The Privacy Narrative: A Tokenomics Comparison

A structured look at the strongest assets in the privacy sector

The privacy category has resurfaced as one of the more active narratives this cycle. With rising discussion around on-chain identity, KYC-gated networks, and increased surveillance concerns, privacy-focused assets are seeing renewed attention.

This report breaks down the tokenomics, supply structure, and utility of the leading privacy tokens: Monero ($XMR), Zcash ($ZEC), Dash ($DASH) and Zano ($ZANO).

Additional demand signals and ecosystem trends are also included to give a clearer view of how the sector is positioned today.

Introduction

Most public blockchains expose every transaction on an open ledger. Addresses aren’t tied to identities by default, but the moment they interact with KYC-based platforms or repeat-use patterns, they become linkable. This gap between transparent ledgers and real confidentiality is pushing demand toward assets built specifically to keep financial activity private.

1. Why Privacy Tokens Matter

Privacy tokens continue to serve three core needs:

- Transactions that cannot be easily blocked

- Payments that are harder to trace

- Transfers that don’t reveal details across the whole network

Whether for individuals, merchants, or developers deploying private dApps, these networks fill a gap that general-purpose L1s cannot address.

2. What Are Privacy Coins?

Privacy coins are cryptocurrencies designed to hide key transaction details. Instead of showing wallet addresses and amounts openly on the blockchain, they use special techniques to keep this information private.

This allows users to send and receive funds without exposing their activity to the entire network.

3. Regulatory Pressure on Privacy Coins

Privacy coins often face scrutiny because their design makes it difficult for authorities to trace transactions. This leads to concerns about misuse and keeps regulators cautious. Major exchanges also limit or delist these assets in some regions, even though most users rely on privacy tools for safety, confidentiality, and financial protection — not illicit activity.

4. Supply Structure & Tech Overview

Supply & Tech is one of the biggest drivers for long-term sustainability in the privacy sector.

Here’s a simplified breakdown:

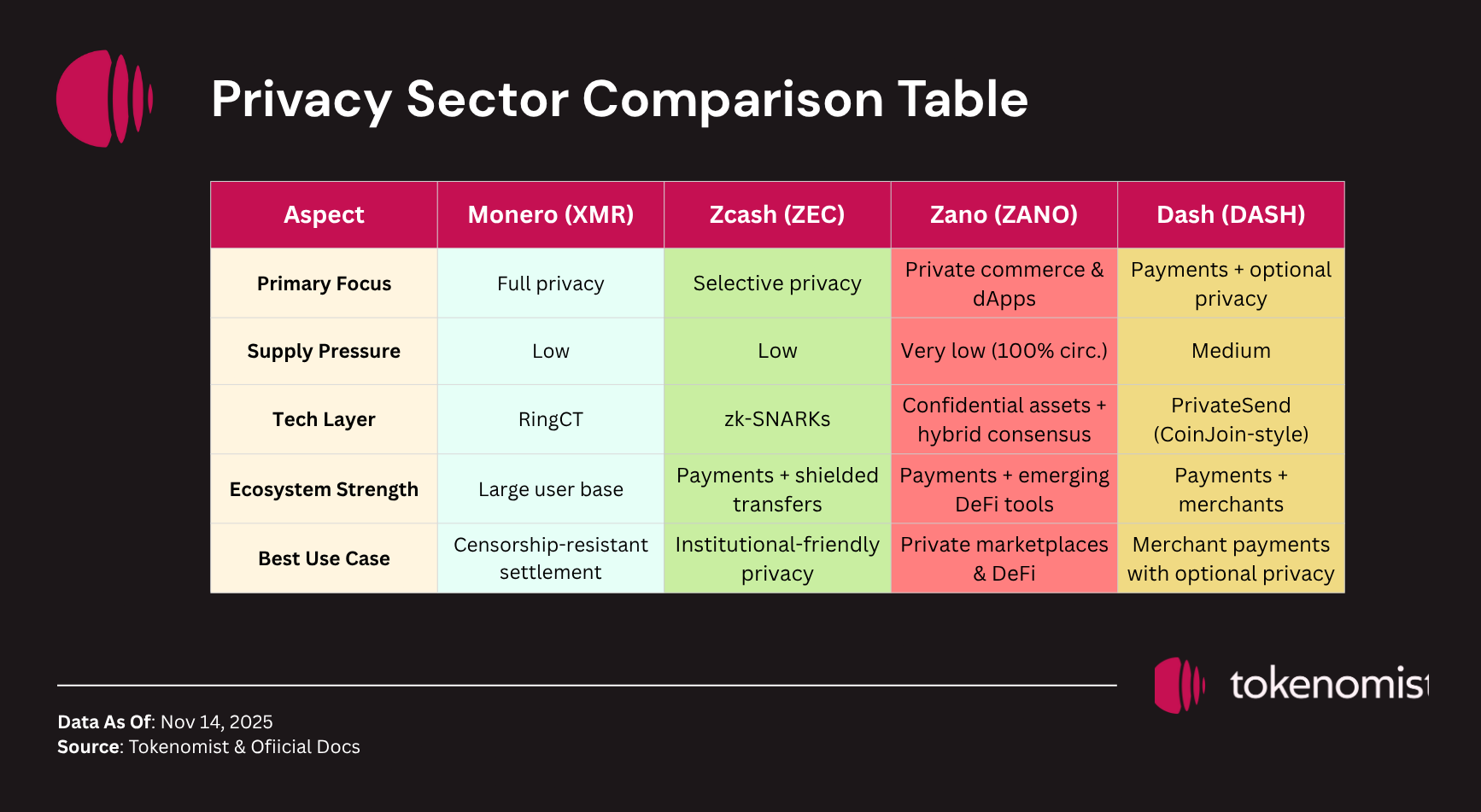

Monero ($XMR):

Monero has remained the uncompromised privacy chain since 2014. Every transaction is private by default.

Tech & Tokenomics

- Privacy Stack: Ring Signatures, Stealth Addresses, RingCT

- Supply: ~18.4M circulating

- Emission: Ongoing tail emission (0.6 $XMR/block) for long-term miner incentive

- Distribution: Fully decentralized; no premine or team fund

Utility

- Untraceable payments

- Censorship-resistant settlement

- Merchant adoption in high-privacy jurisdictions

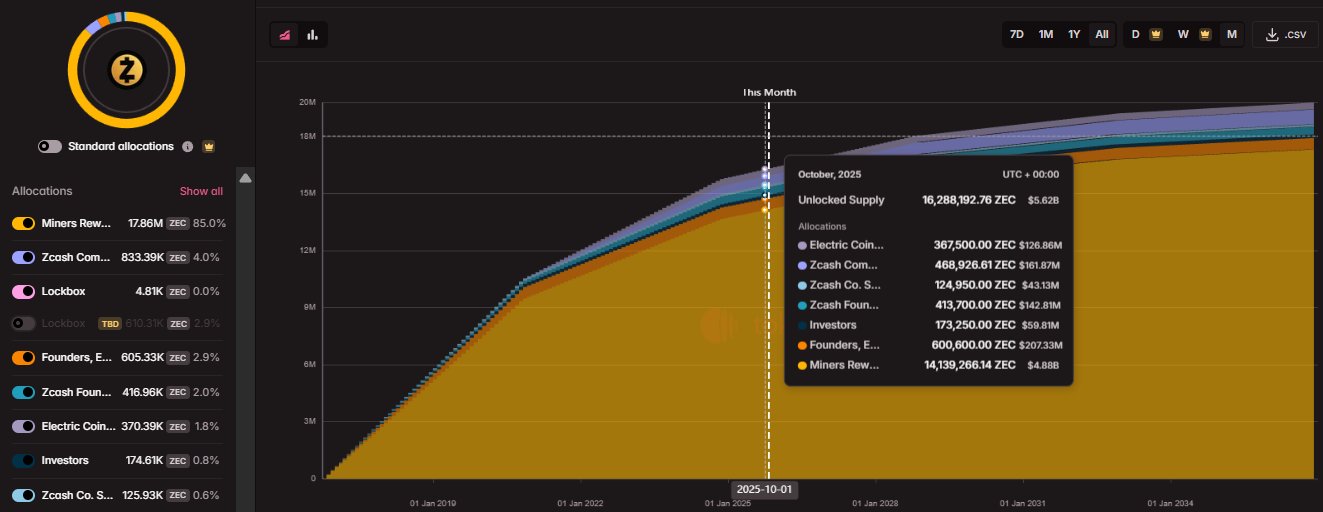

Zcash ($ZEC):

Zcash introduced zk-SNARKs and selective disclosure, allowing users to choose between transparent and shielded transfers.

Tech & Tokenomics

- Privacy Stack: zk-SNARKs → Halo2 → Recursive proofs

- Supply: ~15.3M circulating

- Issuance: Halving every 4 years; ~2% annual inflation

- Distribution: Miner rewards + dev fund + ecosystem grants

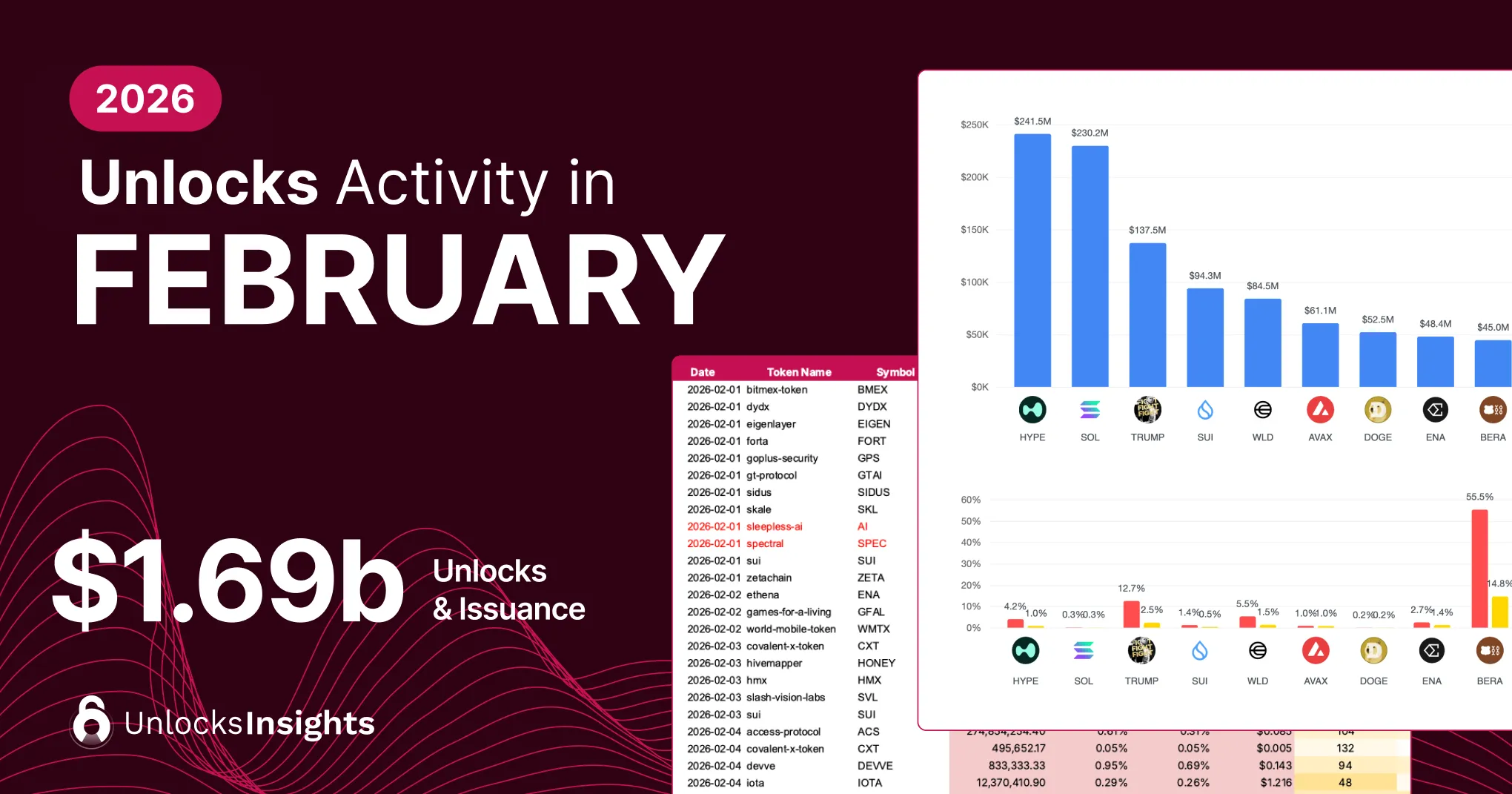

- +6m Emission: 282k $ZEC tokens will be release, valued at approximately $141 million.

Utility

- Optional privacy (“shielded” mode)

- Strong institutional alignment (zk-proof leadership)

- Expanding DeFi connections as EVM bridges mature

See full released schedule : https://tokenomist.ai/zcash

Dash ($DASH):

Dash blends usability with optional privacy via PrivateSend, positioning itself as a fast, retail-friendly settlement coin.

Tech & Tokenomics

- Supply: ~12M circulating

- Issuance: Block rewards reduce annually

- Masternodes: Require 1,000 DASH

- Governance: Masternode DAO decides treasury allocation

Utility

- PrivateSend for coin-mixing privacy

- InstantSend for sub-second confirmations

- dApps and identity tools via Dash Platform

Zano ($ZANO):

Zano is transitioning from a privacy coin to a full privacy-enabled infrastructure layer, with settlement, escrow, and stablecoin tools.

Tech & Tokenomics

- Consensus: Hybrid PoW + PoS

- Supply: Fully circulating; no unlock risk

- Privacy Stack: Confidential transactions + escrow contracts

- Utility Expansion: Bridges, fUSD stablecoin, private marketplaces

5. Privacy sector Comparison

Note: This table is constructed from each project’s public documentation, tokenomics info, and known network design

6. Endorsements from Crypto’s Big Players

The privacy sector’s momentum is amplified by endorsements from crypto’s most influential voices, signaling its strategic importance.

- Vitalik Buterin (Ethereum Co-Founder): https://foresightnews.pro/article/detail/7315

- a16z (Andreessen Horowitz):https://fortune.com/crypto/2025/10/22/andreessen-horowitz-a16z-report-crypto-jobs-ai/

- Balaji Srinivasan (Angel Investor, Ex-Coinbase CTO): https://u.today/ex-coinbase-cto-balaji-srinivasan-hints-at-new-crypto-era-in-play-details

Conclusion

Privacy assets are re-entering focus as users demand confidentiality, institutions explore compliant private transfers, and regulators acknowledge selective disclosure frameworks. Monero, Zcash, Dash, and Zano and more protocols capture a different angle - default privacy, selective privacy, retail payments, private applications etc.

Their designs solve a simple problem: transparent blockchains don’t protect user activity. Their relevance grows as demand shifts toward confidentiality without sacrificing decentralization.