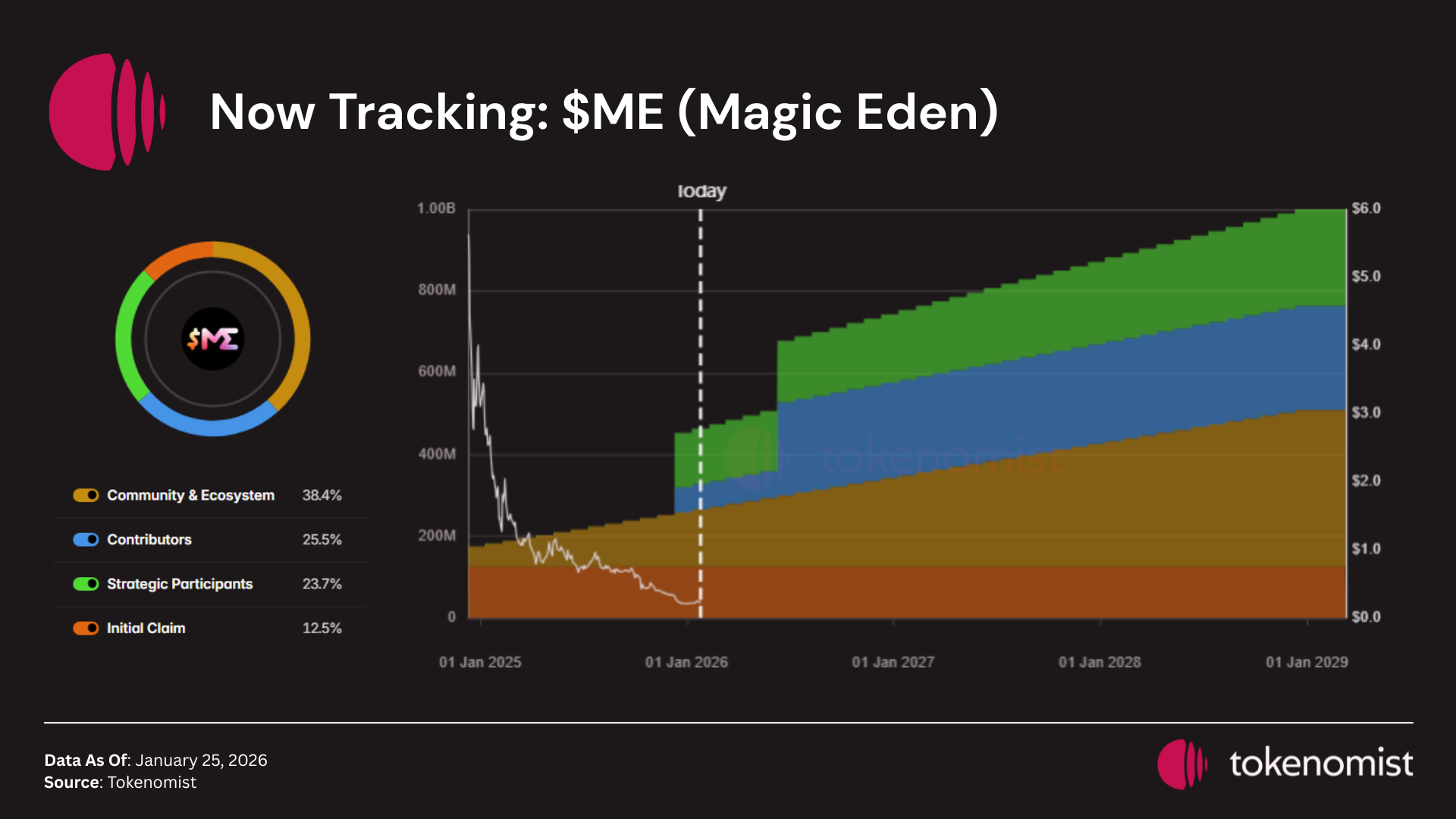

$ME (Magic Eden)

- Sector: NFT Marketplace

- MCap / FDV: $95M / $220M

- Circulating Supply: 46%

- Next Unlock: $2.37M (2.3% of cir.)

- 1Y Supply Growth: +67.66%

The next major cliff unlock is scheduled for June 10, 2026, when over 33% of the current circulating supply will be released into circulation. Given the size of this unlock relative to existing supply, it could become a meaningful inflection point for price action, depending on market conditions and whether allocation holders choose to sell or continue holding.