December Unlocks: Least Dilutive Month of 2025 — Except These

December stands out as the lowest-emission month of 2025, with overall supply expansion dropping sharply compared to previous quarters.

But despite a quieter calendar, several tokens — especially HYPE, SUI, EIGEN, ZRO, STRK, and KMNO — still carry meaningful unlocks, particularly those tied to insider allocations.

On the macro side, markets head into December with expectations of a Federal Reserve rate cut, following comments from NY Fed President Williams and a jump in December cut-probability to 71%.

The month also features several tokenomics updates and buyback programs that may offset supply-side pressure.

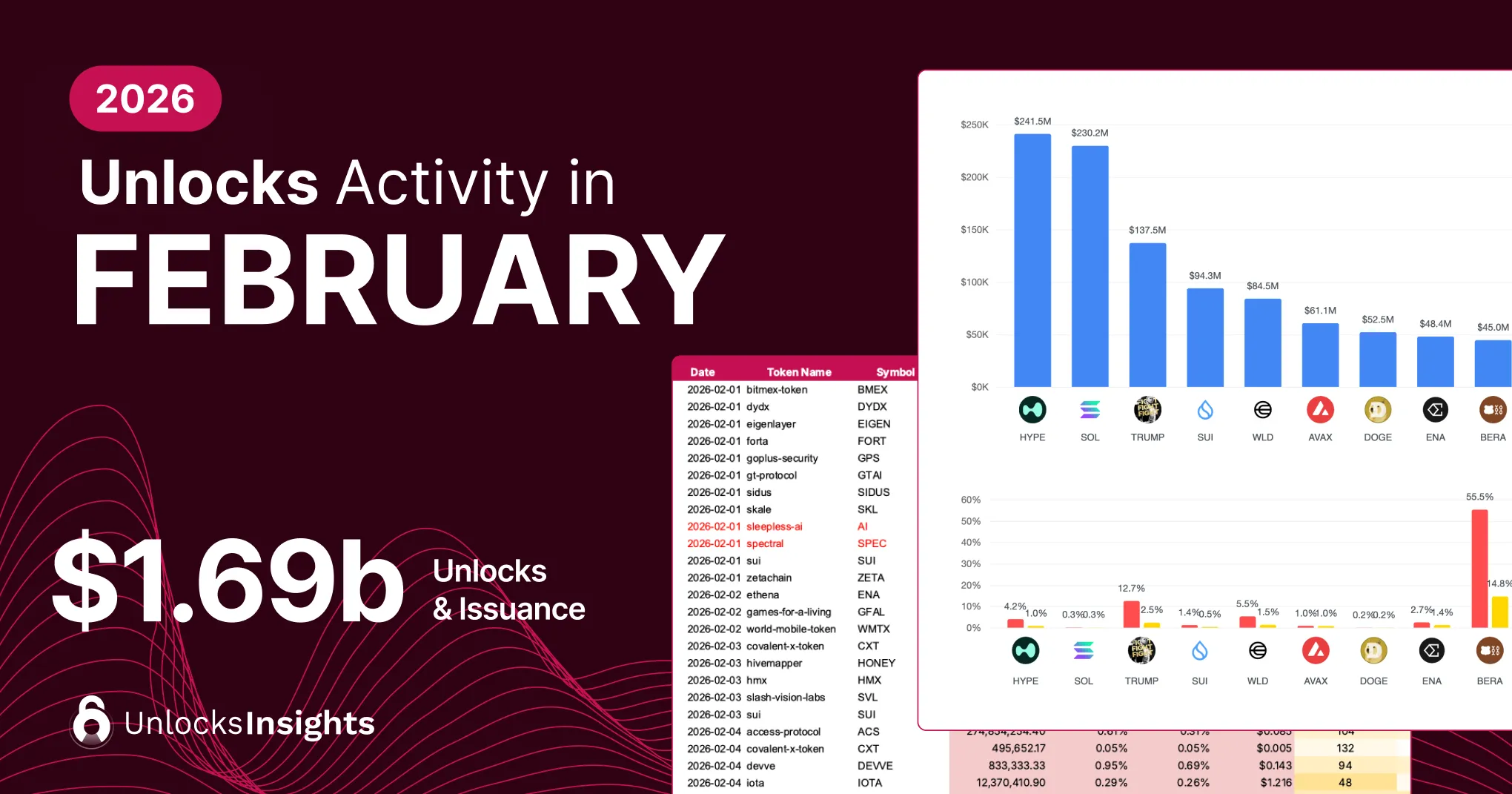

Crypto Market Emissions – December 2025

December marks the lowest emission month of 2025, with scheduled unlocks totaling ~$3.62B, far below the heavy unlock periods seen in Q2 and Q3. Despite the lighter supply pressure, several high-value events stand out — including HYPE’s $333M unlock, SUI’s $67M cliff event, and a cluster of insider-heavy releases from EIGEN, STRK, and ZRO. Overall float expansion remains muted this month, but specific tokens with large insider allocations could still see outsized impact depending on liquidity conditions.

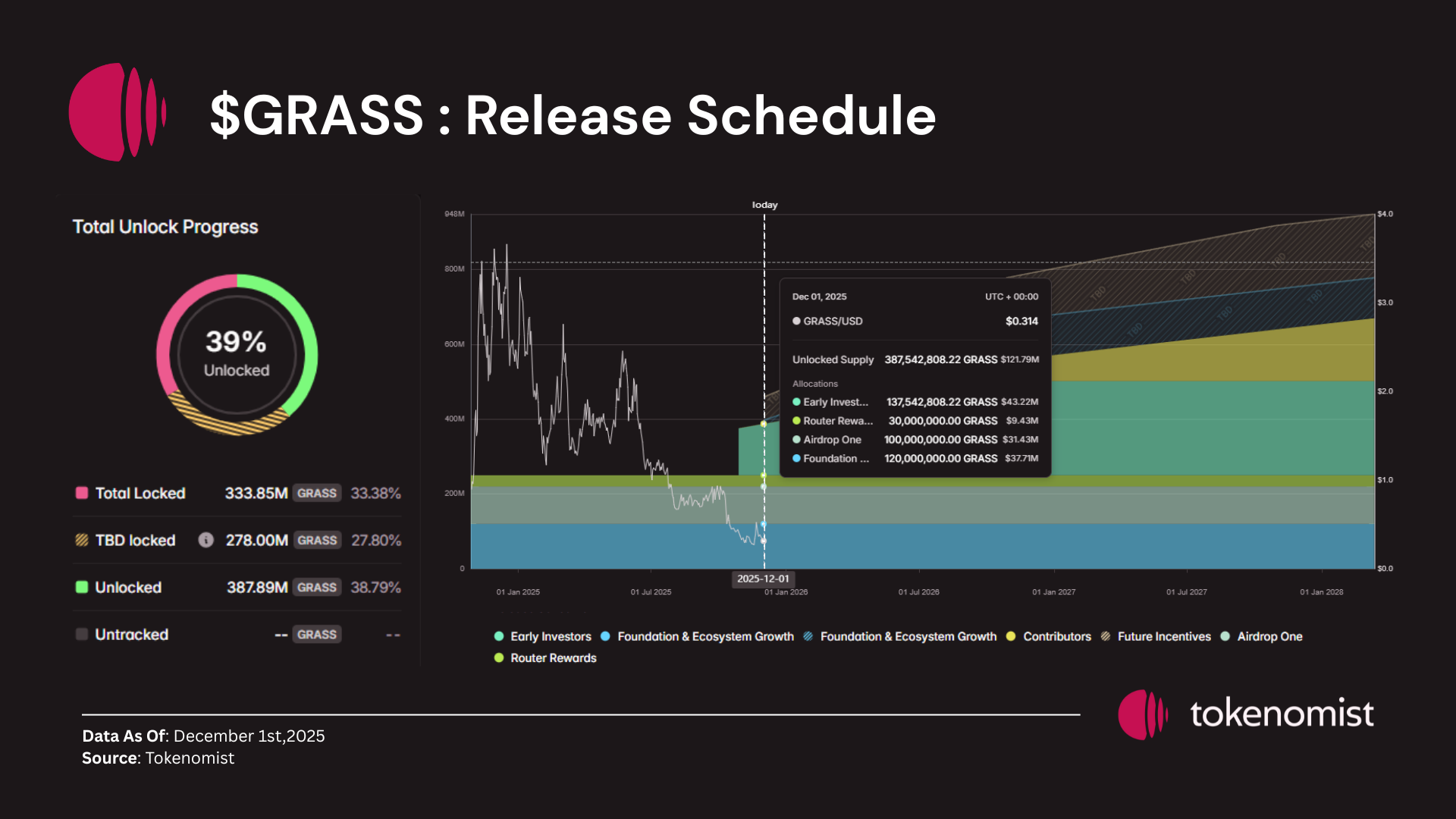

Major December Unlocks to Watch

Among all scheduled events, HYPE and SUI lead December’s supply expansion while EIGEN, STRK, ZRO, and KMNO stand out for their high insider emissions.

Below is the full December unlock map:

Why These Tokens Matter

- HYPE leads the month in dollar value with a $333M unlock — the largest December release.

- EIGEN, STRK, ZRO, and KMNO carry high insider emissions, making them the ones to keep a closer eye on.

- SUI remains notable due to size and ecosystem activity, even with moderate insider allocation.

Key Tokenomics Updates to Note

December brings several protocol-level updates that affect long-term supply posture:

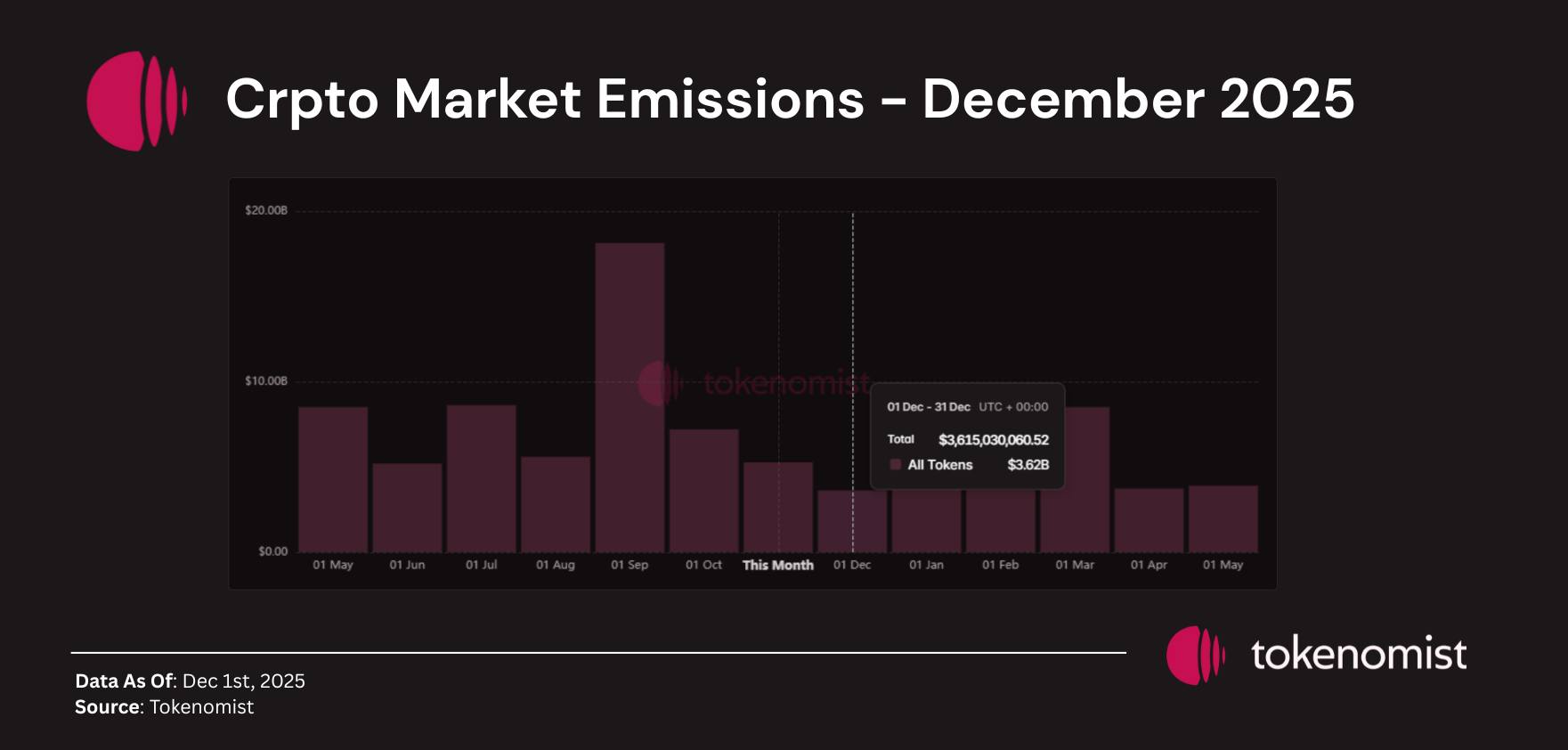

1. Jupiter ($JUP) — 2026 Unlock Revision

- Initial 700M one-time unlock scrapped.

- New phased schedule:

- 200M → Feb 28, 2026

- 200M → Jan 31, 2027

300M → reserved for Jupnet incentives

This reduces near-term dilution and smooths the supply curve.

Full Dashboard : https://tokenomist.ai/jupiter-exchange-solana

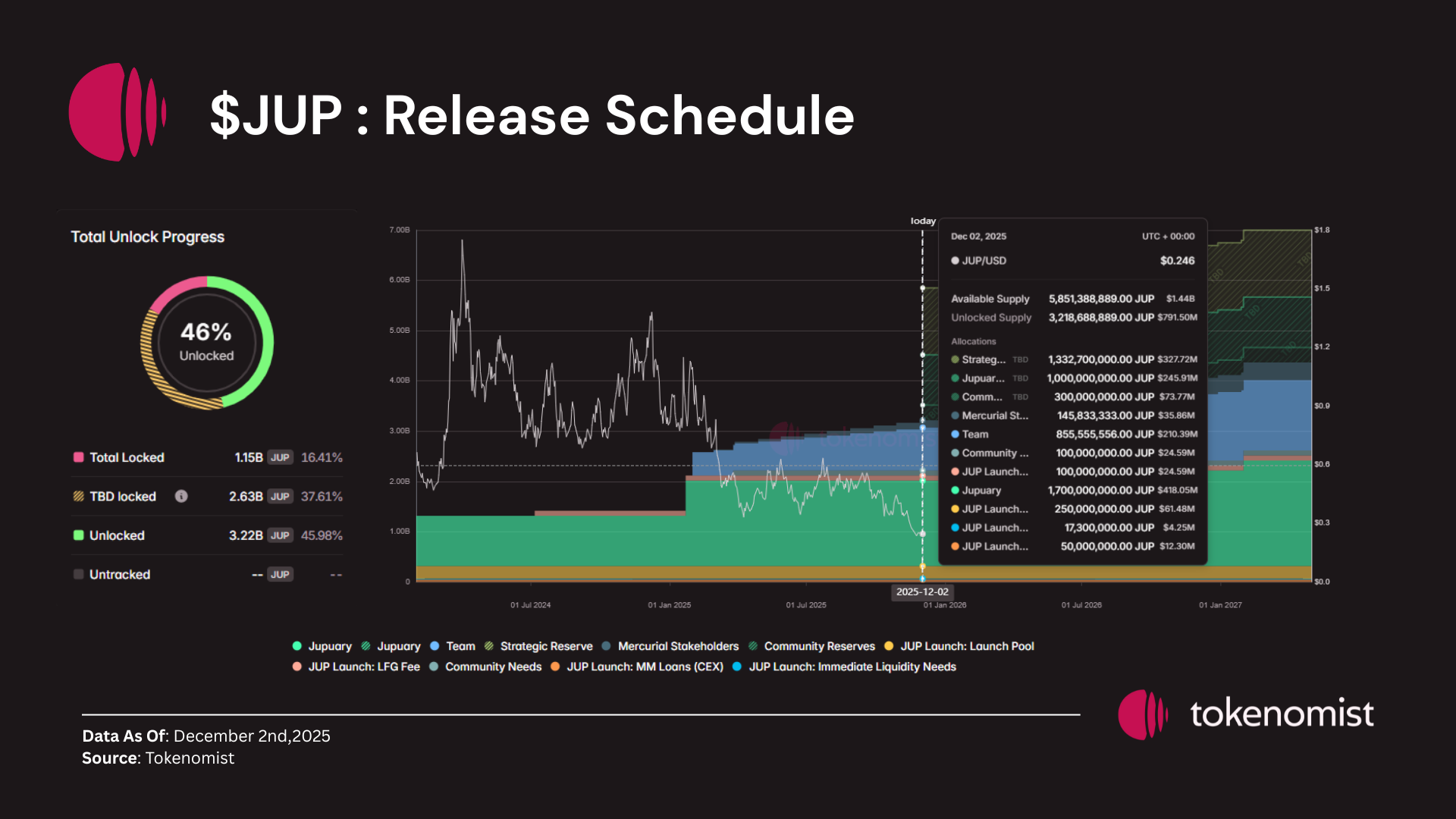

2. Grass ($GRASS) — Lock-up Extended

- Contributor unlock moved from Oct 28, 2025 → Oct 28, 2026.

- Reduces 2025 dilution and shifts most insider supply to 2026+.

Full Dashboard : https://tokenomist.ai/grass

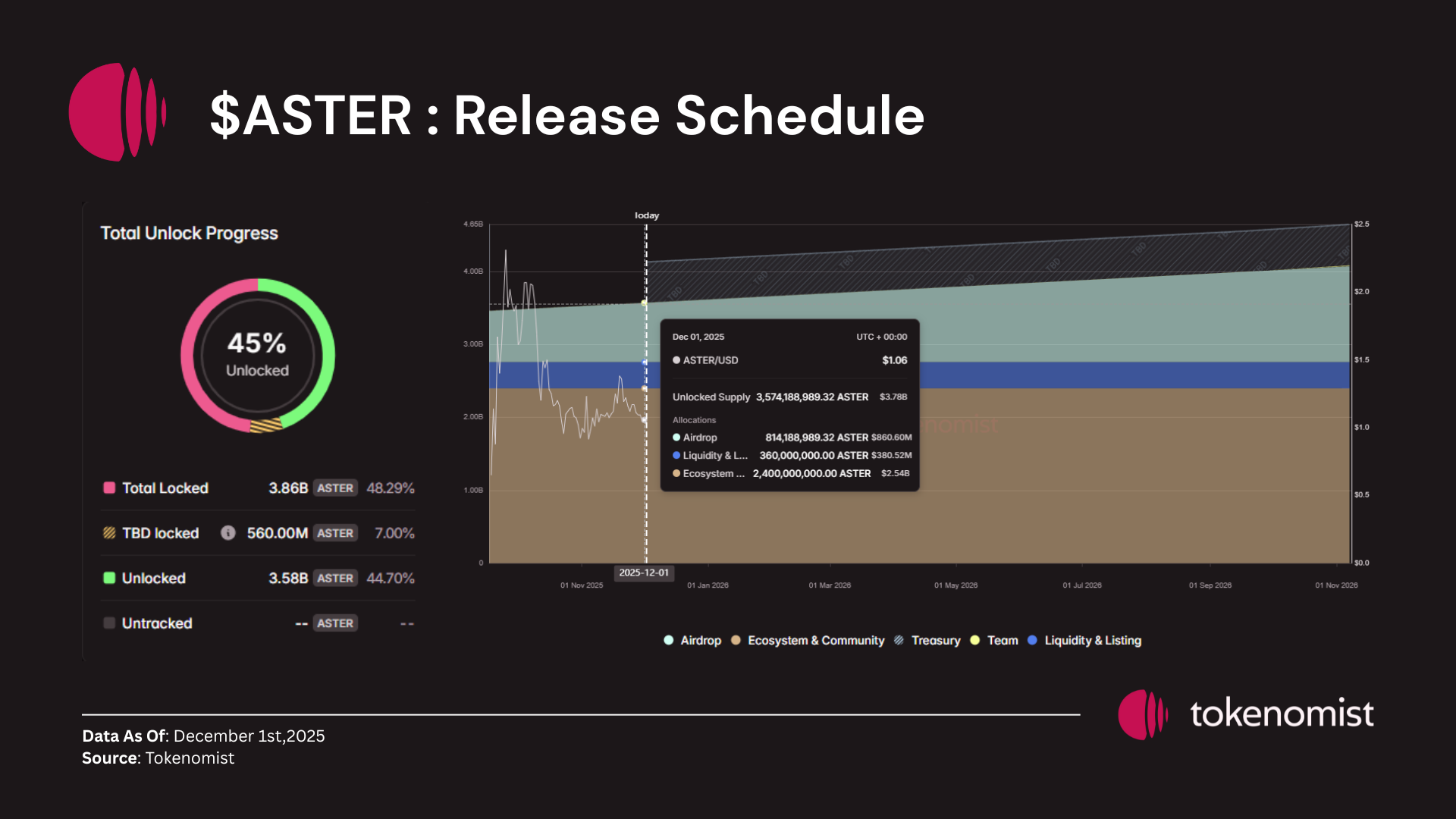

3. ASTER — Major Tokenomics Shift

- 75% of all unlocks pushed to 2026–2035

- One of the biggest dilution-reduction adjustments this cycle

- S4 Buybacks begin Dec 10, with 60–90% of fees used for buybacks.

Full Dashboard : https://tokenomist.ai/aster-2

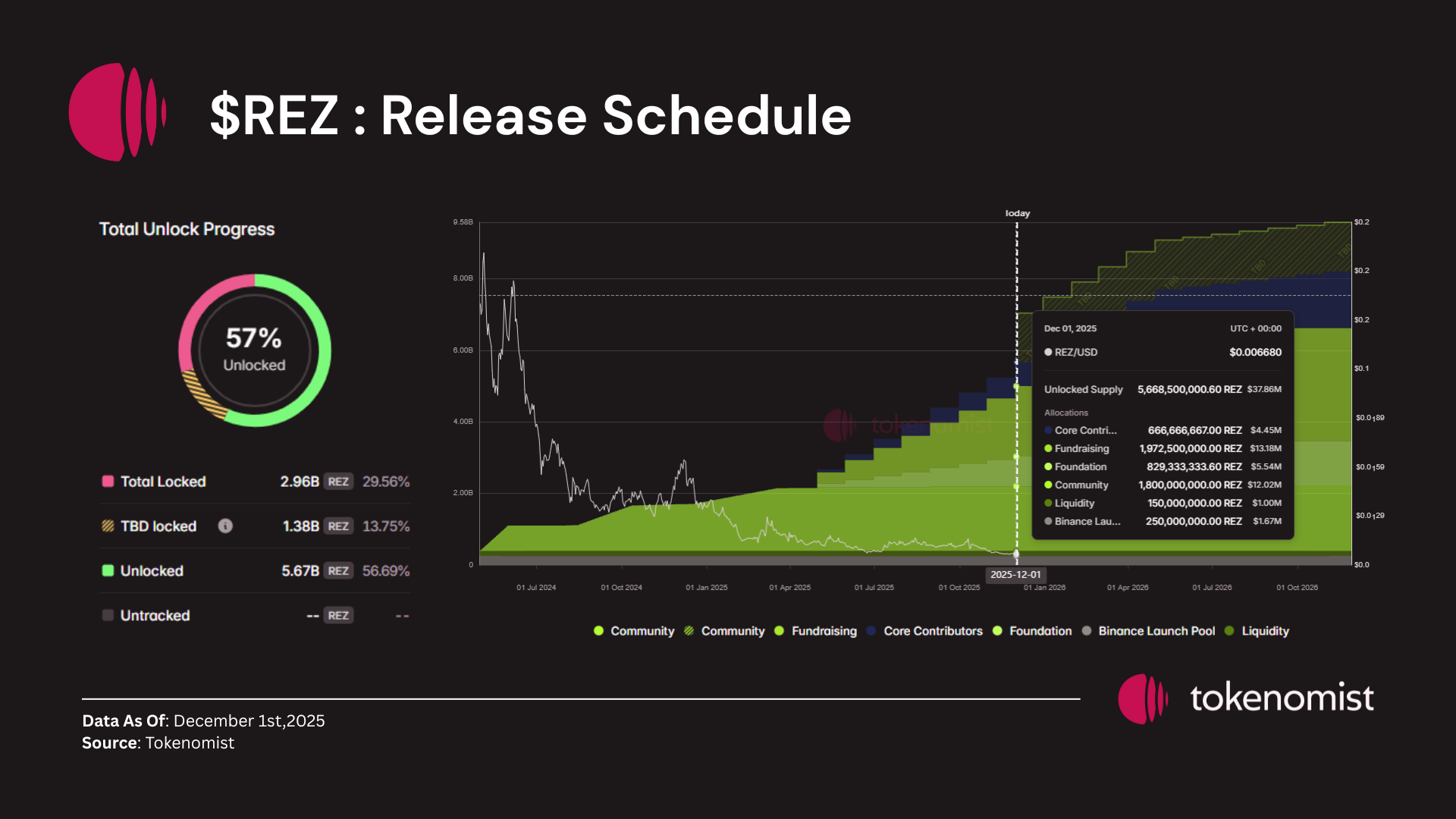

4. RENZO ($REZ)

- Weekly buybacks + burns funded by protocol revenue

- Team will provide a burn report every 5th of the month

Full Dashboard : https://tokenomist.ai/renzo

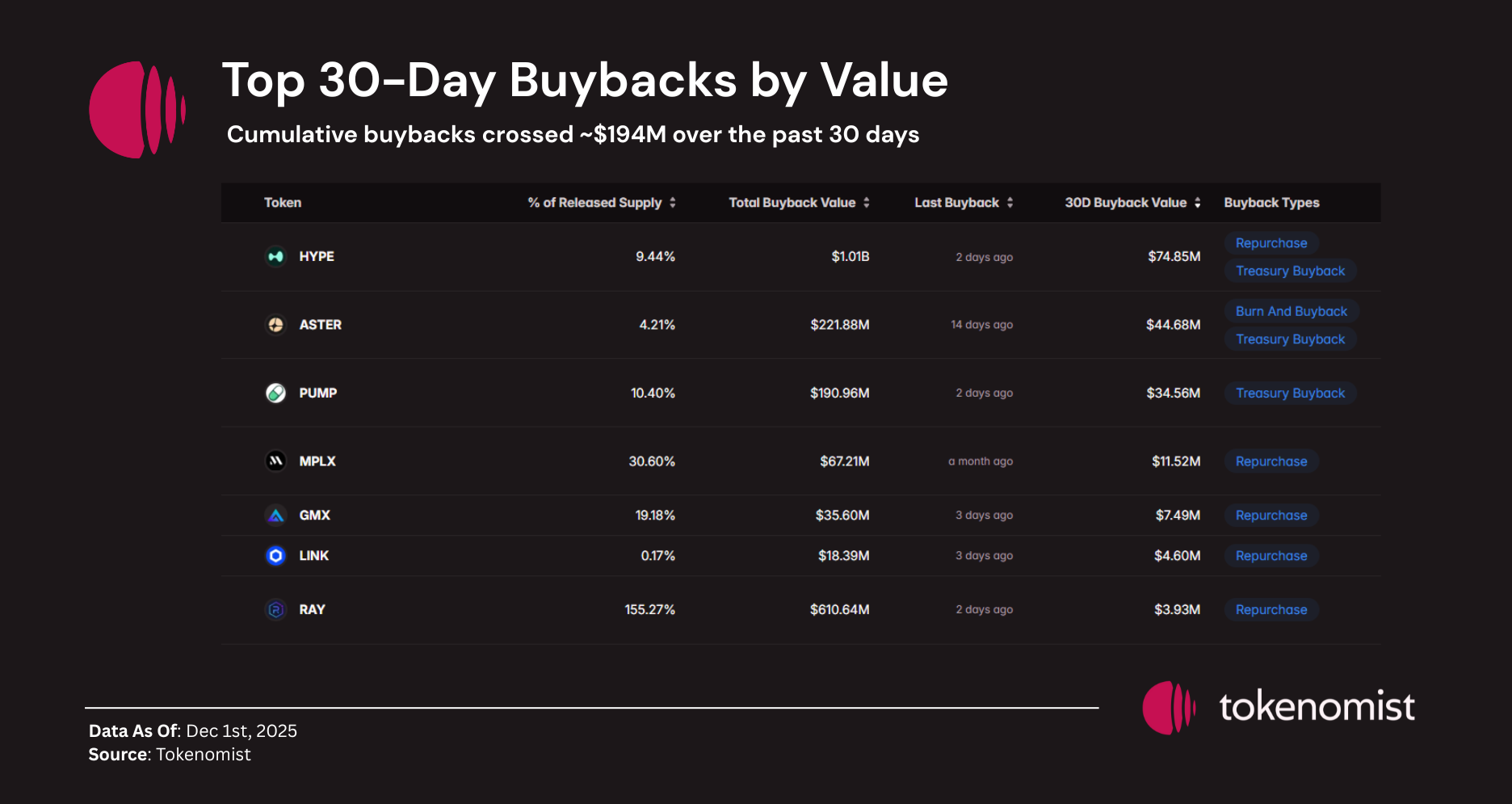

Top 10 Buyback Tokens (30D Total)

Buyback activity remained strong through November, with the top 10 tokens collectively executing over ~$197M in 30-day buybacks.

$HYPE led the market again with $74.8M in monthly repurchases, driven entirely by protocol fees. $ASTER and $PUMP followed with $44.7M and $34.5M, supported by a mix of treasury-funded and revenue-based buybacks. Mid-cap tokens like MPLX, GMX, LINK, and RAY posted steady but smaller repurchase flows, mostly sourced from protocol revenue. Overall, buybacks continue to act as one of the strongest supply-offset mechanisms across these ecosystems heading into December.

Closing Notes

December may look quiet at the headline level, but HYPE, SUI, EIGEN, STRK, ZRO, and KMNO are the ones to watch — each with meaningful supply releases or high insider unlock components. Combined with multiple tokenomics updates and accelerating buyback programs, this month reflects a transitional phase heading into 2026, where supply-side pressure becomes increasingly influenced by protocol-level design changes rather than raw unlock volume.